/Deere%20%26%20Co_%20John%20Deere%20tractor-by%20Yackers1%20via%20iStock.jpg)

With a market cap of $133 billion, Deere & Company (DE) is the world’s largest producer of agricultural equipment, best known for its iconic John Deere brand with the signature green and yellow design. The company operates globally across four segments: Production and Precision Agriculture; Small Agriculture and Turf; Construction and Forestry; and Financial Services.

Shares of the Moline, Illinois-based company have outperformed the broader market over the past 52 weeks. DE stock has climbed 31.9% over this time frame, while the broader S&P 500 Index ($SPX) has returned 16.1%. Moreover, shares of the company are up 16.1% on a YTD basis, compared to SPX’s 9.7% gain.

Focusing more closely, the agricultural equipment manufacturer stock has also outpaced the Industrial Select Sector SPDR Fund’s (XLI) 18.4% increase over the past 52 weeks.

Despite reporting better-than-expected Q3 2025 net income of $4.75 and adjusted revenue of $10.4 billion, Deere’s shares tumbled 6.8% on Aug. 14 as profits dropped sharply from $6.29 per share a year earlier. The company warned its tariff impact would reach nearly $600 million for the year, with Q3 tariffs alone costing about $200 million. Deere also cut the high end of its annual profit forecast to $5.25 billion and reported operating profits in its core tractor and construction units had roughly halved, highlighting margin pressure and weak demand.

For the fiscal year ending in October 2025, analysts expect Deere & Company’s EPS to decline 26.9% year-over-year to $18.72. However, the company's earnings surprise history is promising. It topped the consensus estimates in the last four quarters.

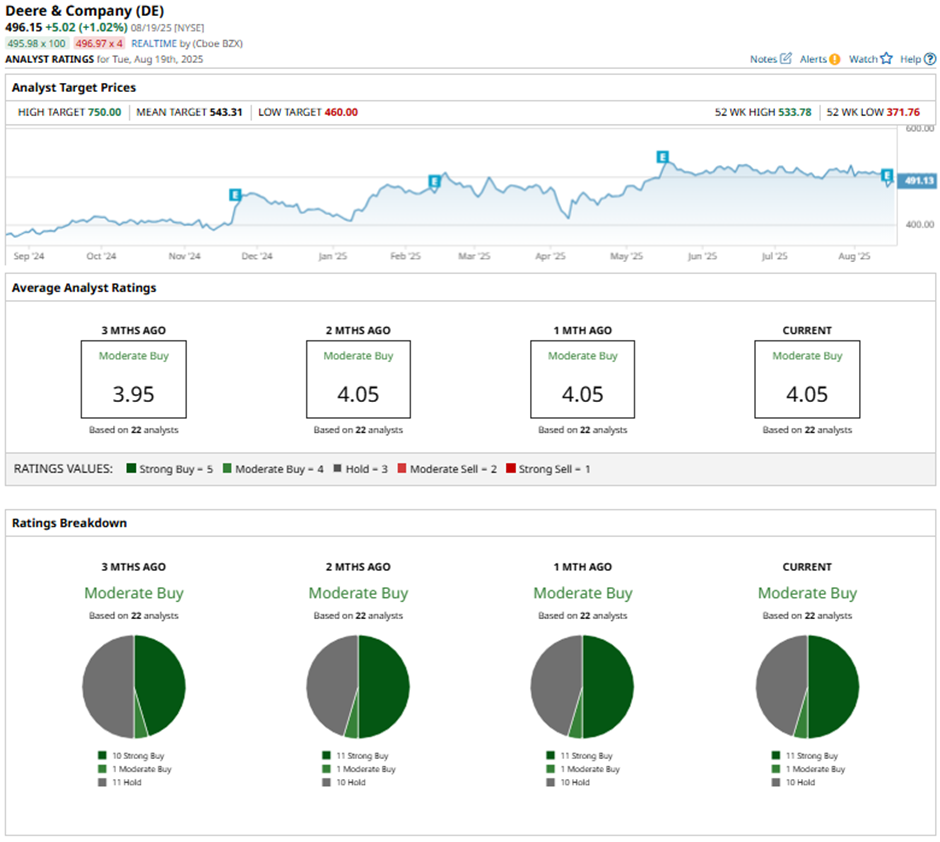

Among the 22 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on 11 “Strong Buy” ratings, one “Moderate Buy,” and 10 “Holds.”

On Aug, 19, Evercore ISI analyst David Raso lowered Deere’s price target to $491 while maintaining an “In Line" rating.

As of writing, the stock is trading below the mean price target of $543.31. The Street-high price target of $750 implies a potential upside of 51.2% from the current price levels.