UnitedHealth Group (UNH) is back in focus ahead of its Oct. 28 update, which could mark a turning point for the world’s largest health insurer. After a volatile year of cost pressures and care delivery challenges, the company is showing signs of stabilization, just as investors start to reprice the stock’s long-term earnings power. Shares have rebounded more than 50% from their 52-week lows, reflecting renewed optimism around the firm’s disciplined reset and growing digital edge.

Behind the scenes, UnitedHealth is leaning heavily on AI-driven analytics and automation to streamline claims management, improve patient outcomes, and rein in medical cost trends. As the healthcare sector undergoes one of its most data-intensive transformations to date, UnitedHealth’s scale and integration through its Optum unit are positioning it as one of the few incumbents able to convert that digital shift into real margin expansion. All eyes now turn to late October, when management is expected to outline the next leg of its recovery heading into 2026.

About UnitedHealth Group Stock

UnitedHealth is the biggest health insurer in the United States, with headquarters in Minnetonka, Minnesota. The firm operates under two arms, namely UnitedHealthcare and Optum. UnitedHealth Group controls a market capitalization of approximately $333 billion and covers over 150 million people all over the globe. Its Optum division, comprising health services, pharmacy benefits, and analytics, is an indispensable engine for UnitedHealth’s competitive barrier amid an ever-more-information-oriented business.

Coming up from an early 2024 peak above $630, UNH shares plummeted hard but settled this fall at around the $350–$370 mark. The stock is currently higher by over 55% versus the 52-week low of $234.60, easily beating the broader S&P 500’s ($SPX) 27% rise over the corresponding period. The bullish momentum has been propelled due to renewed optimism among the investors due to the string of analyst upgrades and rising margin forecasts.

Valuation-wise, UnitedHealth trades at 14.1x trailing and 22.0x forward price-earnings (P/E) ratio, with price-sales (P/S) ratio at 0.81 and price-cash flow (P/CF) at 11.0. Although the next multiple is somewhat higher than the five-year average, it is below the majority of large-capitalization healthcare peers due to moderate growth assumptions during further cost normalization. UNH, with a 23.3% return on equity and 3.6% profit margin, continues to have among the most effective managed care operating profiles.

Investors are also treated to stable shareholder returns. The firm has a 1.5% quarterly-paid dividend yield, underpinned with robust free cash flow generation and a conservative 0.73 debt/equity ratio, indicating potential for both growth investment and further buybacks.

UnitedHealth Tops on Earnings

UnitedHealth Group’s Q2 2025 earnings were a decisive move toward winning back investor confidence. The group published adjusted EPS of $16, beating the Street, with revenues for the year between $445.5 billion and $448.0 billion. Though overall growth is tepid, the revised guidance from the management indicated stabilization of the trend for medical costs and early efficiency gains from technology-based initiatives.

“UnitedHealth Group has taken an ambitious journey back to being a high-performing organization serving the full health needs of people and society at large,” said CEO Stephen Hemsley. The company’s initiatives to “enforce stronger operating disciplines” are likely to form the template for future growth, 2026 and onwards.

One of the central components of that strategy is the increasing role for Optum as an intelligence-enabled engine for predictive care and population health. Through the use of data analytics to automate the processing of claims and advance clinical results, UnitedHealth is unwinding administrative friction and increasing profitability for its Medicare and commercial lines. The technology shift is also helping to balance higher utilization rates, especially for outpatient care.

The company suspended 2025 guidance first this year but reaffirmed it following Q2, indicating optimism regarding its direction. The firm predicts net earnings for the year of at least $14.65 per share and $16.00 adjusted EPS, indicating a return to year-over-year earnings next fiscal year.

