Dell Technologies Inc. (NYSE:DELL) is taking a firm stance amid rising trade and tariff-related uncertainties, with COO Jeff Clarke saying that the company does not expect any major impact going forward and does not plan on increasing prices for customers.

DELL stock is showing notable weakness. Find out why here.

‘We Weathered The Storm’

During the company’s second-quarter earnings call on Thursday, Clarke said their guidance for the full year already has everything they know about the tariffs priced in.

Clarke emphasized that Dell has factored in all known tariff impacts and still sees a favorable pricing environment. In fact, during the second quarter, the company found its input costs to be “deflationary.”

See Also: How To Earn $500 A Month From Dell Stock Ahead Of Q2 Earnings

While tariffs have prompted some tech firms to adjust pricing or issue warnings about cost inflation, Dell signaled its global supply chain is equipped to manage disruptions. “We weathered the storm quite well and ultimately took care of our customers and served them quite well,” Clarke said.

The company’s CFO, Yvonne McGill, echoed this outlook, noting that Dell expects a “10% quarter-over-quarter increase in gross margin dollars,” driven in part by profitable AI server growth and improvements in its storage portfolio, and the deflation that it has since experienced in input costs.

“We are leveraging the agility and resilience we have built over the past four decades,” Clarke said, highlighting Dell's decades-long history in supply chain management as a strategic asset in the face of global uncertainty.

Stock Drops Despite Beat On Earnings And Revenue

Dell released its second-quarter results on Thursday, reporting $29.78 billion in revenue, up 18.98% year-over-year, while beating consensus estimates of $29.17 billion. It posted a profit of $2.32 per share, which was again ahead of Street estimates at $2.31 per share.

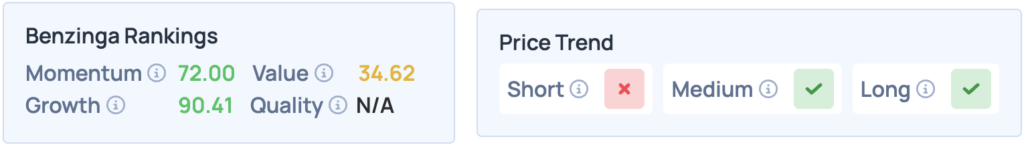

Shares of Dell were up 1.22%, closing at $134.05, but are down 6.08% pre-market. The stock scores well in Benzinga’s Edge Stock Rankings, scoring high on Momentum and Growth, with a favorable price trend in the medium and long terms. Click here for deeper insights into the stock, its peers and competitors.

Read More:

Photo courtesy: mrinalpal / Shutterstock.com