With a market cap of $10.5 billion, Molson Coors Beverage Company (TAP) is one of the world’s largest brewers with a diverse portfolio spanning beers, ciders, hard seltzers, spirits, and ready-to-drink beverages. Operating worldwide, the company is known for iconic brands like Coors Light, Miller Lite, Blue Moon, and Peroni, with a strong commitment to quality and sustainability.

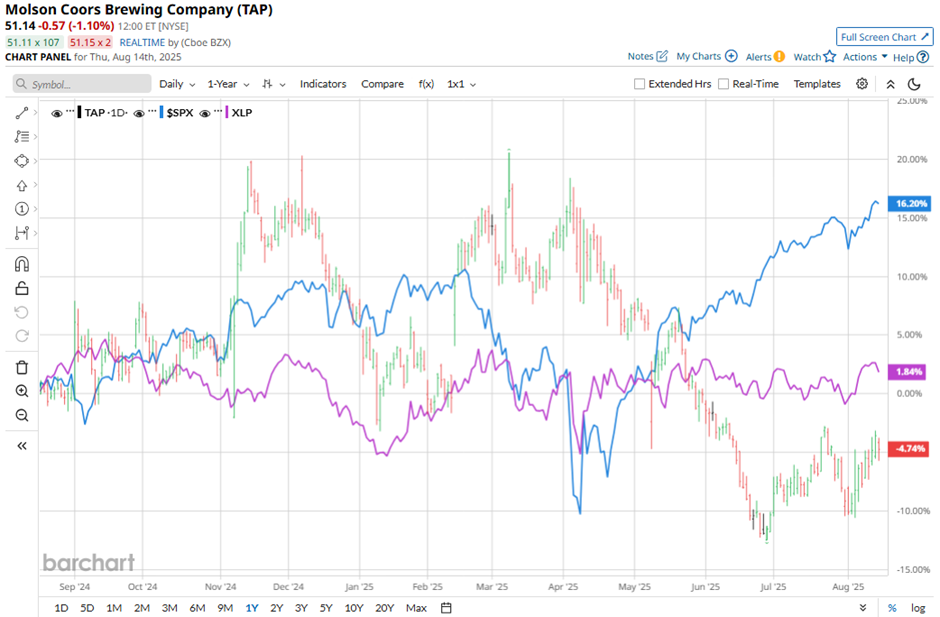

Shares of the Golden, Colorado-based company have underperformed the broader market over the past 52 weeks. TAP stock has dropped 2.6% over this time frame, while the broader S&P 500 Index ($SPX) has gained 18.4%. Moreover, shares of the company are down 10.9% on a YTD basis, compared to SPX’s 9.9% rise.

Narrowing the focus, shares of Molson Coors Beverage Company have lagged behind the Consumer Staples Select Sector SPDR Fund’s (XLP) 3.3% return over the past 52 weeks.

Shares of Molson Coors rose 1.3% on Aug. 5 after the company reported Q2 2025 adjusted EPS of $2.05, beating analyst expectations. Net sales came in at $3.2 billion, down 1.6% year-over-year but above the estimate, driven by pricing growth and favorable timing of U.S. shipments. Investors reacted positively to the earnings and revenue beat despite the company lowering its annual profit forecast due to higher aluminum tariffs, softer U.S. market share, and macroeconomic pressures.

For the fiscal year ending in December 2025, analysts expect TAP’s adjusted EPS to decline 7.9% year-over-year to $5.49. The company’s earnings surprise history is mixed. It beat the consensus estimates in three of the last four quarters while missing on another occasion.

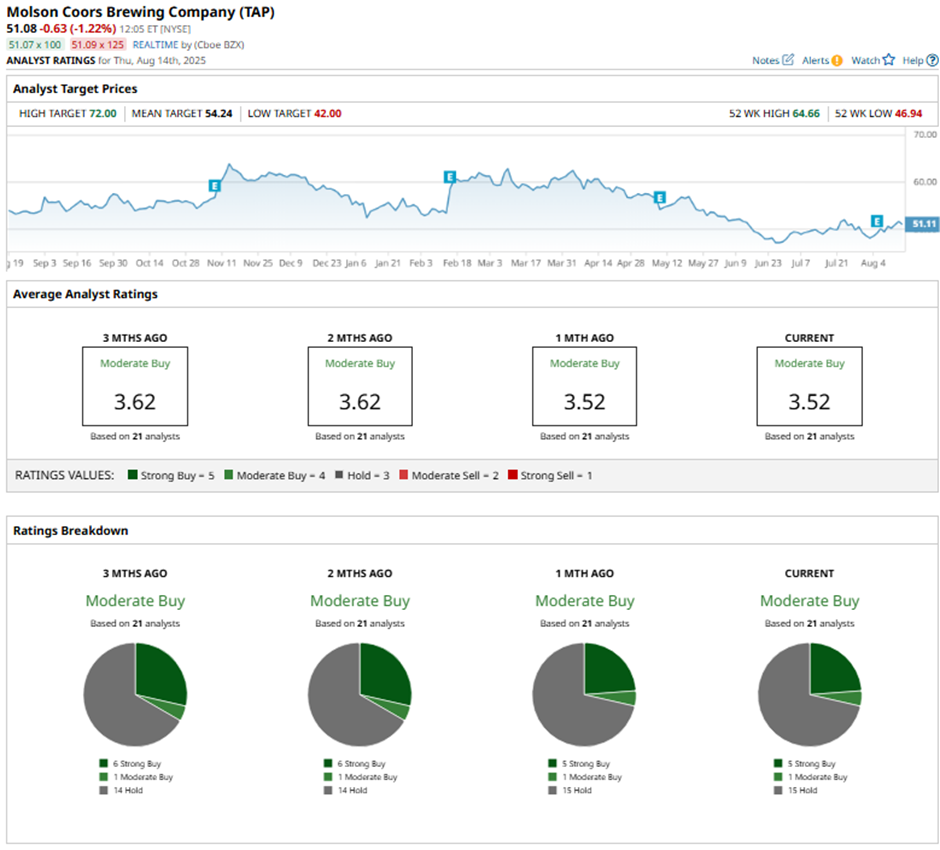

Among the 21 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on five “Strong Buy” ratings, one “Moderate Buy,” and 15 “Holds.”

On Aug. 8, TD Cowen cut Molson Coors’ price target to $47, maintaining a “Hold" rating.

As of writing, the stock is trading below the mean price target of $54.24. The Street-high price target of $72 implies a potential upside of nearly 41% from the current price.