Target (TGT) stands at a critical inflection point as it prepares for its most ambitious Circle Week event yet on Oct. 5. The company continues to maintain its status as a Dividend King with over 50 consecutive years of dividend increases. Despite this, the Minneapolis-based retailer has seen its stock price plummet 35% year-to-date (YTD), trading at levels not seen since 2019.

Adding to the uncertainty, Target’s recent earnings report revealed a 20% decline in net income compared to last year, with profit falling short of analyst expectations. This dramatic decline comes as tariff costs tied to higher duties on Chinese imports continue to pressure merchandising margins and force tighter pricing choices, particularly in discretionary categories. With so much on the line, the coming weeks (particularly Target’s Circle shopping event) could define Target’s trajectory well beyond this holiday season. Let’s dive into Target’s fundamentals.

Taking Stock of Target’s Numbers

Target serves millions across the U.S. with department stores, digital channels, apparel, home goods, groceries, and essentials, leveraging a strong logistics network to deliver on convenience and choice. The company’s annual dividend stands at $4.56, translating to a forward yield of 5.17%. This payout, supported by a robust dividend ratio of 58.62%, remains a pillar for income-focused investors.

TGT stock's price action reveals a clear trend as shares have lost 35.73% year-to-date, declined 43.97% over the last 52 weeks, and trade at $87.17 now.

Meanwhile, market value sits at $39.33 billion, while price-to-earnings on a trailing basis is 11.58x, below the sector’s median of 16.25x, and forward P/E is 11.77x versus the sector’s 16.12x. This places Target at a discount compared to industry peers, with valuations reflecting both earnings challenges and investor caution.

On Aug. 20, Target released its second-quarter earnings for fiscal 2025. It reported a profit of $935 million for the quarter. This translated to net income of $2.05 per share, marking a 20.2% drop year-over-year (YoY). The results missed consensus estimates from analysts polled by Zacks, who expected $2.09 per share. The company delivered revenue of $25.21 billion for the period, beating Street expectations but down 0.9% from last year. This revenue slip signals persistent challenges in attracting shoppers, with comparable sales notably lower. It reflects cautious consumer behavior and pressure from tariffs.

Target’s Retail Playbook for the Holidays

Target rolls out a fresh playbook for the holiday season. Circle Week from Oct. 5 to 11 kicks off this strategy with exclusive product drops, deeper discounts, and curated collections for loyalty members. The Circle loyalty platform now features more than 100 million enrolled shoppers. Members see personalized benefits, gain early access to top deals, and experience online exclusives aimed at building engagement.

The emphasis shifts customer focus toward unique, repeatable value on top of holiday deals. Every major category is refreshed, from apparel and décor to toys and beauty. Weekly drops and collaborations like pop culture partnerships with Netflix’s "Stranger Things" and Universal’s "Wicked" add more incentive for seasonal visits.

TGT is putting real numbers behind its merchandising push. This year, the retailer is stocking shelves and its website with 20,000 new items. That doubles the number from last year and creates the largest assortment Target has ever offered. More than half of these products are exclusive. Thousands of holiday gifts are debuting at accessible $5 price points. Most items in the new assortment remain under $20, a clear nod to shoppers seeking value.

The expansion reaches far beyond product selection. Target is expanding next-day delivery to 35 metro areas, allowing more than half the U.S. population to receive their orders faster. Roughly 85% of in-store merchandise is eligible, so both planners and those shopping last-minute get more choices. Same-day delivery now reaches 80% of homes across the country. Two-day shipping is available for almost everyone, increasing speed and convenience for this critical season.