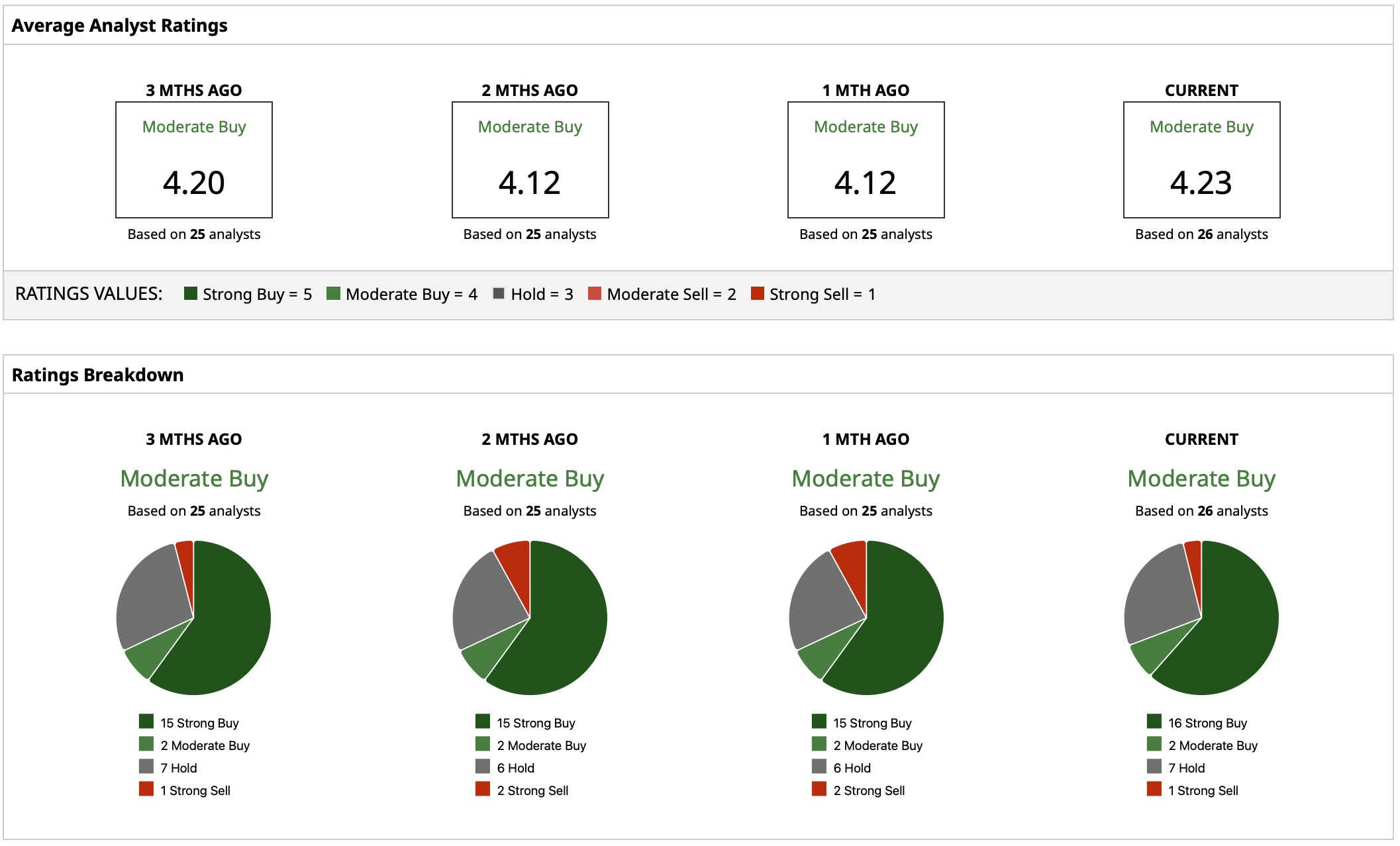

What Do Analysts Predict for UNH Stock?

UnitedHealth, with a "Moderate Buy" rating consensus and mean price target of $363.32, indicating that the shares are priced around consensus fair value. However, the Street-high target of $440 indicates potential upside of around 22% from here, whereas the low target of $198 points to ongoing risks associated with regulatory risk and margin squeezing.