Fox Corporation (FOX), based in New York City, is a major player in the American media landscape. It operates through several key outlets, including Fox News, Fox Sports, the Fox broadcast network, and the streaming platform Tubi. The company has a market capitalization of $24.34 billion.

The company is recognized for its emphasis on live content, particularly in news and sports, reaching a nationwide audience. Its cable and broadcast channels are central to its operations, delivering a mix of entertainment, commentary, and real-time coverage. Fox Corporation has a strong presence in U.S. media, shaping public opinion and offering content across multiple platforms to a broad national audience.

The company’s stock has been holding up well. Over the past 52 weeks, Fox’s shares have gained 43.3% and they are up by 19.5% year-to-date (YTD). The stock has broadly outperformed the S&P 500 Index ($SPX), which has gained 14.3% and 9.5% over the same periods, respectively.

Narrowing our focus, we see that the Vanguard Communication Services Index Fund ETF Shares (VOX) has gained 28.1% over the past 52 weeks and 15.6% YTD, which shows that FOX’s shares are the outperformers in this case as well.

On Aug. 21, Fox Corporation announced the launch of its FOX One app, which would enable users to stream the full portfolio of FOX's News, Sports, and entertainment-branded content, all in one place. Designed for today’s on-demand audience, the platform offers round-the-clock news, live sports, and hit shows powered by AI-driven features.

The rollout builds on FOX’s record-setting Super Bowl LIX stream on Tubi, which drew 15.5 million peak concurrent viewers and 24 million unique viewers, underscoring the company’s growing digital clout. Investors cheered the move, sending the stock to a 52-week high of $55.15 on Aug. 22, and it has only pulled back marginally from this level.

Earlier this month, Fox Corporation also announced robust fourth-quarter and fiscal year 2025 results on Aug. 5. For Q4 (the quarter ended on June 30), the company’s total revenues increased by 6.3% year-over-year (YOY) to $3.29 billion, surpassing the $3.12 billion that Wall Street analysts had expected. Its adjusted EPS of $4.78 was 39.4% higher YOY. However, the stock dropped nearly 3.8% on the same day.

For the fiscal year 2026, ending in June 2026, Wall Street analysts expect Fox’s EPS to decline by 15.9% YOY to $4.02 on a diluted basis, but grow by 9.2% to $4.39 in fiscal 2027. The company has a solid history of surpassing consensus estimates, topping them in all of the trailing four quarters.

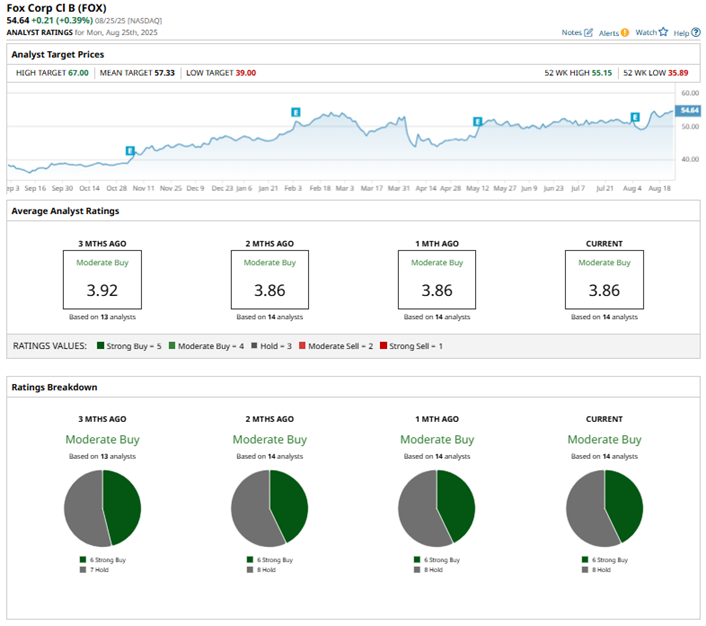

Among the 14 Wall Street analysts covering Fox Corporation’s stock, the consensus is a “Moderate Buy.” That’s based on six “Strong Buy” ratings and eight “Hold” ratings. This current setup has remained fairly steady over the past three months.

Fox Corporation’s mean price target of $57.33 indicates a 4.9% upside over current market prices. The Street-high price target of $67 implies a potential upside of 22.6%.

On the date of publication, Anushka Mukherjee did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.