Chesapeake, Virginia-based Dollar Tree, Inc. (DLTR) operates retail discount stores under the Dollar Tree and Dollar Tree Canada brands. With a market cap of $23.4 billion, the company sells an assortment of everyday general merchandise, as well as offers kitchen and dining, toys, books, crafts, cleaning, personal care, glasses, food carriers, gifts, and other household products.

Shares of this discount retail giant have underperformed the broader market over the past year. DLTR has gained 11.9% over this time frame, while the broader S&P 500 Index ($SPX) has rallied nearly 14.3%. However, in 2025, DLTR stock is up 50.1%, surpassing the SPX’s 9% rise on a YTD basis.

Zooming in further, DLTR’s outperformance is apparent compared to the SPDR S&P Retail ETF (XRT). The exchange-traded fund has gained about 9.3% over the past year. Moreover, DLTR’s double-digit returns on a YTD basis outshine the ETF’s 5.9% gains over the same time frame.

DLTR’s underperformance is mainly due to struggles with its Family Dollar brand. In response, the company is selling Family Dollar for $1 billion to streamline operations and secure a cash infusion, particularly amid uncertainties in trade policy. Despite this move, DLTR faces intense competition from Dollar General Corporation (DG) and Walmart Inc. (WMT), a lack of a strong digital strategy, and economic uncertainties, which could impact its long-term success and stock performance.

On Jun. 4, DLTR shares closed down more than 8% after reporting its Q1 results. Its adjusted EPS of $1.26 exceeded Wall Street expectations of $1.19. The company’s revenue was $4.6 billion, exceeding Wall Street forecasts of $4.5 billion. DLTR expects full-year adjusted EPS in the range of $5.15 to $5.65, and expects revenue in the range of $18.5 billion to $19.1 billion.

For the current fiscal year, ending in January 2026, analysts expect DLTR’s EPS to grow 6.7% to $5.44 on a diluted basis. The company’s earnings surprise history is mixed. It beat the consensus estimate in two of the last four quarters while missing the forecast on two other occasions.

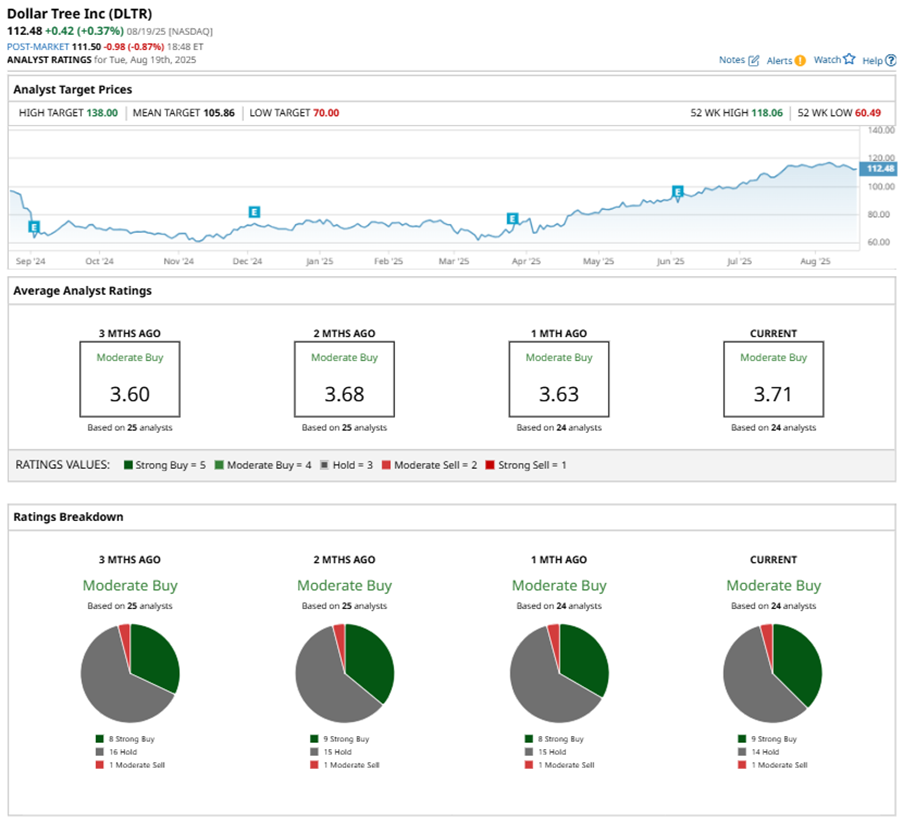

Among the 24 analysts covering DLTR stock, the consensus is a “Moderate Buy.” That’s based on nine “Strong Buy” ratings, 14 “Holds,” and one “Moderate Sell.”

This configuration is more bullish than a month ago, with eight analysts suggesting a “Strong Buy.”

On Aug. 18, Jefferies Financial Group Inc. (JEF) analyst Corey Tarlowe maintained a “Hold” rating on DLTR and set a price target of $130, implying a potential upside of 15.6% from current levels.

While DLTR currently trades above its mean price target of $105.86, the Street-high price target of $138 suggests a 22.7% upside potential.