/MGM%20Resorts%20International%20lion%20by-%20atosan%20via%20iStock.jpg)

MGM Resorts International (MGM), headquartered in Las Vegas, Nevada, owns and operates casino, hotel, and entertainment resorts. Valued at $8.7 billion by market cap, the company offers accommodation, dining, meeting, convention, and hospitality management services for casino and non-casino properties.

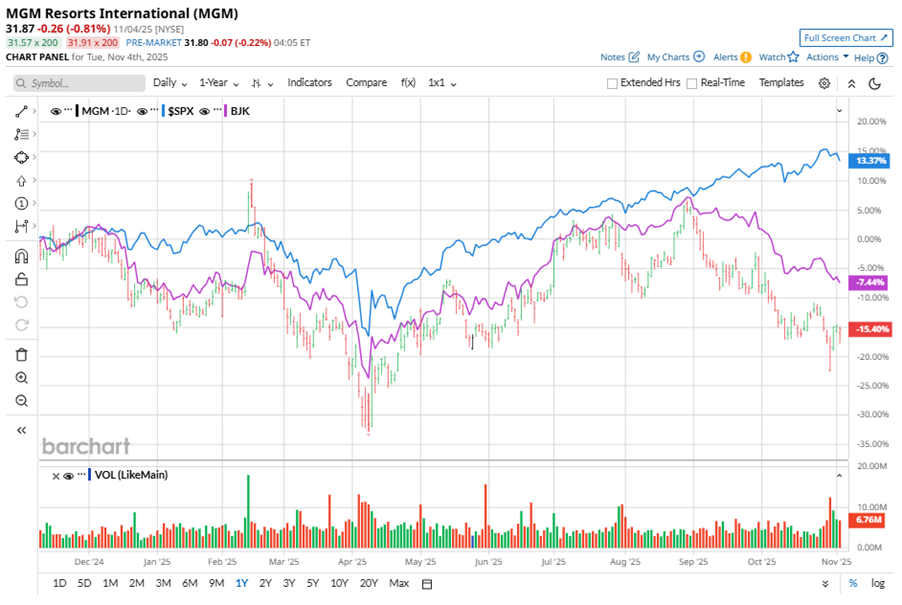

Shares of this global hospitality and entertainment giant have notably underperformed the broader market over the past year. MGM has declined 12.5% over this time frame, while the broader S&P 500 Index ($SPX) has rallied nearly 18.5%. In 2025, MGM stock is down 8%, compared to the SPX’s 15.1% rise on a YTD basis.

Narrowing the focus, MGM’s underperformance looks less pronounced compared to the VanEck Gaming ETF (BJK). The exchange-traded fund has declined about 5.4% over the past year. Moreover, the ETF’s marginal gains on a YTD basis outshine the stock’s single-digit dip over the same time frame.

MGM's underperformance was attributed to renovation disruptions, softer occupancy, and pricing issues at mid-tier properties, such as Luxor and Excalibur.

On Oct. 29, MGM shares closed down by 2.3% after reporting its Q3 results. Its adjusted EPS of $0.24 did not meet Wall Street expectations of $0.37. The company’s revenue was $4.3 billion, beating Wall Street forecasts of $4.2 billion.

For the current fiscal year, ending in December, analysts expect MGM’s EPS to decline 17.8% to $2.13 on a diluted basis. The company’s earnings surprise history is mixed. It beat the consensus estimate in three of the last four quarters while missing the forecast on another occasion.

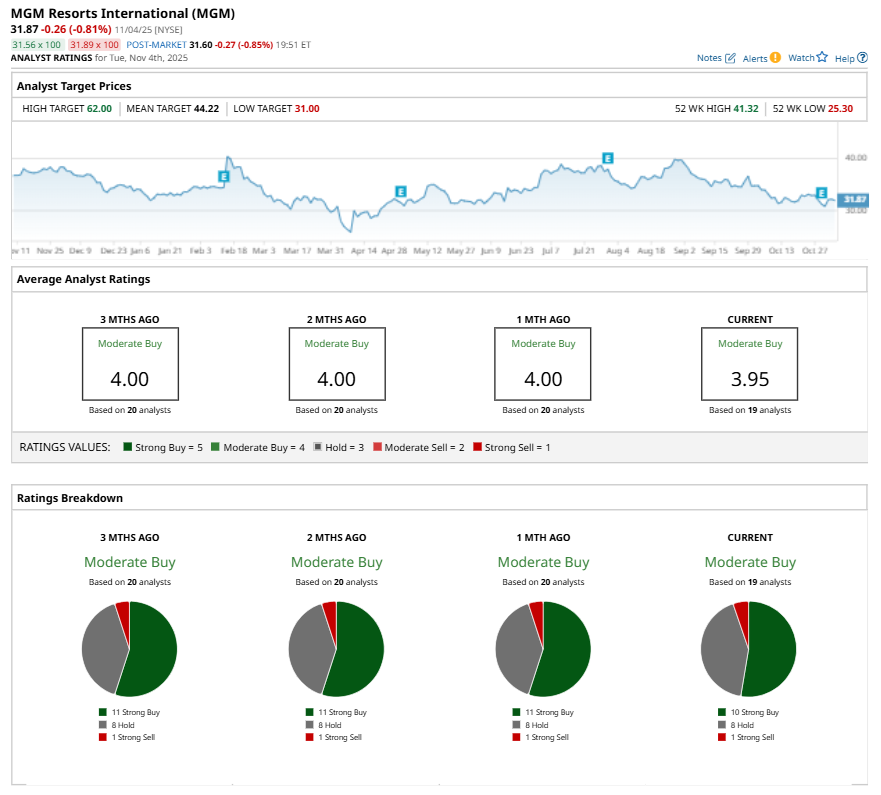

Among the 19 analysts covering MGM stock, the consensus is a “Moderate Buy.” That’s based on 10 “Strong Buy” ratings, eight “Holds,” and one “Strong Sell.”

This configuration is less bullish than a month ago, with 11 analysts suggesting a “Strong Buy.”

On Oct. 30, Shaun Kelley from Bank of America Corporation (BAC) reiterated a “Hold” rating on MGM with a price target of $35, implying a potential upside of 9.8% from current levels.

The mean price target of $44.22 represents a 38.8% premium to MGM’s current price levels. The Street-high price target of $62 suggests an ambitious upside potential of 94.5%.

.png?w=600)