/Semiconductor%20chip%20by%20Mykola%20Pokhodzhay%20via%20iStock.jpg)

Today, Oct. 16, is the day that sets the tone for the next chapter of the world’s largest contract chipmaker, Taiwan Semiconductor (TSM), which unveils its Q3 2025 earnings. In an era where artificial intelligence (AI) and high-performance computing are redrawing the semiconductor playbook, TSMC’s next move carries outsized implications. The company not only sets the tone for global chipmaking trends but also must now navigate geopolitical expectations, such as the U.S. “50-50” production proposal that many believe will be a hot topic during the call.

Also, with investors eager for clues on next-gen nodes like 2nm production, AI-driven revenue momentum, and capital spending plans, Oct. 16 is shaping up to be more than just an earnings date; it’s a potential inflection point for the stock and the entire semiconductor sector.

About Taiwan Semiconductor Stock

Founded in 1987, TSMC pioneered the pure-play foundry model and has since grown into the world’s leading dedicated semiconductor foundry, supplying advanced logic, specialty, and packaging services to a wide range of global customers. Headquartered in Hsinchu, Taiwan, TSM operates multiple fabs both in Taiwan and overseas, including in the U.S., China, and other parts of Asia and Europe. TSM’s market cap is around $1.6 trillion, placing it among the world’s most valuable technology companies.

Over the past year, TSM has emerged as one of the breakout names in tech, with its stock rising 62% and recently hitting a fresh high of around $311.37 just this morning, suggesting investor confidence is running high. Fueled by strong demand from AI, high-performance computing, and advanced-node customers like Nvidia (NVDA), and speculations for the company to deliver above-expectation revenue for Q3. On a year-to-date (YTD) basis, the stock has gained 53.4%, far outpacing the broader indices. The S&P 500 Index ($SPX) in comparison, has delivered 13.8% returns YTD.

On the valuation front, TSM now trades at a premium, with its forward P/E of 30.71, underscoring that much of the growth story is baked in.

Its stature is further boosted by a consistent history of paying quarterly cash dividends. Its current payout equates to $0.83, with an ex-dividend date set for Dec. 11. On the yield side, TSM’s annual dividend of $3.12 works out to a yield of 1.11%.

Taiwan Semiconductor’s Solid Q2 Earnings Report

TSM reported its Q2 2025 financial results on Jul. 17, delivering robust performance that underscored its pivotal role in the global semiconductor industry.

TSMC achieved net revenue of $30.1 billion, marking a 44.4% year-over-year (YoY) increase and a 17.8% sequential rise from Q1 2025. The company’s net income reached $12.8 billion, reflecting a 60.7% YoY growth. Earnings per share (EPS) stood at $2.47 per ADR, up 60.7% from the same quarter the previous year.

Profitability remained strong, with a gross margin of 58.6%, an operating margin of 49.6%, and a net profit margin of 42.7%. The revenue growth was driven by robust demand in advanced semiconductor technologies, particularly in the 3nm and 5nm process nodes. From a technology mix standpoint, the share of wafer revenue from 3nm, 5nm, and 7nm processes totaled 74%, with 24% coming from 3nm, 36% from 5nm, and 14% from 7nm.

Furthermore, TSMC’s September performance reflects sustained growth, driven by robust demand in advanced semiconductor technologies. The company reported consolidated revenue of NT$331 billion ($10.8 billion), marking a 31.4% YoY increase and a 1.4% decrease from August.

Taiwan Semiconductor's New Earnings Hit Today

As Taiwan Semiconductor prepares for its investor conference this morning, all eyes are on how the company will address the U.S. government’s proposal for a “50-50” split in semiconductor production. This proposal, articulated by U.S. Commerce Secretary Howard Lutnick, suggests that half of the chips required for U.S. consumption should be produced domestically, with the other half remaining in Taiwan.

TSMC has already committed to a significant investment in the U.S., with plans to build three advanced wafer fabs in Arizona, totaling $65 billion. The first of these fabs began production in late 2024. The company has further announced plans to expand its investment in advanced semiconductor manufacturing in the United States by an additional $100 billion.

Additionally, the company projects consolidated revenue between $31.8 billion and $33 billion. Gross margin is expected to range from 55.5% to 57.5%, slightly lower than the 58.6% recorded in Q2. Operating margin is anticipated to be between 45.5% and 47.5%, down from 49.6% in the previous quarter.

Wall Street remains bullish, eyeing a 33.2% increase in revenue to $31.5 billion and a 33.5% EPS growth to $2.59. The company also has a history of surpassing the Street EPS estimates in the trailing four quarters. Looking ahead, analysts expect profits to rise 38.8% this year and climb another 15.6% in fiscal 2026.

