ABC and its parent company, Walt Disney (DIS), continue to see the impact of ABC’s decision to suspend late-night talk show host Jimmy Kimmel in the wake of Charlie Kirk’s assassination.

A report from Antenna Research Associations shows about 7 million subscribers cancelled their Disney+ and Hulu subscriptions after ABC put Kimmel on the shelf from Sept. 17 to Sept. 25. Kimmel, in his Sept. 17 monologue, discussed reactions to the shooting death of Kirk, the founder of Turning Point USA. He said, “We hit some new lows over the weekend with the MAGA gang desperately trying to characterize this kid who murdered Charlie Kirk as anything other than one of them, and doing everything they can to score political points from it.”

ABC took Kimmel’s show, Jimmy Kimmel Live!, off the air Sept. 17, after FCC chairman Brendan Carr threatened action against ABC and Disney. “We can do this the easy way or the hard way. These companies can find ways to change conduct and take action, frankly, on Kimmel, or there's going to be additional work for the FCC ahead,” he said.

The drop of 7 million subscribers is significant. Disney reported 183 million Disney+ and Hulu subscribers at the end of the second quarter, up 2.6 million from the previous quarter. So, losing 7 million would be a setback—even though the company also added 2.2 million new Disney+ subscribers in September through a paid plan or free trial. Hulu added 2.1 million new subscribers, according to Antenna's report.

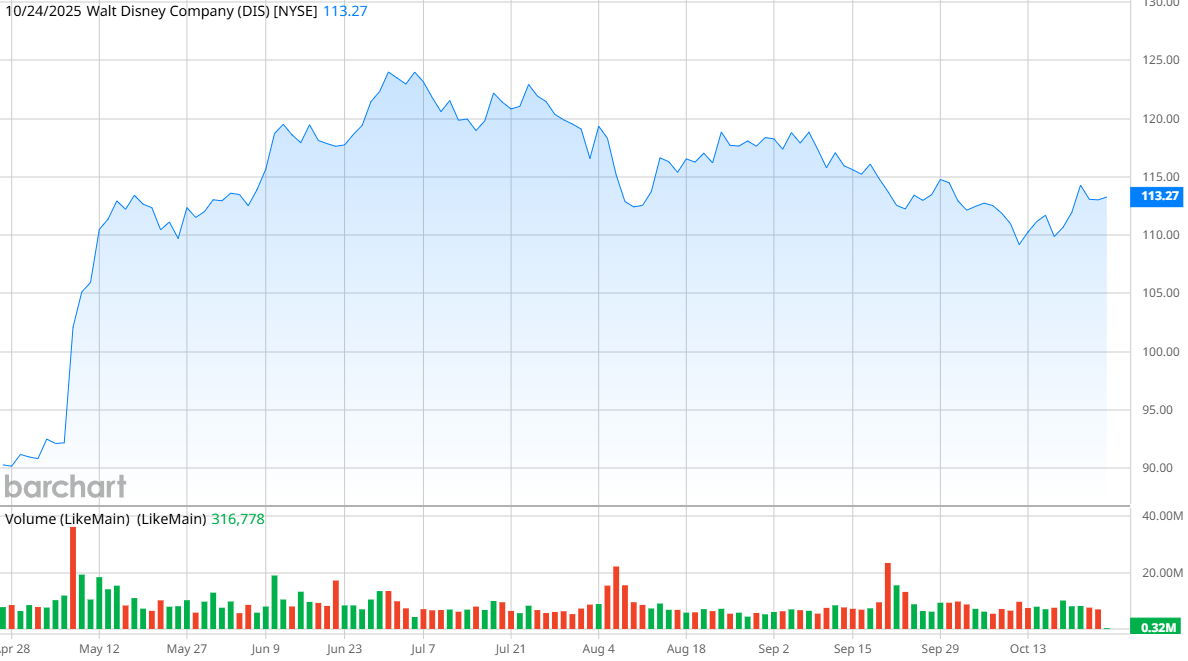

DIS stock has been treading water for the last month, and the subscriber base for Disney+ and Hulu is churning. How should investors view Disney right now?

About Walt Disney Stock

Based in Burbank, California, Disney is a lot more than just television. In addition to its streaming services and ABC television, Disney owns the ESPN platform, which is the dominant sports broadcaster in the U.S.; film studios that include Disney, Pixar, Star Wars, and Marvel Entertainment; cruise lines; and the company’s signature theme parks in Florida and California. With a market cap of more than $200 billion, Disney is a true entertainment conglomerate.

Share prices have trailed the market this year, however, up only 0.36% versus the 15.5% year-to-date (YTD) return in the S&P 500 ($SPX).

The company has a price-to-earnings (P/E) ratio that’s relatively favorable, particularly compared to its competition. Disney’s trailing P/E of 17.7 is better than Netflix (NFLX) (46.5) and Warner Bros. Discovery (WBD) (70.3). Paramount Skydance (PSKY) is slightly better, with a P/E of 13.5.

Disney pays a small dividend of $1 per share, representing a yield of 0.9%. Interestingly, Disney typically pays the dividend twice a year, rather than quarterly, so that’s something to be aware of if you’re counting on a consistent revenue stream.

