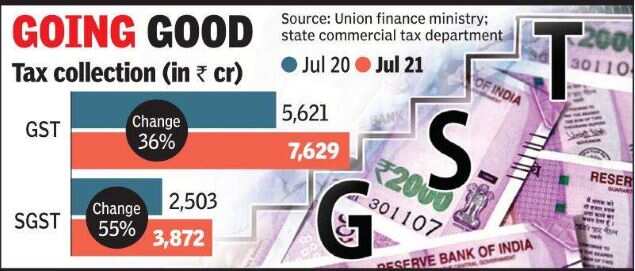

AHMEDABAD: Signalling an increase in economic and commercial activity and a surge in inflation, the collection of total Goods and Services Tax (GST) in Gujarat surged 36% in July 2021, states the data released by the Union finance ministry. Total GST collection stood at Rs 7,629 crore in July 2021 against Rs 5,621 crore in the same month last year.

The growth in tax collection in Gujarat was higher than the India average of 32% during the same period. The growth is comparatively high on a lower base as tax collection suffered due to a slower recovery in demand after the lockdown last year. State commercial tax department officials and industry players attribute the growth to a surge in economic activity.

“The commercial activity has increased significantly in July. The demand has bounced back after slowing after the second wave of Covid-19, signalling a revival in the economy.

In the run up to the festive season, the demand has taken off across various industrial sectors as the cases of Covid-19 have consistently remained very low,” said J P Gupta, state commercial tax commissioner.

“As compared to July last year, inflation has also increased which contributed to the surge in overall tax collection,” said a tax official on condition of anonymity.

State GST (SGST) collection in Gujarat was the second highest ever in July since the new tax regime was rolled out, according to data provided by the state commercial tax department. The highest was in April 2021, at Rs 4,279 crore.

The state’s revenues through GST also showed a significant 55% growth in July this year over last year. Gujarat recorded Rs 3,872 crore of SGST collection in July 2021 – up 55% against Rs 2,503 crore in the same month last year.

In fact, SGST collection also surged 34% against June’s Rs 2,875 crore.

“With businesses opening up after easing of Covid-19 related curbs and demand bouncing back across various sectors after the second wave, the industrial activity has picked up pace. This is witnessed across sectors; it could be a major contributor to the growth in tax collection,” said an Ahmedabad-based corporate professional.