/Delta%20Air%20Lines%2C%20Inc_%20passanger%20plane-by%20viper-zero%20via%20iStock.jpg)

With a market cap of $37 billion, Delta Air Lines, Inc. (DAL) is one of the four major U.S. carriers controlling over 60% of the domestic aviation market. The company operates through two segments: Airline and Refinery, providing scheduled passenger and cargo transportation across an extensive domestic and international network.

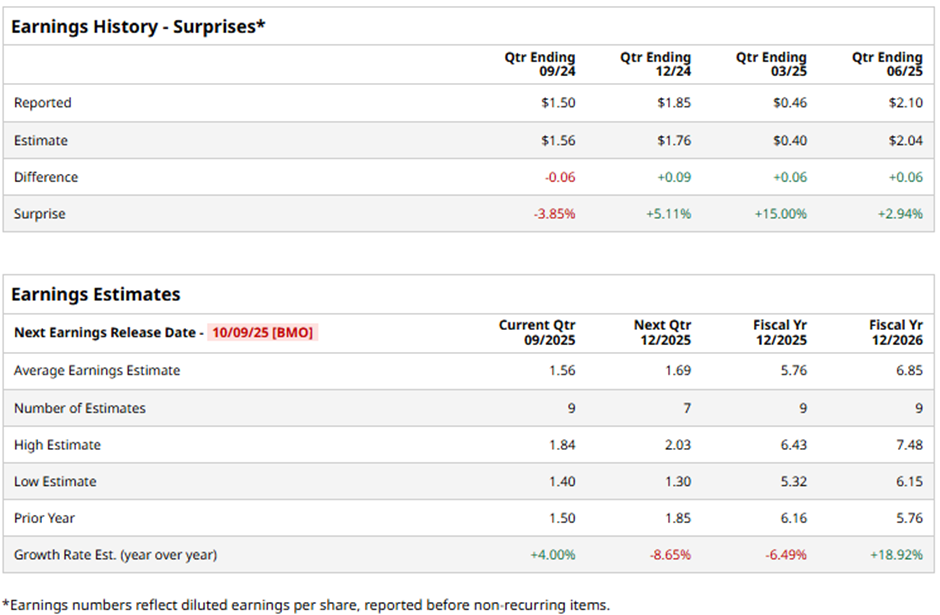

The Atlanta, Georgia-based company is expected to announce its fiscal Q3 2025 results before the market opens on Thursday, Oct. 9. Ahead of this event, analysts expect Delta Air Lines to report an adjusted EPS of $1.56, up 4% from $1.50 in the year-ago quarter. It has surpassed Wall Street's earnings estimates in three of the last four quarters while missing on another occasion.

For fiscal 2025, analysts predict the company to report an adjusted EPS of $5.76, a 6.5% decline from $6.16 in fiscal 2024. However, adjusted EPS is anticipated to increase 18.9% year-over-year to $6.85 in fiscal 2026.

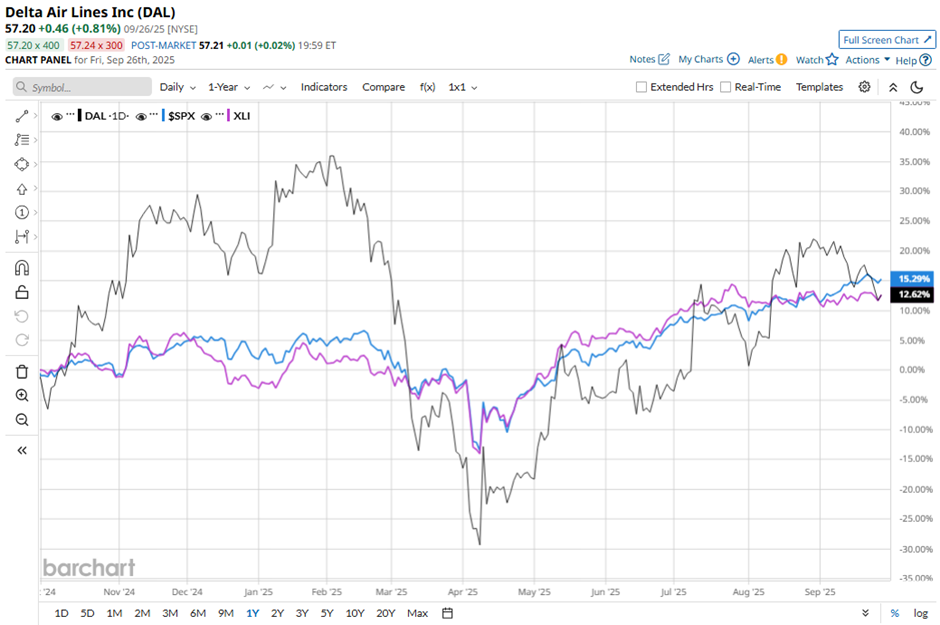

Shares of Delta Air Lines have returned 10.4% over the past 52 weeks, underperforming both the S&P 500 Index's ($SPX) 15.6% gain and the Industrial Select Sector SPDR Fund's (XLI) 13.3% increase over the same period.

Shares of Delta Air Lines jumped nearly 12% on Jul. 10 after the company reported better-than-expected Q2 2025 adjusted EPS of $2.10 and revenue of $16.7 billion. Despite flat passenger revenue and a 5% drop in domestic unit revenue, Delta issued a full-year profit forecast of $5.25 per share to $6.25 per share and projected Q3 EPS of $1.25 to $1.75, surpassing the consensus at the high end.

Analysts' consensus view on DAL stock is bullish, with an overall "Strong Buy" rating. Among 20 analysts covering the stock, 17 suggest a "Strong Buy," and three give a "Hold." This configuration is less bullish than three months ago, with 19 analysts suggesting a "Strong Buy."

The average analyst price target for Delta Air Lines is $69.36, indicating a potential upside of 21.3% from the current levels.