With a market cap of $23.5 billion, CMS Energy Corporation (CMS) provides electricity and natural gas to approximately 1.9 million electric and 1.8 million gas customers across residential, commercial, and industrial sectors. It operates through Electric Utility, Gas Utility, and NorthStar Clean Energy segments, with a strong focus on power generation, energy distribution, and renewable energy development.

Shares of the Jackson, Michigan-based company have lagged behind the broader market over the past 52 weeks. CMS stock has returned 9.9% over this time frame, while the broader S&P 500 Index ($SPX) has rallied 11.8%. However, shares of the company are up 9.7% on a YTD basis, outpacing SPX's marginal decline.

Looking closer, shares of the energy company have underperformed the State Street Utilities Select Sector SPDR ETF's (XLU) 17.1% increase over the past 52 weeks.

Shares of CMS Energy Corporation rose 1.8% on Feb. 5 after the company reported strong Q4 2025 results, with adjusted EPS of $3.61, up from $3.34 in 2024 and above guidance, driven largely by outperformance at NorthStar Clean Energy. Investor sentiment was further boosted as CMS Energy raised its 2026 adjusted EPS guidance to a range of $3.83 - $3.90 and reaffirmed long-term adjusted EPS growth of 6% to 8%.

For the fiscal year ending in December 2026, analysts expect CMS' EPS to grow 6.9% year-over-year to $3.86. The company's earnings surprise history is mixed. It beat the consensus estimates in three of the last four quarters while missing on another occasion.

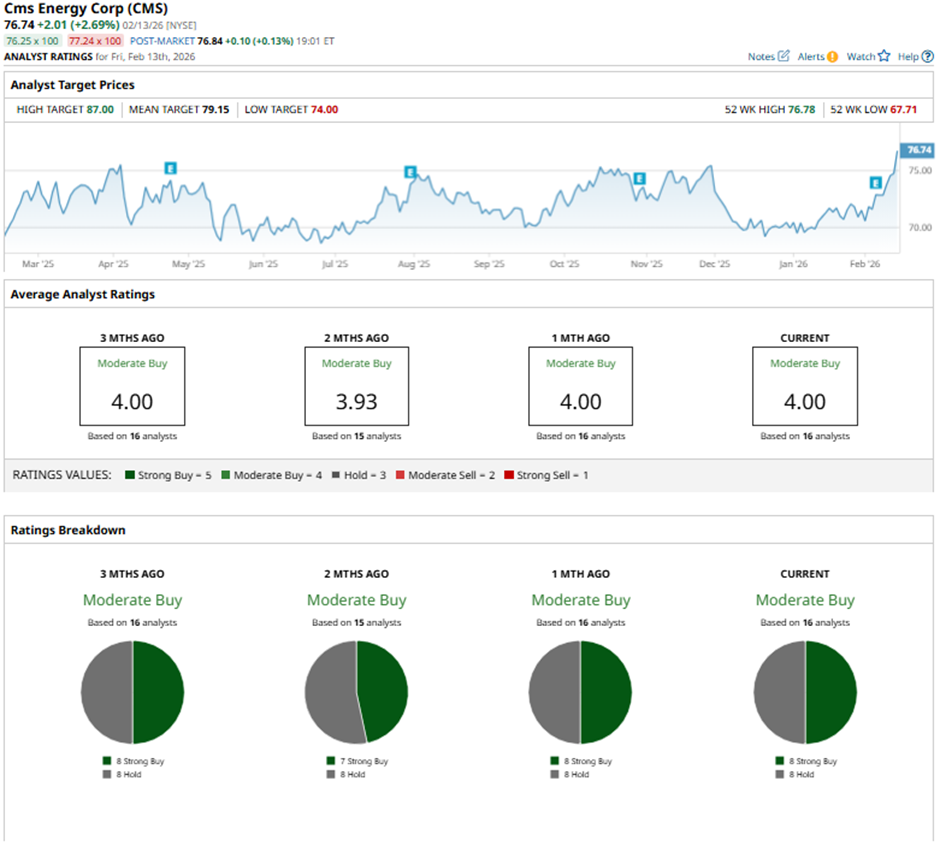

Among the 16 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on eight “Strong Buy” ratings and eight “Holds.”

On Feb. 11, Jefferies analyst Julien Dumoulin Smith reiterated a “Buy” rating on CMS Energy Corporation and set a price target of $84.

As of writing, the stock is trading above the mean price target of $79.15. The Street-high price target of $87 suggests a 13.4% potential upside.