/Tesla%20Inc%20tesla%20by-%20Iv-olga%20via%20Shutterstock.jpg)

Tesla, Inc. (TSLA), headquartered in Austin, Texas, specializes in electric vehicles (EVs), energy storage, and clean energy solutions. Valued at $1.5 trillion by market cap, the company designs, manufactures, and sells a range of innovative products, including luxury EVs such as the Model S, Model X, and Model Y, as well as clean energy solutions such as solar panels, solar roofs, and energy storage systems.

Shares of this EV giant have notably outperformed the broader market over the past year. TSLA has gained 75.4% over this time frame, while the broader S&P 500 Index ($SPX) has rallied nearly 18.3%. However, in 2025, TSLA stock is up 14%, compared to SPX’s 17.2% rise on a YTD basis.

Zooming in further, TSLA’s outperformance is also apparent compared to the Global X Autonomous & Electric Vehicles ETF (DRIV). The exchange-traded fund has gained about 29% over the past year. However, the ETF’s 32% gains on a YTD basis outshine the stock’s returns over the same time frame.

On Oct. 22, TSLA reported its Q3 results, and its shares closed up more than 2% in the following trading session. Its revenue stood at $28.1 billion, up 11.6% year over year. The company’s adjusted EPS declined 30.6% from the year-ago quarter to $0.50.

For the current fiscal year, ending in December, analysts expect TSLA’s EPS to decline 44.1% to $1.14 on a diluted basis. The company’s earnings surprise history is disappointing. It missed the consensus estimate in three of the last four quarters, while beating the forecast on another occasion.

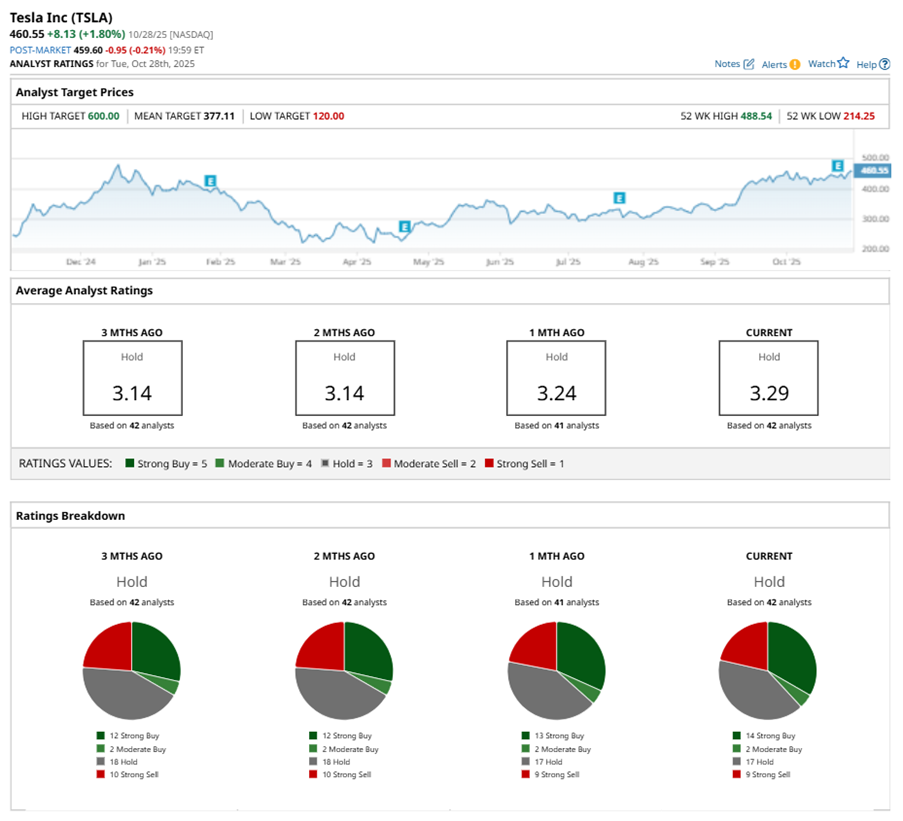

Among the 42 analysts covering TSLA stock, the consensus is a “Hold.” That’s based on 14 “Strong Buy” ratings, two “Moderate Buys,” 17 “Holds,” and nine “Strong Sells.”

This configuration is more bullish than a month ago, with 13 analysts suggesting a “Strong Buy.”

On Oct. 27, Cantor Fitzgerald kept an “Overweight” rating on TSLA and raised the price target to $510, implying a potential upside of 10.7% from current levels.

While TSLA currently trades above its mean price target of $377.11, the Street-high price target of $600 suggests a 30.3% upside potential.