Devon Energy Corporation (DVN) is a leading Oklahoma City-based independent oil and natural gas exploration and production company. With a market cap of $22 billion, Devon’s operations span the Delaware Basin, Eagle Ford, Anadarko Basin, Williston Basin, and other regions in North America.

The energy giant has significantly underperformed the broader market over the past year. Devon’s shares have dwindled 26.9% over the past 52 weeks and gained 3.2% on a YTD basis, compared to the S&P 500 Index’s ($SPX) 17% surge over the past year and 8.2% rise on a YTD basis.

Narrowing the focus, Devon has underperformed the iShares U.S. Oil & Gas Exploration & Production ETF’s (IEO) 8.2% decline over the past 52 weeks, while outperforming IEO’s 1.7% rise on a YTD basis.

On Jul. 28, Devon Energy shares rose over 3% driven by a more than 2% surge in WTI crude oil prices to a one-week high.

For the current year, ending in December, analysts expect DVN to report a 14.1% year-over-year decline in earnings to $4.14 per share. Moreover, the company has exceeded the Street’s bottom-line estimates in three of the past four quarters, while missing on another occasion.

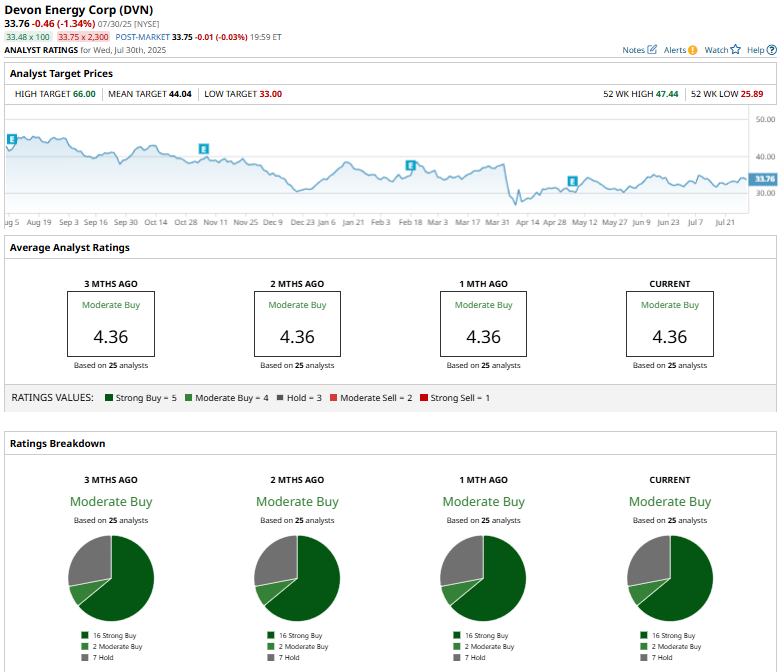

DVN holds a consensus “Moderate Buy” rating overall. Of the 25 analysts covering the stock, opinions include 16 “Strong Buys,” two “Moderate Buys,” and seven “Holds.”

This configuration has been mostly stable in recent months.

On July 22, Raymond James analyst John Freeman reiterated his "Outperform" rating on Devon Energy and raised the price target from $40 to $45.

DVN’s mean price target of $44.04 indicates a 30.5% premium to current price levels, while its Street-high target of $66 suggests a staggering 95.5% upside potential.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.