Disney Beats on Earnings

On Aug. 6, Disney reported earnings for its fiscal third quarter (ending June 28). Revenue of $23.65 billion was up 2% from a year ago, while operating income of $4.57 billion was up 8% on a year-over-year (YoY) basis. Disney posted earnings per share of $1.61, beating analysts’ estimates of $1.46.

Disney is leaning hard into its sports programming with its direct-to-consumer platform for ESPN that offers tens of thousands of sports events annually through its app or connected TVs, rather than relying on cable providers to purchase ESPN for its customers. The direct-to-consumer division posted a profit of $346 million for the quarter, with revenue of $6.17 billion.

“The company is taking major steps forward in streaming with the … launch of ESPN’s direct-to-consumer service, our just-announced plans with the NFL, and our forthcoming integration of Hulu into Disney+, creating a truly differentiated streaming proposition that harnesses the highest-caliber brands and franchises, general entertainment, family programming, news, and industry-leading sports content,” Disney CEO Bob Iger said.

For the fourth quarter, Disney issued guidance for more than 10 million additional Disney+ and Hulu subscribers. The churn experienced in the wake of the Kimmel controversy may make it difficult to hit those numbers. Disney has scheduled its Q4 earnings report for Nov. 13.

What Do Analysts Expect for DIS Stock?

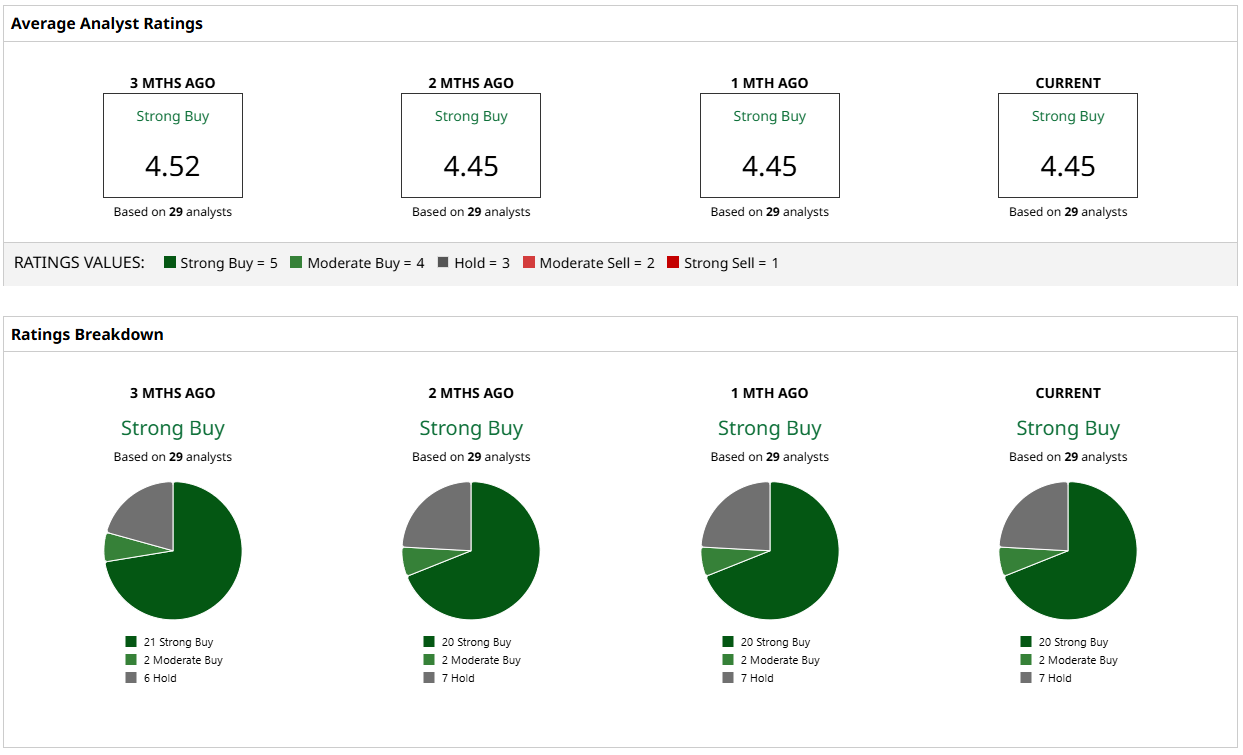

There’s a lot of bullish sentiment for Disney stock. Of the 29 analysts currently covering it, 20 of them call DIS stock a “Strong Buy,” and two others call it a “Moderate Buy.” The rest all advocate holding, but not a single analyst suggests selling.

Price targets for DIS stock range between $100 and $160, with the mean price target of $136.58 indicating a 20% upside. If you’re extremely bullish about Disney, you could expect as much as 41% upside, but the most bearish analyst’s target would suggest a dip of nearly 12%.

Considering the overwhelming sentiment for DIS stock, the Kimmel controversy looks to be a minor one for Disney (and one from which it has already backtracked, as Kimmel is back on the air). Expect the churn of subscribers to fade quickly and for Disney to continue adding subscribers to Disney+ and Hulu.

.png?w=600)