Hironari Nozaki, a professor at Toyo University's Faculty of Global and Regional Studies, spoke with The Yomiuri Shimbun about the near-term prospects of Japanese banks. The following are excerpts from the interview.

Struggles with core banking business

The Yomiuri Shimbun: Looking ahead, in which sectors should banks concentrate their activities?

Nozaki: As evidenced by the three mega banks' announcements of large-scale personnel cuts and branch closures, banks are under pressure to implement drastic changes to their business models. What changes should the banks implement in the coming years?

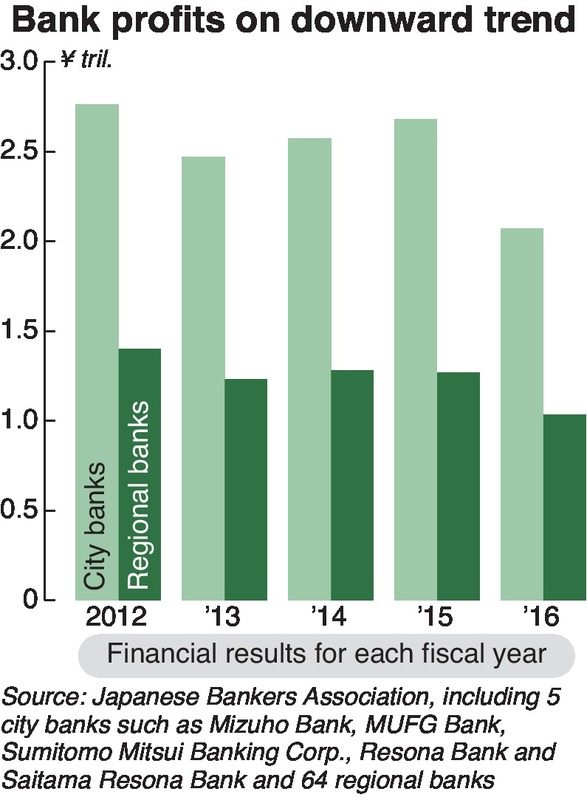

The core business of banks is collecting savings from customers, on which they pay interest, and then earning income by loaning these funds at higher interest rates. However, it has become difficult for banks to earn money this way. Profits accruing from core activities have fallen more than 20 percent for both mega banks and regional banks over the last five years.

Although the three mega banks -- Mitsubishi UFJ Financial Group, Sumitomo Mitsui Financial Group and Mizuho Financial Group -- have kept their total net profits above 2 trillion yen for the last couple of years, their profits have been driven by stock sales and other means, not by core banking activities.

One reason why core activities are no longer profitable is the negative interest rate policy introduced by the Bank of Japan in February 2016. While interest rates on deposits cannot be made negative, the policy has prompted banks to lower interest rates on loans, and their profit margins have shrunk.

Another factor is competition among banks over lowering interest rates. During the latter half of the 1990s, a financial crisis occurred in which banks failed one after another. This prompted regulators to toughen their oversight of banks, giving rise to extremely cautious lending practices. Banks targeted reliable borrowers who were sure to repay their loans and competed for the business of such customers. As a result, a competition broke out over how far to lower interest rates on loans.

Banks have tried to compensate for this trend by earning more commissions through sales of insurance and investment trust products. However, this practice was deemed problematic by the Financial Services Agency as the banks prioritized high sales figures over customers' needs. They can no longer sell such products in a reckless manner.

Wasteful services, procedures

Q: How should banks become more efficient?

A: Amid the bleak business environment, the mega banks announced a series of large-scale personnel cuts and branch closures last year.

Mizuho will reduce its workforce by 19,000 over the next 10 years, and eliminate or integrate 100 branches that account for 20 percent of its operational base. Mitsubishi UFJ will reduce its workforce by 6,000, and Sumitomo Mitsui plans to eliminate operations equivalent to 4,000 jobs.

A: Restructuring is inevitable due to structural problems such as the declining population and decreasing number of companies. With advances in information technology, the cost of systems investment is also growing.

For banks, this is a good opportunity to examine the extent of demand for services by customers and to scale back unnecessary products and services, while keeping those that provide value. Do customers really want to go to bank counters that are like hospital waiting rooms?

Automatic teller machines like those in convenience stores are said to cost between 2.5 million yen to 3 million yen per unit, while the ATMs used by banks, which can process entries in bankbooks and handle transactions with coins, cost more than twice as much at around 10 million yen. Rather than spending such a large amount on maintaining the bankbook system, I think customers would better appreciate, for example, being able to settle one's accounts on smartphones in a manner that is simple, even for the elderly.

There is also a lot of room to save on labor in areas like clerical procedures. Banking is a regulated industry with a deeply rooted "sealing culture," which requires the use of multiple personal seals. There is also a lot of paperwork. Such manual labor could be streamlined through the use of AI and automation technology.

Learning from AI

Q: How will "fintech," financial services that utilize IT, transform banks?

A: There seems to be a view that start-ups involved in fintech will replace banks in the future. However, banks will not go away. Banks play an important role in facilitating the flow of money, which is the lifeblood of the economy.

Start-ups abroad that provide platforms for individuals to lend and borrow money have been touted for a while. However, use of such platforms is not widespread. Banks maintain a superior ability to collect information on borrowers.

Of course, incorporating advanced technology into business practices is important. U.S.-based Amazon.com has launched a system in which it provides funding to vendors based on an AI-powered examination of their sales and other factors. This deserves attention.

Nevertheless, it is difficult for AI to comprehensively assess creditworthiness, which includes factors like the appearance of corporate managers and changes in their lifestyles. Lending at an appropriate interest rate to borrowers who have a risk of default is an important task performed by banks.

They also play a big role in converting savings into investments. Although the Financial Services Agency wants banks to engage in customer-oriented operations, I think that bankers should learn from "robot advisers," a type of AI that recommends suitable investments for customers. Instead of peddling particular products banks want to sell, bankers would be able to suggest products needed by customers by looking at their asset composition.

Stability-minded bank employees will no longer be needed. It is important to cultivate highly skilled workers who can work with new concepts. We are entering an era where only banks that capably adopt fintech and turn themselves into a provider of financial services that can truly consider the needs of customers, will survive.

-- This interview was conducted by Yomiuri Shimbun Staff Writer Tomoko Echizenya.

-- Hironari Nozaki / Toyo University Professor

Nozaki received an MBA from Yale University School of Management in 1991 after graduating from Keio University's Faculty of Economics in 1986. He has held his current post since April 2018, after working for Citigroup Global Markets Japan and as a professor at Kyoto Bunkyo University, among other positions.

Read more from The Japan News at https://japannews.yomiuri.co.jp/