Shares of Walt Disney Co (NYSE:DIS) and Netflix Inc (NASDAQ:NFLX) are trading lower Friday, possibly pressured by reports that a Paramount Skydance Corp (NASDAQ:PSKY) group is preparing a bid for Warner Bros. Discovery Inc (NASDAQ:WBD). The news could sparked a threat for the streaming industry leaders.

What To Know: A primary concern is the creation of a new media juggernaut. A successful deal would combine WBD's powerhouse assets like HBO, DC Comics and Harry Potter with Paramount's library, including "Top Gun," "Mission: Impossible" and the CBS network.

This entity would also boast a commanding sports rights portfolio across the MLB, NBA, NFL and NHL, creating a formidable competitor that could disrupt the streaming landscape and challenge Disney’s ESPN.

The prospect of facing a super-competitor is creating uncertainty for both streaming giants Friday afternoon as Wall Street weighs the potential outcomes.

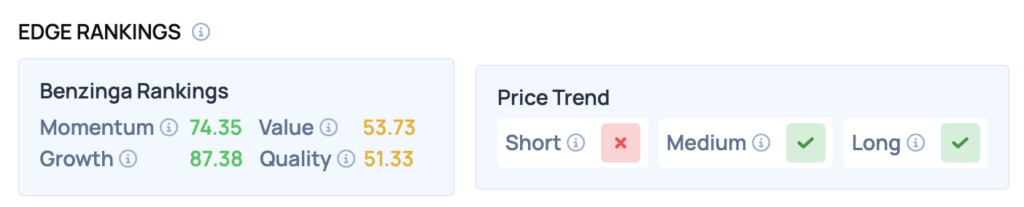

Benzinga Edge Rankings: Despite the stock’s weakness on Friday, Disney’s Benzinga Edge rankings show significant underlying strength with a Growth score of 87.38.

DIS, NFLX Price Action: According to data from Benzinga Pro, DIS shares are trading lower by 1.04% to $115.85. NFLX shares are trading lower by 1.38% to $1,186.95.

Read Also: Cathie Wood Says Yes To Klarna IPO: Ark Invest Scoops Up Shares On First Two Days Of Trading

How To Buy DIS Stock

By now you're likely curious about how to participate in the market for Walt Disney – be it to purchase shares, or even attempt to bet against the company.

Buying shares is typically done through a brokerage account. You can find a list of possible trading platforms here. Many will allow you to buy “fractional shares,” which allows you to own portions of stock without buying an entire share.

If you're looking to bet against a company, the process is more complex. You'll need access to an options trading platform, or a broker who will allow you to “go short” a share of stock by lending you the shares to sell. The process of shorting a stock can be found at this resource. Otherwise, if your broker allows you to trade options, you can either buy a put option, or sell a call option at a strike price above where shares are currently trading – either way it allows you to profit off of the share price decline.

Image: Shutterstock