Debenhams Group has launched a new executive bonus scheme which could see its boss paid almost £150 million without a shareholder vote if the online fashion firm’s value sharply rebounds.

It comes amid a major dispute between the leadership of Debenhams and significant shareholder Mike Ashley.

The bonus plans came as bosses at the business said its turnaround is “gathering real pace” and the retailer heavily reduced its losses after cutting around £160 million in costs.

But the business, which was recently renamed from Boohoo Group, also reported another fall in revenues.

On Thursday, Debenhams revealed a new bonus scheme for bosses – called its group turnaround scheme – designed to incentivise executives and some other members of its senior management team to execute its turnaround strategy.

As part of this, it said chief executive Dan Finley would secure a £148.1 million maximum bonus if the group’s share value soars to almost 26 times its current value.

Debenhams shares would have to surge from their current level of 11.5p per share to £3 per share over a five-year period to receive the full payment.

This would see the company’s market value rise from around £145 million to £4.2 billion.

The company was valued at more than £5 billion in 2020 as e-commerce stocks boomed but has tumbled in recent years amid waning consumer demand and rising cost pressures.

The company would pay out a total of £222.2 million to all members of the incentive scheme if shares jumped back to £3.

Debenhams said the planned scheme would not need a shareholder vote at a general meeting, as typically takes place among most listed firms.

In supporting its decision, the listed company highlighted the action of “a major competitor who is a significant shareholder of Debenhams” who it claims has sought to “disrupt the Debenhams Group’s growth strategy and operations”.

It is understood this related to Mike Ashley’s Frasers Group, which owns almost 30% of the business.

Frasers has previously criticised pay policies at the business and early this year voted against plans for the business to change its corporate name.

In a separate results announcement, Debenhams reported a pre-tax loss on continuing operations of £2.5 million for the six months to August 31, shrinking from a £130 million loss a year earlier.

It said the improvement in performance has been driven by the Debenhams brand, which saw gross merchandise value and earnings grow over the half-year.

Nevertheless, group revenues fell by 23% to £296.9 million over the half-year.

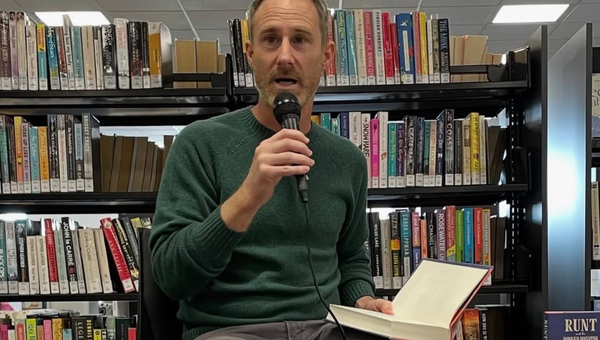

Mr Finley, group chief executive, said: “Our turnaround is gathering real pace.

“We are making progress, we are moving fast, and we are transforming the business.

“We have returned all our brands to profitability and grown adjusted EBITDA (earnings before interest, tax, depreciation and amortisation). These results show that our strategy is working.”