While most investors may arguably be focused on productive ventures such as cloud computing and artificial intelligence, it's an objective reality that the robust but controversial defense sector has been an outperformer. Since the beginning of the year, the benchmark Dow Jones U.S. Select Aerospace & Defense Index has gained nearly 35%. In contrast, the S&P 500 is up a hair over 6% during the same frame.

Still, the upward trajectory of defense-focused funds doesn't necessarily mean that the surge was linear. Like any other market segment, the publicly traded arm of the military-industrial complex experiences ebbs and flows. In the business week ending Aug. 1, the aforementioned aerospace and defense index declined by 1.24%. Despite the recent splashing of red ink, investors may use this time to consider conducting more research.

First, it's likely that the sector is permanently relevant, albeit in an incredibly cynical manner. Since recorded history, humanity has not always been able to resolve its conflicts civilly and diplomatically. Beyond this point, there's an argument to be made that a robust military keeps honest people honest.

Second, geopolitical flashpoints continue to rage. Perhaps most notably, Russian President Vladimir Putin has indicated that there will be no shift in Russia's stance on the Ukraine conflict, despite the risk of sanctions set by President Donald Trump. Instead, Putin appears to be doubling down on his war course, citing battlefield gains that are apparently shifting the tide in Russia's favor. Such posturing may force the Trump administration to reconsider its Ukraine policy, which may have implications for defense spending.

But it's not just Ukraine that presents a threat to geopolitical stability. Earlier this year, Defense Secretary Pete Hegseth urged Asian partners to bolster their military spending, labeling China's maneuvering as a threat. To be fair, recent headlines have been relatively quiet on this front. That said, Taiwan is a sensitive topic for Beijing, which the Council on Foreign Relations warned could represent a flashpoint in U.S.-China relations.

Finally, it should be noted that the U.S. consistently spends more on defense than any other nation; in fact, the Peter G. Peterson Foundation reports that the U.S. spends more on defense than the next nine countries combined. With this trend unlikely to fade significantly anytime soon, investors may consider the potential viability of a defense-focused fund.

The Direxion ETF: Those market participants reading between the geopolitical lines may look into the Direxion Daily Aerospace & Defense Bull 3X Shares (NYSE:DFEN). This ultra-leveraged exchange-traded fund seeks daily investment results, before fees and expenses, of 300% of the performance of the aforementioned Dow Jones defense sector index.

A key reason for considering Direxion's leveraged ETFs is convenience. Generally speaking, investors interested in accelerating their potential payouts (assuming a profitable outcome) must engage the options market. However, financial derivative products carry complexities that may not be suitable for all market participants. In contrast, Direxion ETFs can be bought and sold much like any other publicly traded security, thus mitigating the learning curve.

Still, prospective traders must be aware of these funds' unique risks. First, ultra-leveraged ETFs typically encounter far greater volatility than funds tracking benchmark indices, such as the S&P 500. Second, Direxion ETFs are designed for exposure lasting no longer than one day. Holding these ETFs for longer than the recommended period may expose participants to value decay due to the daily compounding effect.

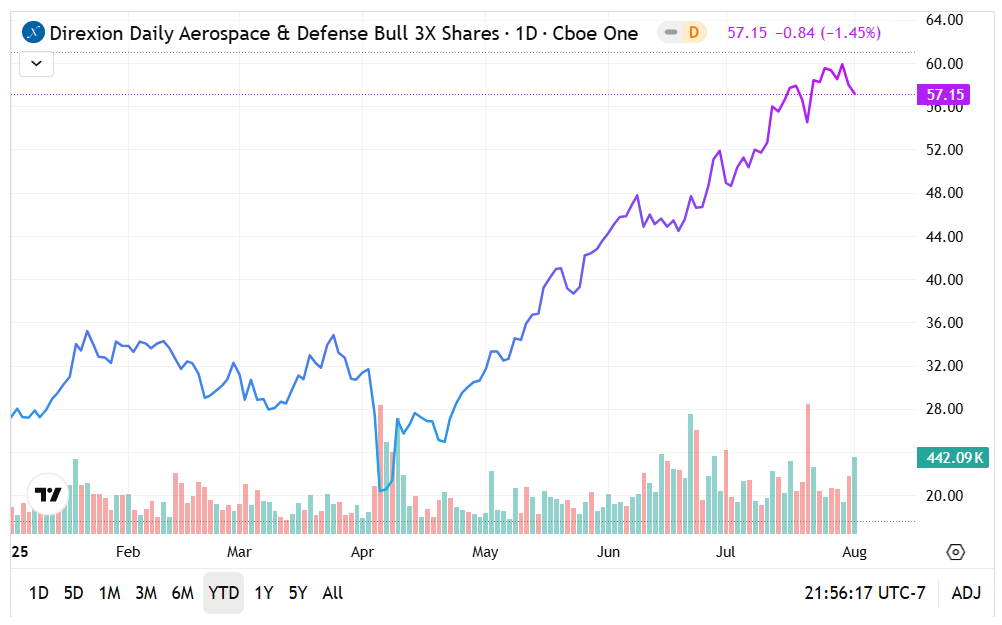

The DFEN ETF: Since the start of the year, the DFEN ETF has gained nearly 108%, a blistering performance compared to the equities benchmark index. However, in the trailing week, it did lose roughly 6%.

- With the latest bout of volatility, the DFEN ETF is currently straddling the 20-day exponential moving average, inviting a closer look for discount-seeking speculators.

- Technically, DFEN has previously corrected to the 20-day EMA, only to bounce higher. With the ultra-bull fund firmly above the 50 and 200 DMAs, this posture may inspire confidence.

Featured image by WikiImages on Pixabay.