/Texas%20Instruments%20Inc_%20Santa%20Clara%2CCA%20campus-by%20Tada%20Images%20via%20Shutterstock.jpg)

With a market cap of $166.1 billion, Texas Instruments Incorporated (TXN) is a leading original equipment manufacturer specializing in analog, mixed-signal, and digital signal processing (DSP) integrated circuits. With global manufacturing and design facilities, the company serves diverse end-markets including industrial, automotive, personal electronics, and communications.

Shares of the Dallas, Texas-based company have underperformed the broader market over the past 52 weeks. TXN stock has risen 2.3% over this time frame, while the broader S&P 500 Index ($SPX) has increased 21.5%. In addition, shares of Texas Instruments are down 1.1% on a YTD basis, compared to SPX's 7.1% gain.

Looking closer, the chipmaker stock has also lagged behind the Technology Select Sector SPDR Fund's (XLK) 31.4% return over the past 52 weeks.

Despite reporting stronger-than-expected Q2 2025 EPS of $1.41 and revenue of $4.45 billion on Jul. 22, TXN's shares tumbled 13.3% the next day due to a disappointing Q3 outlook. The company projected Q3 EPS between $1.36 and $1.60, with the midpoint ($1.48) falling short of the analyst consensus, and revenue guidance of $4.5 billion to $4.8 billion, below expectations. Management also flagged weak analog chip demand, a shallow automotive recovery, tariff-related supply chain disruptions, and flat gross margin expectations.

For the fiscal year ending in December 2025, analysts expect Texas Instruments' EPS to grow 7.1% year-over-year to $5.57. The company's earnings surprise history is promising. It beat the consensus estimates in the last four quarters.

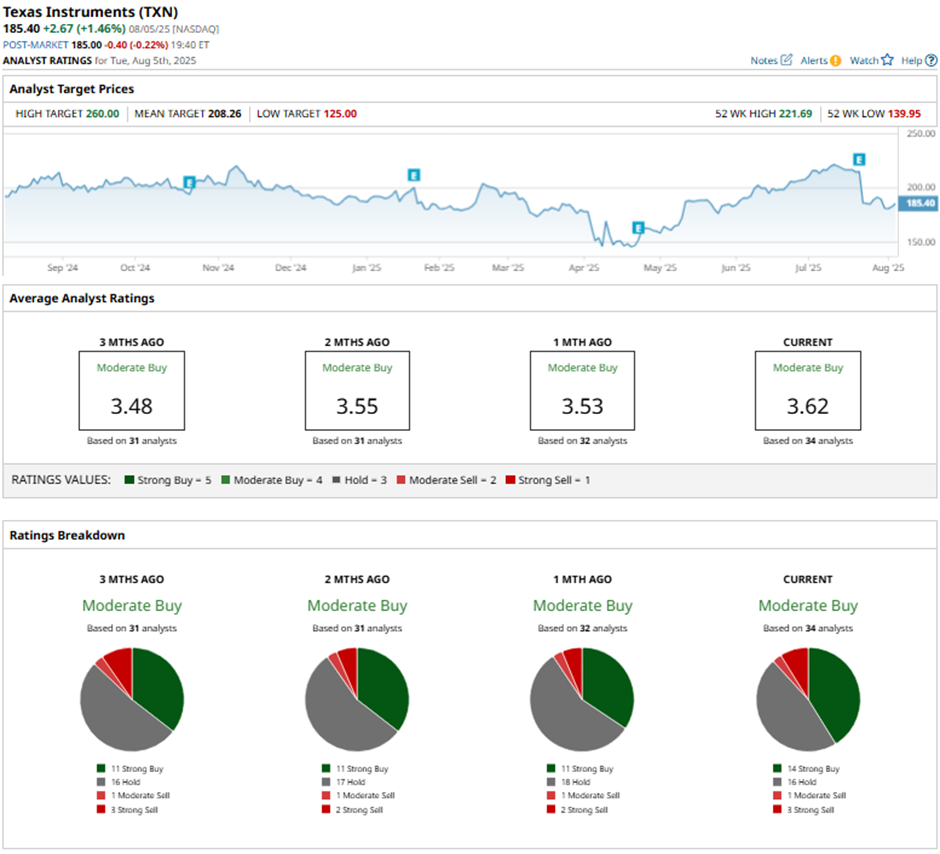

Among the 34 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on 14 “Strong Buys,” 16 “Hold” ratings, one “Moderate Sell,” and three “Strong Sells.”

This configuration is more bullish than three months ago, with 11 “Strong Buy” ratings on the stock.

On Jul. 23, Argus increased its price target on Texas Instruments to $250 and maintained a “Buy” rating.

As of writing, the stock is trading below the mean price target of $208.26. The Street-high price target of $260 implies a potential upside of 40.2% from the current price levels.