The Walt Disney Company (DIS) is a global leader in media, entertainment, and experiences, best known for its iconic brands such as Disney, Pixar, Marvel, Star Wars, and ESPN. Disney’s creative legacy expanded beyond animation into live-action films, television, theme parks, and consumer products. The company’s theme parks and resorts, spanning North America, Europe, and Asia, have set industry standards for immersive guest experiences.

Established in 1923 by brothers Walt and Roy Disney as a small animation studio, Disney quickly rose to prominence, now catering to customers worldwide.

About DIS Stock

Disney’s stock has experienced a mixed 2025 in the equity markets. Over the past five days, DIS stock has risen 1.4%, but it has dipped more than 4.5% in the last month. The six-month performance shows a solid 31% rise, while the year-to-date (YTD) figure remains nearly flat, down just 0.5%. In comparison, the S&P 500 ($SPX) climbed over 13% YTD, well ahead of Disney’s return. The stock’s recovery is closely tied to streaming growth and theme park momentum, but it trails the broader market’s robust performance.

Disney Posted Mixed Results

Walt Disney reported its Q3 fiscal 2025 results on August 6, posting revenue of $23.7 billion, a 2% increase year-over-year (YoY) but slightly below analyst estimates of $23.76 billion. Adjusted earnings per share came in at $1.61, beating consensus forecasts by 11.5% and reflecting a 16% increase from the previous year.

The company’s segment operating income rose 8% to $4.6 billion, driven primarily by a profitable shift in its Direct-to-Consumer streaming segment, which swung to an operating profit of $346 million from a loss in the previous year. Parks and Experiences also showed strength with a 13% increase in operating income.

However, the Entertainment segment faced challenges, with operating income declining 15%, impacted by fewer blockbuster releases and the Star India transaction. Content sales and licensing revenue also softened compared to prior periods. Despite operational headwinds, Disney’s financial position remained solid, supported by strong cash flow and investments in future growth, such as new cruise ships, which incurred approximately $185 million in pre-opening costs.

For guidance, Disney raised its full-year adjusted EPS outlook to $5.85, an 18% increase over fiscal 2024, expecting continued growth in streaming subscribers and profitability. Management emphasized an ongoing focus on global expansion, integration of streaming platforms, and innovation in content and experiences to drive future success.

Disney is also scheduled to release its fourth-quarter 2025 results on Nov. 13.

Disney Set to Ride the Taylor Swift Wave

Walt Disney is set to premiere a highly anticipated six-part docuseries, "Taylor Swift | The Eras Tour | The End of an Era," on Disney+ beginning Dec. 12. This behind-the-scenes series offers viewers an intimate glimpse into the creation and global impact of Swift’s record-breaking Eras Tour, which took her to 51 cities across five continents from March 2023 through December 2024, grossing over $2 billion and drawing more than 10 million attendees. The docuseries will spotlight not only Swift but also featured performers and close collaborators, including Gracie Abrams, Ed Sheeran, and Florence Welch.

Alongside the docuseries, Disney+ will release "Taylor Swift | The Eras Tour | The Final Show," a full concert film capturing Swift’s finale at BC Place Stadium in Vancouver on Dec. 8, 2024, including live performances of songs from "The Tortured Poets Department," which was introduced partway through the tour. This builds on the success of the previous theatrical concert film, the highest-grossing of all time of its kind, which Disney+ extended in March 2024.

Taylor Swift continues to break records beyond touring, with her newest album, "The Life of a Showgirl," selling 4 million equivalent units in the first week in the U.S., leveraging both physical sales and streaming to top charts impressively. Disney’s exclusive streaming partnership with Swift highlights the company’s strategy to boost subscribers with premium, original music content.

Should You Get DIS?

