/Leidos%20Holdings%20Inc%20logo%20on%20smartphone-by%20Photo%20For%20Everything%20via%20Shutterstock.jpg)

With a market cap of $22.9 billion, Leidos Holdings, Inc. (LDOS) is a global science and technology leader serving government and commercial customers across defense, intelligence, civil, health, and international markets. The company delivers advanced solutions in areas such as cybersecurity, digital modernization, data analytics, systems engineering, and mission-critical operations worldwide.

Shares of the Reston, Virginia-based company have outpaced the broader market over the past 52 weeks. LDOS stock has risen nearly 20% over this time frame, while the broader S&P 500 Index ($SPX) has rallied 13.8%. Moreover, shares of the company are up 25.1% on a YTD basis, compared to SPX’s 8.3% gain.

Focusing more closely, the security and engineering company stock has also outperformed the Industrial Select Sector SPDR Fund’s (XLI) 18.5% return over the past 52 weeks.

Shares of Leidos climbed 7.5% on Aug. 5 after the company reported Q2 2025 adjusted EPS of $3.21, well above Wall Street’s expectation. Revenue came in at $4.3 billion, topping estimates, and management raised its full-year adjusted profit forecast to $11.15 per share - $11.45 per share. Investor optimism was further supported by strong demand for Leidos’ technical services and munitions amid ongoing global geopolitical tensions.

For the fiscal year, ending in December 2025, analysts expect LDOS’ adjusted EPS to grow 11.7% year-over-year to $11.40. The company's earnings surprise history is promising. It topped the consensus estimates in the last four quarters.

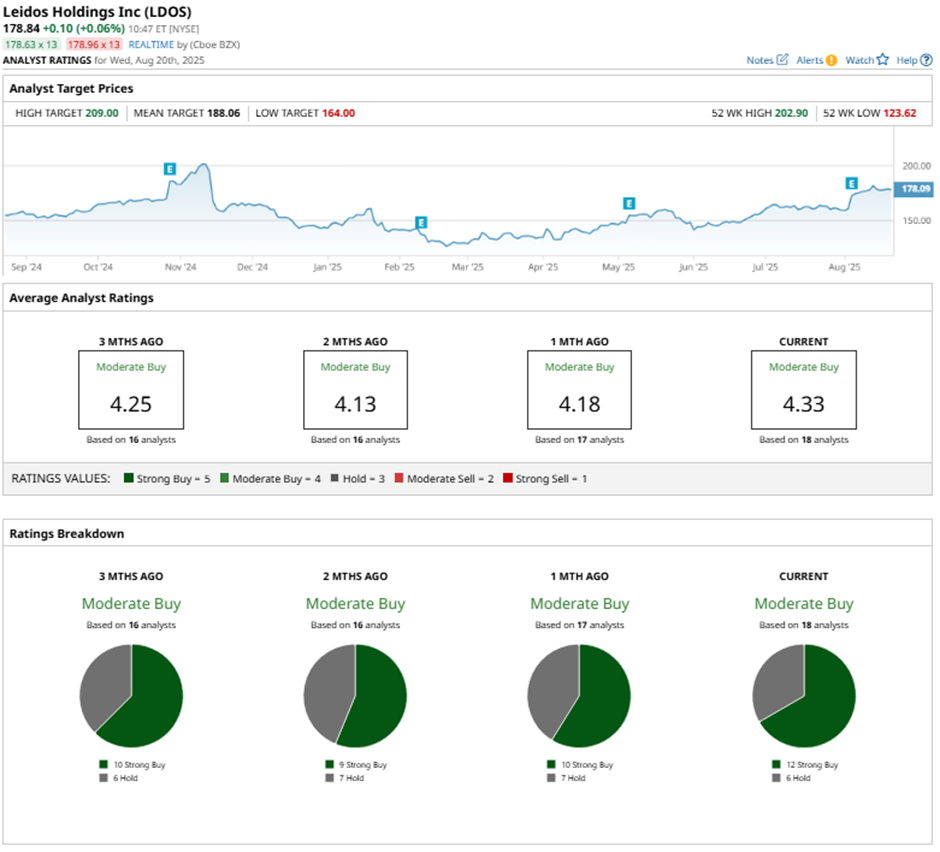

Among the 18 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on 12 “Strong Buy” ratings and six “Holds.”

This configuration is more bullish than three months ago, with 10 “Strong Buy” ratings on the stock.

On Aug. 6, Truist raised its price target on Leidos to $188 while maintaining a “Buy” rating.

As of writing, the stock is trading below the mean price target of $188.06. The Street-high price target of $209 implies a potential upside of 16.9% from the current price levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.