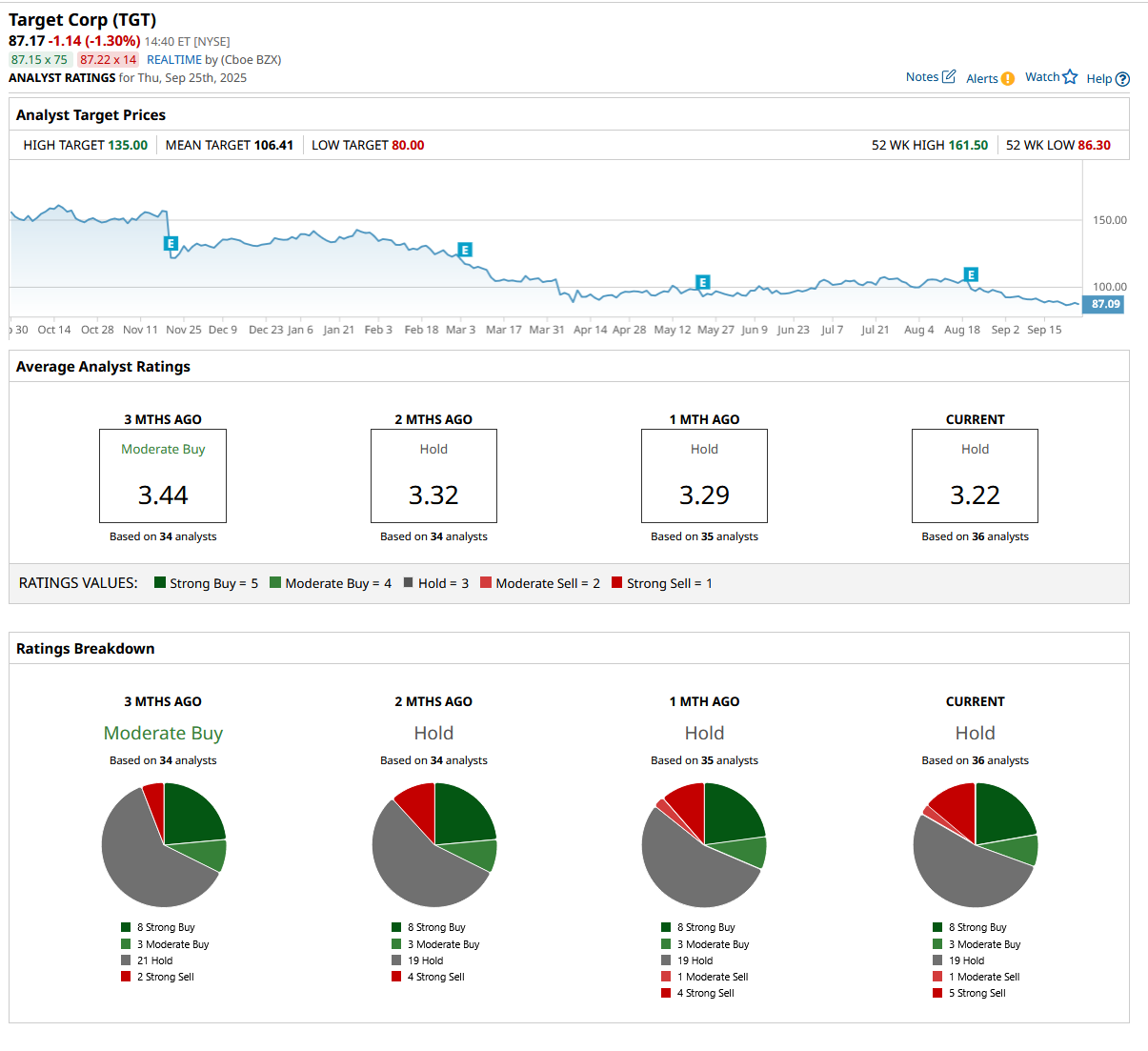

Analysts Temper Expectations Ahead

Earnings season is always a key time for Target watchers, and this fall is no exception. Analysts are expecting quarterly earnings of $1.80 per share. That’s down from $1.85 last year, reflecting a modest 2.7% YoY decrease. Looking a bit further out, the fiscal year estimate sits at $7.49 per share, a steep drop from last year’s $8.86. The estimated annual growth rate is a negative 15.46%. Target’s own guidance puts full-year earnings in a range of $7 to $9 per share.

This cautious outlook is mirrored by consensus across Wall Street. The 36 analysts covering TGT stock have placed a consensus "Hold" rating on it. This consistent stance hints at ongoing uncertainty, and most want to see how holiday performance shakes out before making moves. The mean price target is $106.41. At the current stock price of $87.17, that forecast implies a potential upside of about 22% should Target hit its projected stride.

Conclusion

In the end, Circle Week could be a turning point. Target’s strategy is strong, and the upcoming event will get investors watching closely. Given the consensus “Hold” rating and modest upside potential, shares are more likely to drift sideways or inch upward if Circle Week delivers. If the holiday rollout sparks enough excitement and numbers come in above estimates, TGT stock could recover some lost ground and head toward that analyst target in the next year.