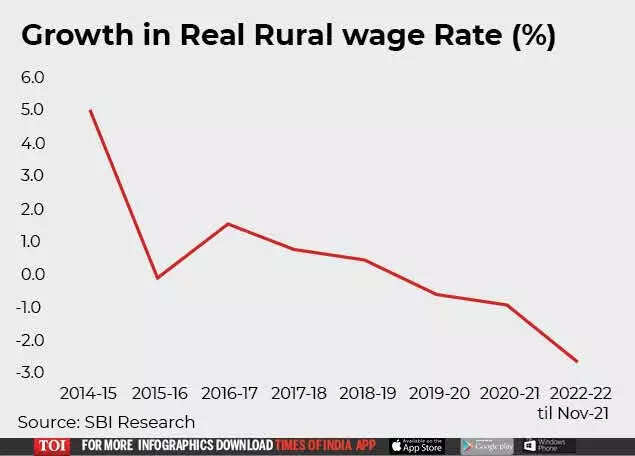

NEW DELHI: Concerns of soaring inflation has led to fall in growth of real rural wages, a report by State Bank of India (SBI) economists said.

A major source of livelihood for farmers, growth in real rural wages have declined since financial year 2017 and is a major cause of concern particularly during the Covid-pandemic era, the report said.

Nominal wages have shown tepid growth from Rs 298 per day in FY17 to Rs 364 per day in FY22.

"Higher prices have been eating into farmer incomes," the report said.

The decline in growth comes even as farm sector is estimated to grow at a robust pace of 3.9 per cent in FY22, as per the latest first advance estimate of national income.

Agriculture sector was the only silver lining amidst the pandemic-induced economic slump in FY21.

However, the report said that after 2 years, the terms of trade in agriculture have once again gone against farming due to high inflation.

SBI economists estimate that per capita agricultural GDP (in current prices) was around Rs 55,000 in FY21. In comparison, non-agricultural per capita GDP was Rs 2,20,000 during the same period.

This shows that per capita agricultural income was around 25 per cent of per capita non-agricultural income, indicating disparity.

Asymmetric growth in deposits

Data analysed by the report showed asymmetrical growth in deposit accretion across various geo-population groups.

At rural centres, deposits growth likely remained subdued in Q3.

While metropolitans -- which has the largest chunk of deposit base -- is also expected to show lesser growth in preceding quarter.

Impact on livelihood

The report further noted that sale of two-wheelers and consumption of fast moving consumer goods (FMCG) in rural India has been tepid in first few quarters of the current financial year.

However, continued robust demand for work under the MGNREGA in FY22 despite the lifting of lockdowns and return of normal economic activity in the cities, does point towards a recovery in rural areas.

More than 6.8 crore households worked under the scheme in FY22 (till February 15) as against 7.55 crore households worked in FY21 and 5.48 crore in FY20.

Loans for rural poor

Economists at SBI suggested that the government can offer livelihood loans up to Rs 50,000 to rural poor.

This loan may be given on the premise that interest-servicing alone will keep the loan standard with subsequent loan renewal linked to successful repayment record, it said.

"If the government were to bear, say, 3 per cent interest subsidy, on a portfolio of Rs 50,000 crore, the outlay would be only Rs 1,500 crore during 2022-23. And these loans will also act as a big consumption booster at subsistent levels," it said.

The additional advantage of these micro livelihood loans is that they will help the banking system prepare a comprehensive database and credit history of marginal borrowers that can be further leveraged to create new credit-worthy borrowing classes, the report said.

(With inputs from agencies)