/Dexcom%20Inc%20HQ-by%20JHVEPhoto%20via%20Shutterstock.jpg)

San Diego, California-based DexCom, Inc. (DXCM) is a medical device company that designs, develops, and commercializes continuous glucose monitoring (CGM) systems. Valued at $27.4 billion by market cap, the company develops a small implantable device that continuously measures glucose levels in subcutaneous tissue just under the skin and a small external receiver to which the sensor transmits glucose levels at specified intervals. The global leader in glucose biosensing is expected to announce its fiscal fourth-quarter earnings for 2025 after the market closes on Thursday, Feb. 12.

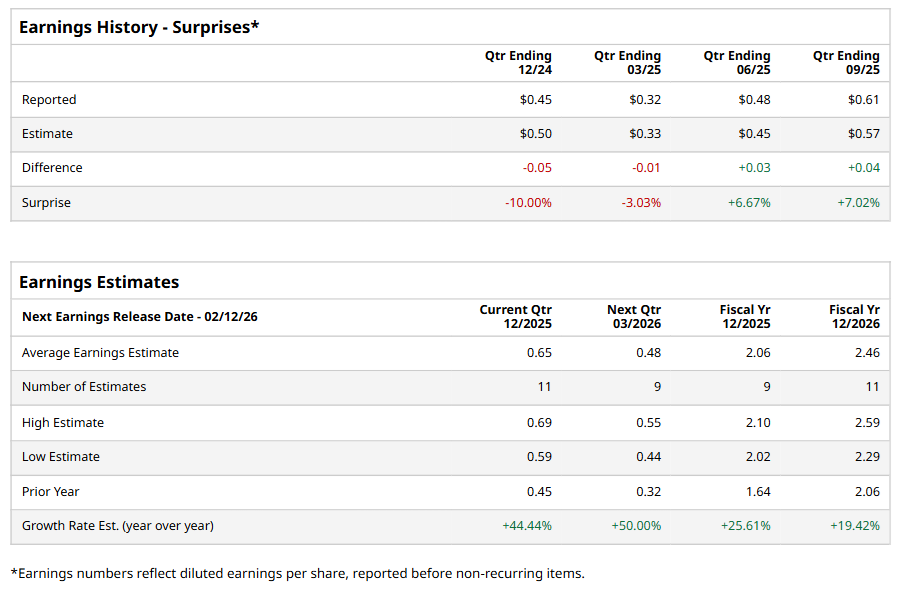

Ahead of the event, analysts expect DXCM to report a profit of $0.65 per share on a diluted basis, up 44.4% from $0.45 per share in the year-ago quarter. The company beat the consensus estimates in two of the last four quarters while missing the forecast on two other occasions.

For the full year, analysts expect DXCM to report EPS of $2.06, up 25.6% from $1.64 in fiscal 2024. Its EPS is expected to rise 19.4% year over year to $2.46 in fiscal 2026.

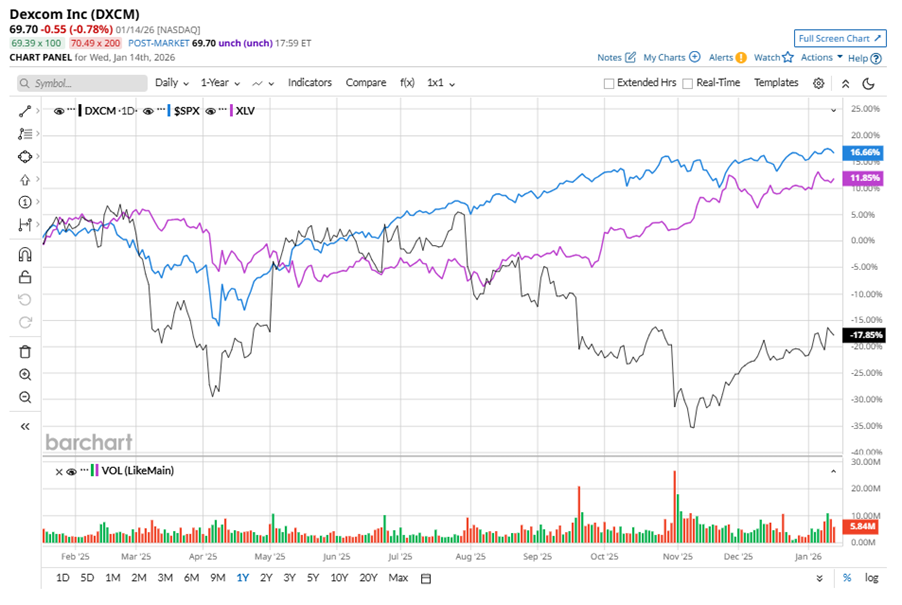

DXCM stock has underperformed the S&P 500 Index’s ($SPX) 18.6% gains over the past 52 weeks, with shares down 12% during this period. Similarly, it underperformed the Health Care Select Sector SPDR Fund’s (XLV) 12.8% returns over the same time frame.

DXCM's underperformance is due to the FDA warning letter over manufacturing issues and trade war worries with China, sparking supply chain concerns. Additionally, higher scrap rates and sensor deployment issues also weigh in, although management sees improvements with new quality controls and shipping methods.

On Oct. 30, 2025, DXCM reported its Q3 results, and its shares closed down by 14.6% in the following trading session. Its adjusted EPS of $0.61 surpassed Wall Street expectations of $0.57. The company’s revenue was $1.21 billion, exceeding Wall Street forecasts of $1.18 billion. DXCM expects full-year revenue in the range of $4.6 billion to $4.7 billion.

Analysts’ consensus opinion on DXCM stock is bullish, with a “Strong Buy” rating overall. Out of 28 analysts covering the stock, 22 advise a “Strong Buy” rating, one suggests a “Moderate Buy,” four give a “Hold,” and one recommends a “Strong Sell.” DXCM’s average analyst price target is $85.20, indicating a potential upside of 22.2% from the current levels.