Wall Street’s Bullish Bet on Taiwan Semiconductor Manufacturing

Recently, Barclays raised its price target for TSM from $325 to $330 while maintaining an “Overweight” rating. This adjustment reflects Barclays’ confidence in TSMC’s pivotal role in the AI sector and its leadership in advanced semiconductor manufacturing. The firm highlighted TSMC’s strong performance across business segments and identified it as a top semiconductor pick.

On Oct. 10, Susquehanna raised its price target for TSM from $300 to $400, maintaining a “Positive” rating. The firm expects TSMC to beat and raise guidance when it reports Q3 2025 results today and expects an exceptionally strong year ahead.

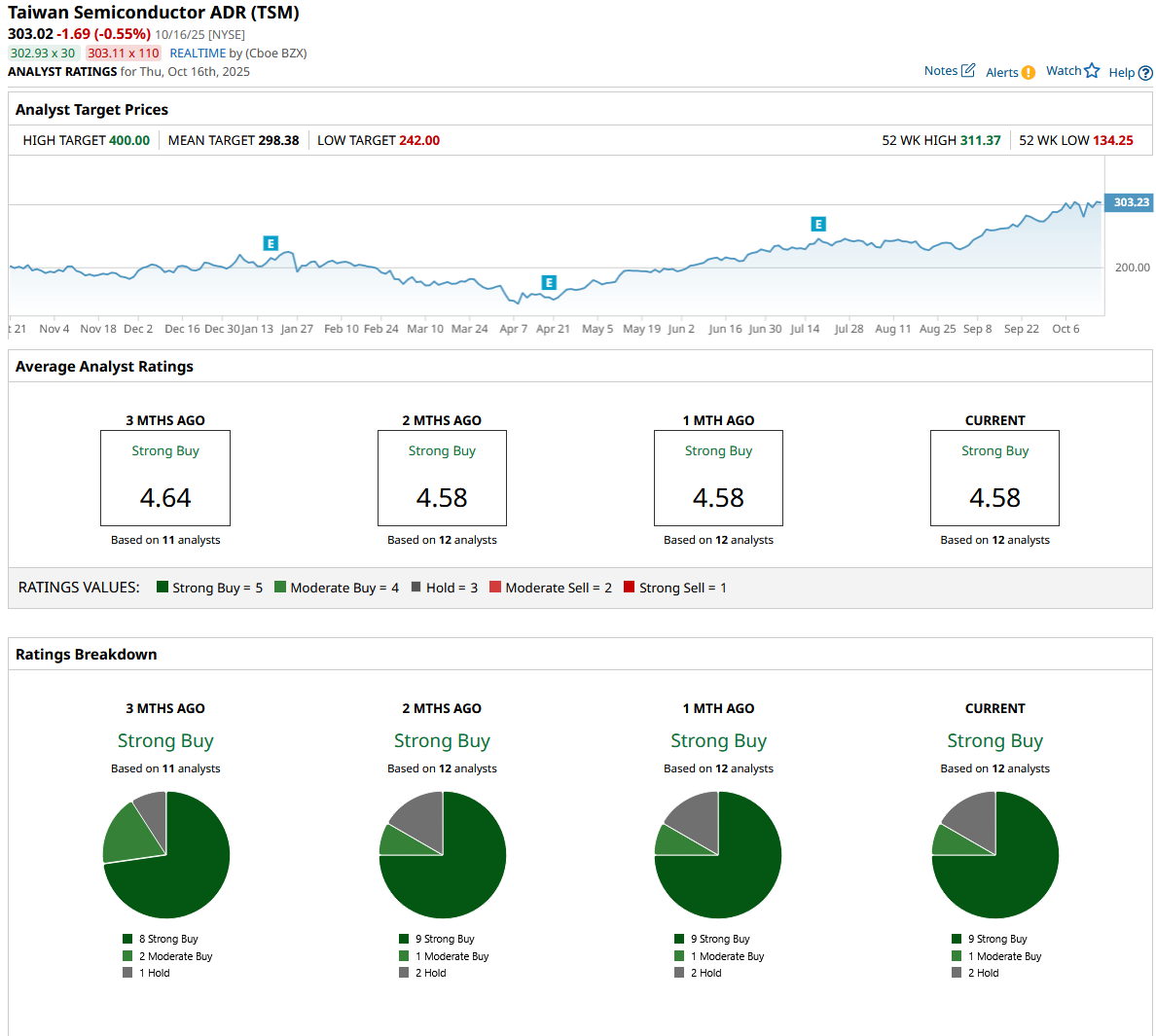

Analysts are highly bullish on TSM stock overall, with a “Strong Buy” consensus rating. Out of the 12 analysts with coverage, nine recommend a “Strong Buy,” one advises a “Moderate Buy,” and two analysts maintain a “Hold” rating.

The stock is currently trading above its mean price target of $298.38. Meanwhile, the Susquehanna Street high target of $400 indicates that the stock can rally as much as 32.1% from current levels.