/EBay%20Inc_%20logo%20by-%20JHVEPhoto%20via%20iStock.jpg)

With a market cap of $42.3 billion, eBay Inc. (EBAY) is a global e-commerce company that connects millions of buyers and sellers through its online marketplace and mobile platforms. Headquartered in San Jose, California, eBay has grown from a small auction site into a major international retail platform.

Shares of eBay have significantly outperformed the broader market over the past 52 weeks. EBAY stock has soared nearly 60% over this time frame, while the broader S&P 500 Index ($SPX) has rallied nearly 15%. In addition, shares of eBay are up 45.2% on a YTD basis, compared to SPX’s 6.5% increase.

Focusing more closely, the e-commerce company stock has also outpaced the Consumer Discretionary Select Sector SPDR Fund’s (XLY) 18.2% return over the past 52 weeks and a 3.7% YTD decline.

Shares of eBay jumped 18.3% following its Q2 2025 results on Jul. 30. The company reported adjusted earnings of $1.37 per share and revenue of $2.7 billion, surpassing forecasts, driven by strong demand for collectibles and Pokémon cards. Additionally, eBay guided Q3 revenue between $2.69 billion and $2.74 billion, above analyst expectations, and highlighted growth in pre-owned apparel, successful AI integration, and resilience to tariff impacts as key growth drivers.

For the fiscal year ending in December 2025, analysts expect EBAY’s EPS to grow 9.7% year-over-year to $4.31. The company's earnings surprise history is mixed. It beat the consensus estimates in three of the last four quarters while missing on another occasion.

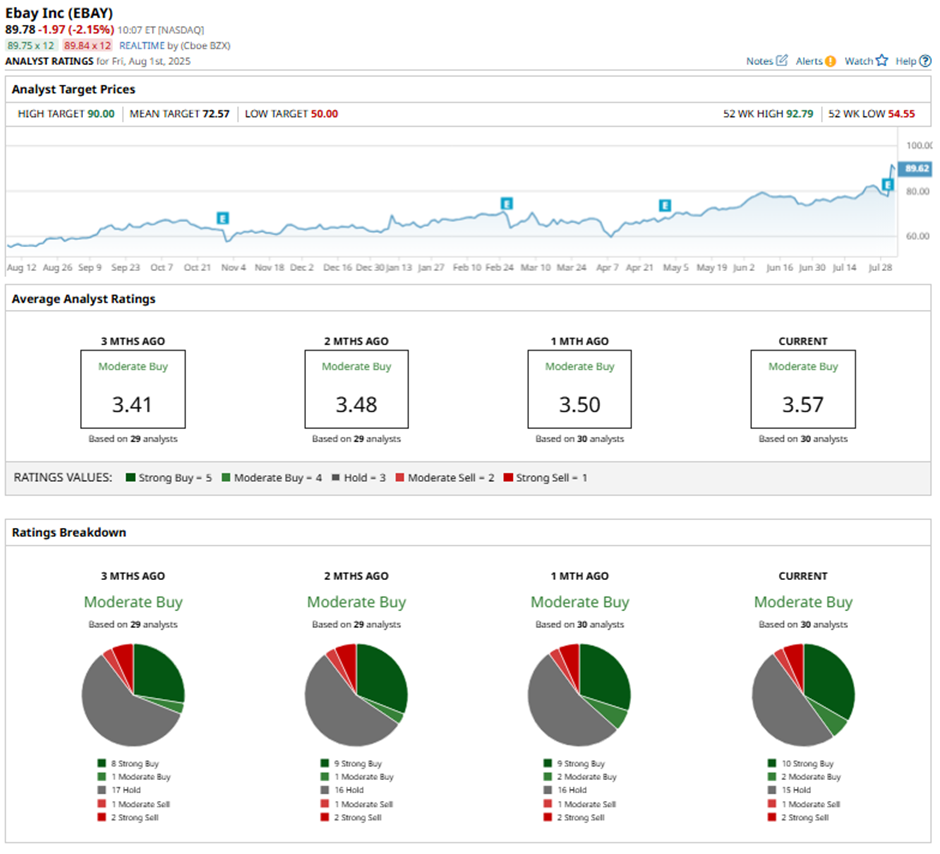

Among the 30 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on 10 “Strong Buy” ratings, two “Moderate Buys,” 15 “Holds,” one “Moderate Sell,” and two “Strong Sells.”

This configuration is more bullish than three months ago, with eight “Strong Buy” ratings on the stock.

On Jul. 31, Truist raised its price target on eBay to $86 while maintaining a “Hold” rating, citing solid Q2 performance, a strong Q3 outlook, and the company's effective execution and resilience amid macroeconomic uncertainty.

As of writing, the stock is trading above the mean price target of $72.57. The Street-high price target of $90 implies a marginal potential upside from the current price levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.