With a market cap of $10.3 billion, BXP, Inc. (BXP) is the largest publicly traded real estate investment trust (REIT) focused on developing, owning, and managing premier workplaces in the United States. BXP operates a 53.3 million square foot portfolio across six key gateway markets, including New York, San Francisco, and Washington, DC.

Shares of the Boston, Massachusetts-based company have lagged behind the broader market over the past 52 weeks. BXP has gained 4.2% over this time frame, while the broader S&P 500 Index ($SPX) has rallied 9.8%. Moreover, shares of BXP are down 12.6% on a YTD basis, compared to SPX’s marginal decline.

Zooming in further, the REIT’s underperformance becomes more evident when compared to the Real Estate Select Sector SPDR Fund’s (XLRE) 5.9% gain over the past 52 weeks.

Shares of BXP fell 2.1% following its Q1 2025 earnings release on Apr. 29, primarily due to its FFO per share of $1.64 missing the consensus estimate and marking a 5.2% year-over-year decline. Despite better-than-expected revenue of $865.2 million, investor sentiment was weighed down by a 60 basis point drop in occupancy to 86.9% and a rise in net debt to EBITDAre to 8.33. Additionally, the company narrowed its full-year 2025 FFO per share guidance to $6.80 - $6.92.

For the current fiscal year, ending in December 2025, analysts expect BXP’s FFO per share to decline nearly 3% year-over-year to $6.89. The company’s earnings surprise history is mixed. It beat or met the consensus estimates in three of the last four quarters while missing on another occasion..

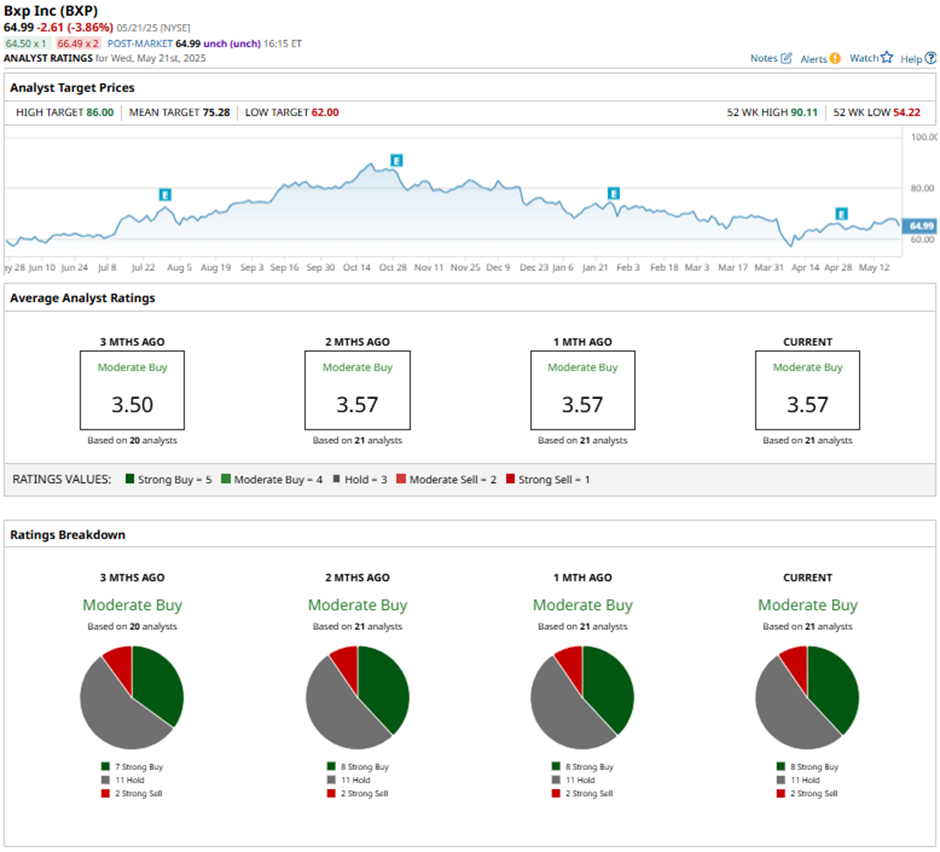

Among the 21 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on eight “Strong Buy” ratings, 11 “Holds,” and two “Strong Sells.”

This configuration is slightly more bullish than three months ago, with seven “Strong Buy” ratings on the stock.

On May 17, Piper Sandler analyst Alexander Goldfarb reaffirmed a Buy rating on Boston Properties and set a price target of $85.

As of writing, BXP is trading below the mean price target of $75.28. The Street-high price target of $86 implies a potential upside of 32.3% from the current price.