/Computer%20board%20micro%20chip%20green%20by%20blickpixel%20via%20Pixabay.jpg)

Nvidia (NVDA) has long stolen the show, but some on Wall Street are convinced there’s a supporting character worthy of more attention.

That role is played by none other than Texas Instruments (TXN), a chip stock analysts are now dubbing “unique.”

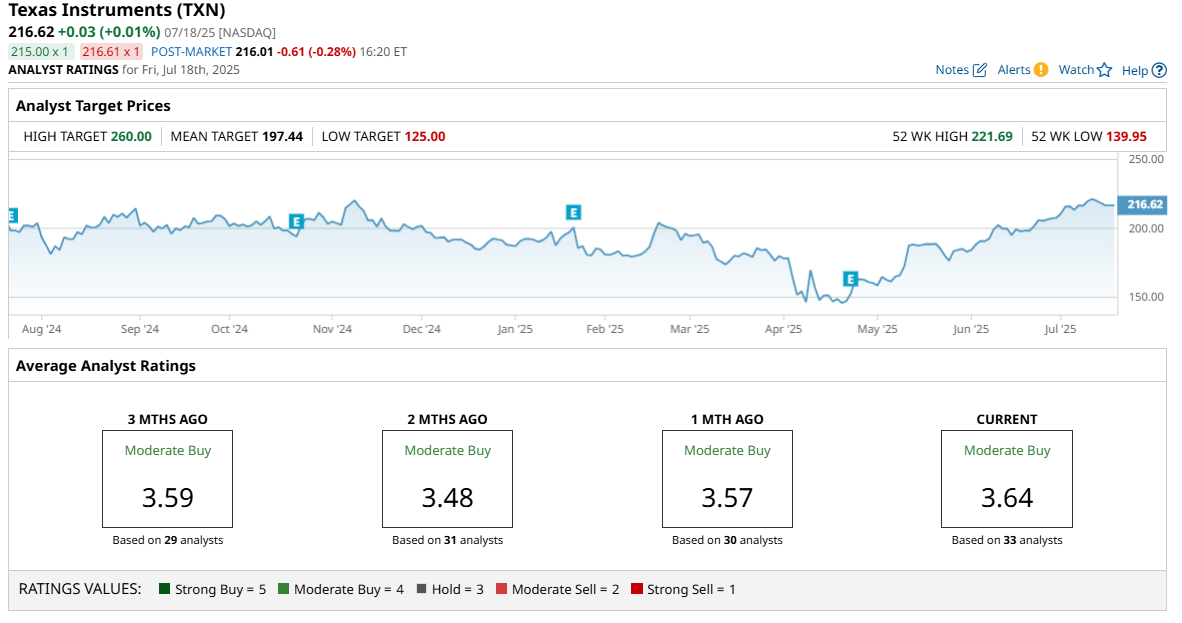

Shares of the semiconductor and electronics manufacturer have rebounded more than 50% from their April lows following President Donald Trump’s tariff announcement. In fact, shares are just over 2% off new all-time highs.

According to analysts at TD Cowen, TXN stock is worth a closer look here. Their $245 price target implies 13.5% upside from here.

Big Analyst Upgrade

Texas Instruments’ core business, which relies on sales of analog and embedded devices, has continued to see growth, with analysts at TD Cowen projecting the company can generate around $7 per share in free cash flow amid a murky tariff outlook. This forecast is driven in part by the company’s solid U.S. footprint, which should offset many of the trade worries that initially drove shares of the analog chip maker to new lows in April.

Is the Valuation Too Rich?

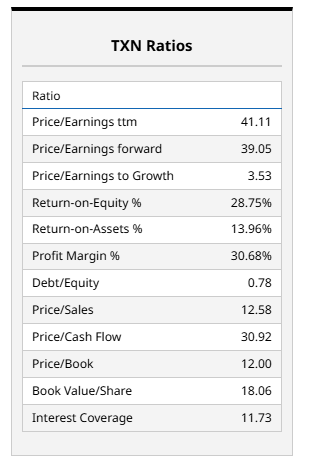

In this analyst note, the TD Cowen team did note that Texas Instruments’ valuation is rich.

The stock trades at a forward price-earnings ratio of nearly 40x, and a price-sales ratio of 12.6x. This puts it significantly above sector medians for both metrics.

But if the company can produce $7 per share in free cash flow, a $245 price target does imply a free cash flow yield of just under 3%, which is reasonable for a company of this quality and scale.

I’m of the view that the real catalyst that could take TXN stock higher in the medium term is the company’s overall profit margin and its return on equity, so I am not sweating its valuation as much here.

What Other Analysts Say About TXN Stock

Overall, Texas Instruments does appear to be fairly valued here, at least based on what the analyst community thinks.

The current consensus analyst price target for TXN stock sits at $197.44 per share, implying investors could have roughly 9% downside from here. But TD Cowen analysts aren’t even the most bullish on Texas Instruments here. This is a stock that has received price targets as high as $260 per share, implying more than 20% upside potential, and it’s that analysts could soon raise their lower price targets based on the stock’s recent performance.

Given the lagging nature of many analyst upgrades, more recent notes tend to get more attention in the investment community. There’s good reason for this, and the TD Cowen analysts noted above do make good points about this company’s fundamentals and its free cash flow growth potential. In my view, this recent analyst upgrade seems reasonable, but this is a stock I'm going to happily watch from the sidelines for now.