Amid rising concerns about stagflation, investors have continued to bid up the equities sector. As evidence, the benchmark S&P 500 sector is up over 13% year-to-date. However, the concern is that most of these tremendous gains are now concentrated in an elite minority of tech players known as the Magnificent Seven. These entities have recently combined to reach a market capitalization of nearly $21 trillion: great for them but not great for underperforming sectors like healthcare.

One of the laggards is the healthcare industry. Since the beginning of the year, exchange-traded funds that track the biggest names in the broader care ecosystem have traded slightly below parity — a far cry from benchmark indices as well as other individual sectors. Not surprisingly, the Trump administration and its policies play a major role in perceived risks.

For one thing, health insurance companies have sounded the alarm that the White House's tariffs could lead to higher premiums for enrollees in the individual and small group markets next year. Fundamentally, the levies are expected to raise the costs of prescription drugs, medical devices and other medical products and services. As such, the impact to the wider medical supply chain will likely be passed down to patients.

If that wasn't enough, President Donald Trump's push to align U.S. drug prices with overseas markets has sent chills to major pharmaceuticals like Eli Lilly (NYSE:LLY), which earlier this year got dropped from a major formulary in favor of Novo Nordisk (NYSE:NVO).

Despite the challenging waters, though, there could be a bullish opportunity for intrepid contrarians. Primarily, speculation may rise regarding a valuation reset. Yes, the tech sector — particularly artificial intelligence — has dominated proceedings. However, an argument exists that many of these individual players feature valuations that have gotten too hot. As such, a rotation into relatively cheaper names may materialize, which could benefit the healthcare sector.

Also, the health space benefits from the fundamentals of inevitability. No matter what, humans get older and, during the aging process, encounter various challenges. In particular, the baby boomer generation is reshaping the healthcare landscape — and this may have significant implications for sector viability.

The Direxion ETF: For those interested in betting on the care industry to an extremely aggressive magnitude, financial services provider Direxion offers an ultra-leveraged exchange-traded fund. Known as the Direxion Daily Healthcare Bull 3X Shares (NYSE:CURE), the financial vehicle tracks 300% of the performance of the Health Care Select Sector index.

Specifically, the CURE ETF is geared for extreme speculators seeking short-term exposure to the underlying industry, which carries two main advantages. First, market gamblers can place extreme wagers without having to rely on call options, which can carry complexities that may not be appropriate for everyone. Second, ETFs spread risk across multiple names rather than relying on any one enterprise.

Despite the advantages of Direxion ETFs, prospective participants must consider their risks. First, leveraged funds tend to be far more volatile than funds tracking benchmark indices such as the S&P 500. Second, traders should not hold these products for longer than one day. Doing so exposes stakeholders to the daily compounding effect, which can lead to positional decay. This is especially problematic for triple-leveraged ETFs.

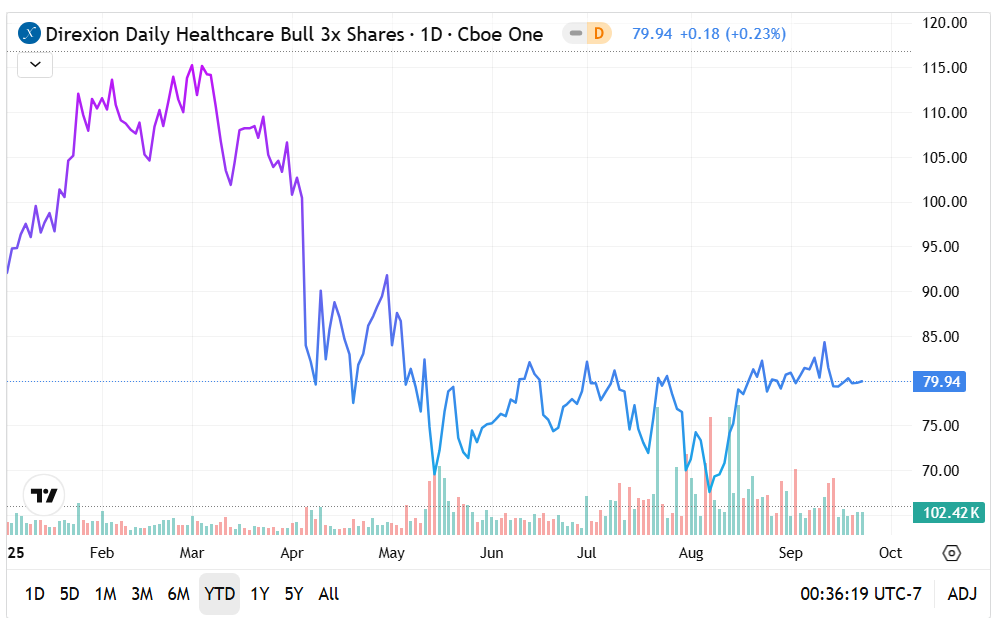

The CURE ETF: Since the beginning of the year, the CURE ETF has lost a bit more than 13%, which isn't terrible considering the triple-leveraged structure. However, in the past 52 weeks, it's down over 40%.

- Presently, the ultra-leveraged fund is sandwiched between the 200-day moving average above and the 50 DMA below. With the latest move, CURE poked its head above the 20-day exponential moving average.

- Since the first half of May, the CURE ETF has generally traded along a sideways consolidation pattern. This may demonstrate resilience, potentially giving weight to the aforementioned valuation reset.

Featured image by Chokniti Khongchum from Pixabay.