/Chipotle%20Mexican%20Grill%20logo%20on%20building%20by-%20John%20Hanson%20Pye%20via%20Shutterstock.jpg)

Newport Beach, California-based Chipotle Mexican Grill, Inc. (CMG) operates quick-casual and fresh Mexican food restaurant chains. Its offerings include burritos, quesadillas, tacos, salads, and more. With a market cap of $41.8 billion, Chipotle’s operations span the U.S., Canada, France, Germany, Dubai, and the U.K.

The restaurant giant has massively underperformed the broader market over the past year. CMG stock prices have plummeted 47.6% on a YTD basis and tanked 47.3% over the past 52 weeks, compared to the S&P 500 Index’s ($SPX) 12.3% gains in 2025 and 11% returns over the past year.

Narrowing the focus, CMG has also underperformed the sector-focused Consumer Discretionary Select Sector SPDR Fund’s (XLY) marginal 51 bps uptick in 2025 and 4.9% gains over the past year.

Chipotle Mexican Grill’s stock prices tanked 18.2% in a single trading session following the release of its Q3 results on Oct. 29. The company has continued to observe lower comparable transactions at its stores for several quarters now, and has relied on price hikes and new restaurant openings to boost sales. Its overall topline for the quarter increased 7.5% year-over-year to $3 billion, missing the Street’s expectations by 48 bps. Meanwhile, its adjusted EPS inched up by 2 cents compared to the year-ago quarter to $0.29.

For the full fiscal 2025, ending in December, analysts expect CMG to deliver an adjusted EPS of $1.16, up 3.6% year-over-year. On the positive note, the company has a solid earnings surprise history. It has surpassed the Street’s bottom-line estimates in each of the past four quarters. Its EPS of $0.29 for Q3 surpassed the projections by 3.6%.

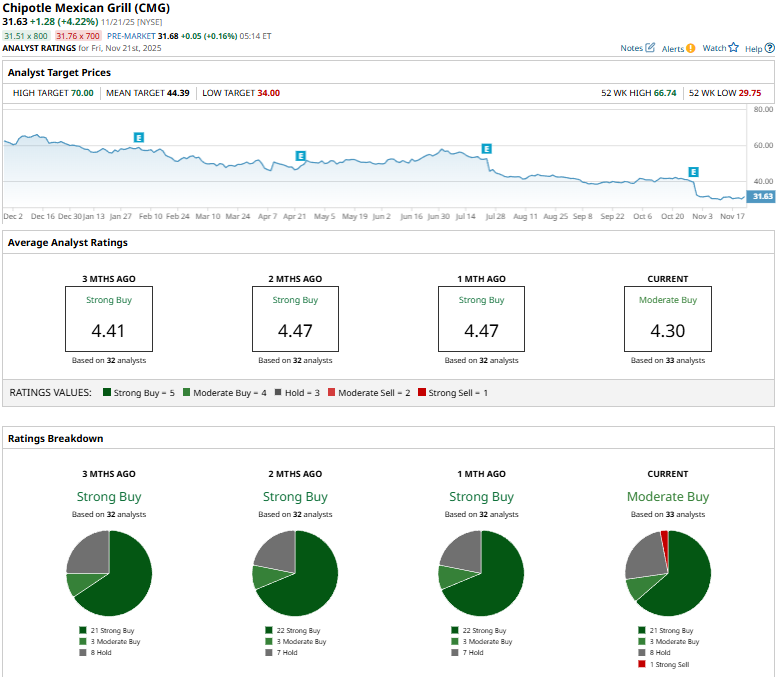

Among the 33 analysts covering the CMG stock, the consensus rating is a “Moderate Buy.” That’s based on 21 “Strong Buys,” three “Moderate Buys,” eight “Holds,” and one “Strong Sell.”

This configuration is slightly less optimistic than a month ago, when 22 analysts gave “Strong Buy” recommendations and none of the analysts suggested “Strong Sell” ratings.

On Oct. 30, JP Morgan (JPM) analyst John Ivankoe maintained a “Neutral” rating on CMG, but lowered the price target from $44 to $40.

As of writing, CMG’s mean price target of $44.39 represents a 40.3% premium to current price levels. Meanwhile, the street-high target of $70 suggests a massive 121.3% upside potential.

.png?w=600)