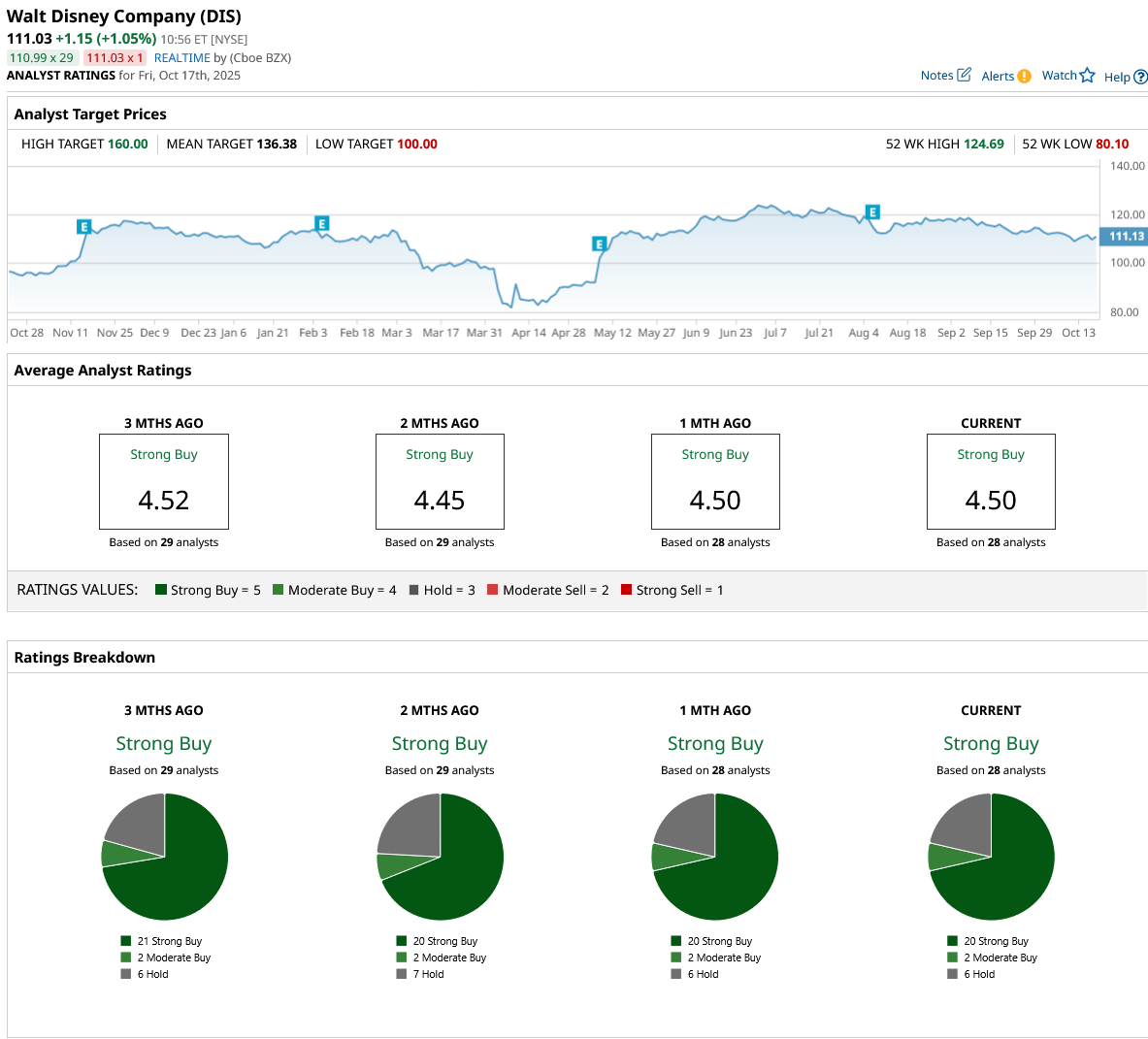

Disney has been one of the top entertainment companies in the world, and analysts' confidence reflects its strong grip on the industry. Wall Street has a consensus “Strong Buy” rating with a mean price target of $136.38, reflecting an upside potential of 23% from the market rate.

The stock has been rated by 28 analysts so far, receiving 20 “Strong Buy” ratings, two “Moderate Buy” ratings, and six “Hold” ratings.