With a market cap of $12.4 billion, Jack Henry & Associates, Inc. (JKHY) is a financial technology company that connects individuals and financial institutions through technology solutions and payment processing services. It operates across four segments: Core; Payments; Complementary; and Corporate and Other, delivering integrated banking systems, digital banking tools, and secure payment processing solutions to banks and credit unions.

Shares of the Monett, Missouri-based company have lagged behind the broader market over the past 52 weeks. JKHY stock has fallen marginally over this time frame, while the broader S&P 500 Index ($SPX) has returned 11%. Moreover, shares of the company are down 2.6% on a YTD basis, compared to SPX’s 12.3% gain.

Focusing more closely, shares of the payment processing company have underperformed the Financial Select Sector SPDR Fund’s (XLF) nearly 3% rise over the past 52 weeks.

Shares of JKHY jumped 4.9% following its Q1 2026 results on Nov. 4, reporting EPS of $1.97, which beat analyst estimates. Investors reacted positively to revenue of $644.7 million, up 7.3% year-over-year, alongside a 21% increase in net income to $144 million. Sentiment was further boosted by the company raising its fiscal 2026 guidance, projecting revenue of $2.49 billion - $2.51 billion and EPS of $6.38 - $6.49, above its prior outlook.

For the fiscal year ending in June 2026, analysts expect Jack Henry & Associates’ EPS to grow 3.4% year-over-year to $6.45. The company’s earnings surprise history is promising. It beat the consensus estimates in the last four quarters.

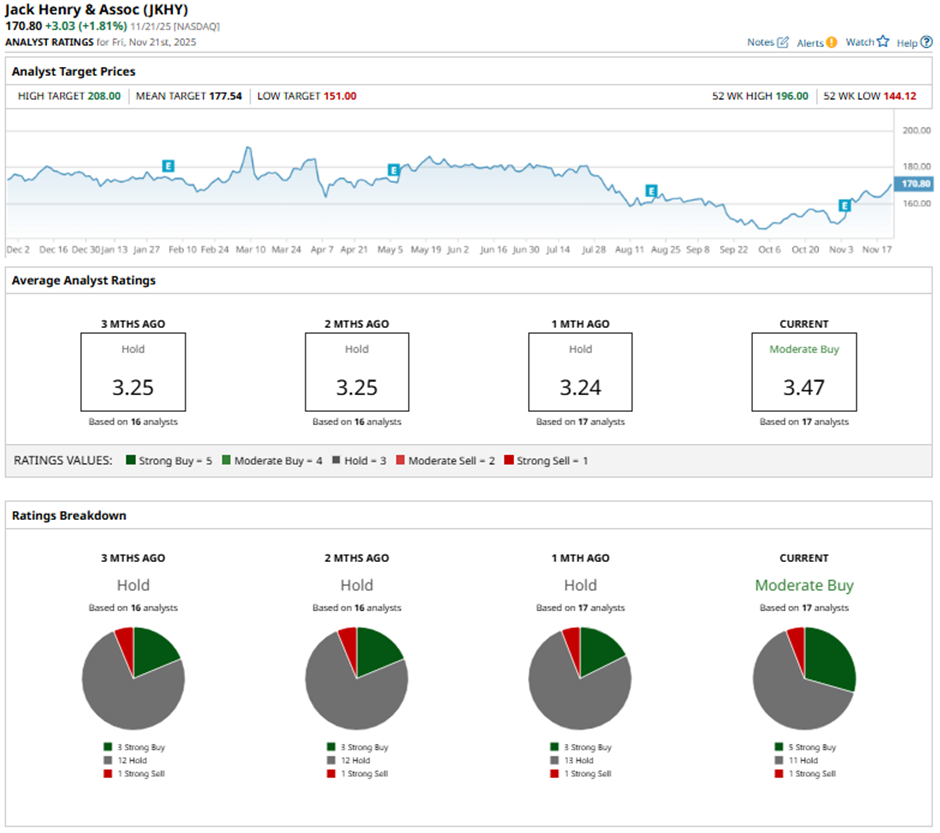

Among the 17 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on five “Strong Buy” ratings, 11 “Holds,” and one “Strong Sell.”

This configuration is more bullish than three months ago, with three “Strong Buy” ratings on the stock.

On Nov. 6, Goldman Sachs raised its price target on Jack Henry to $175 while maintaining a “Neutral” rating.

The mean price target of $177.54 represents a 3.9% premium to JKHY’s current price levels. The Street-high price target of $208 suggests a 21.8% potential upside.