/Technology%20abstract%20by%20TU%20IS%20via%20iStock.jpg)

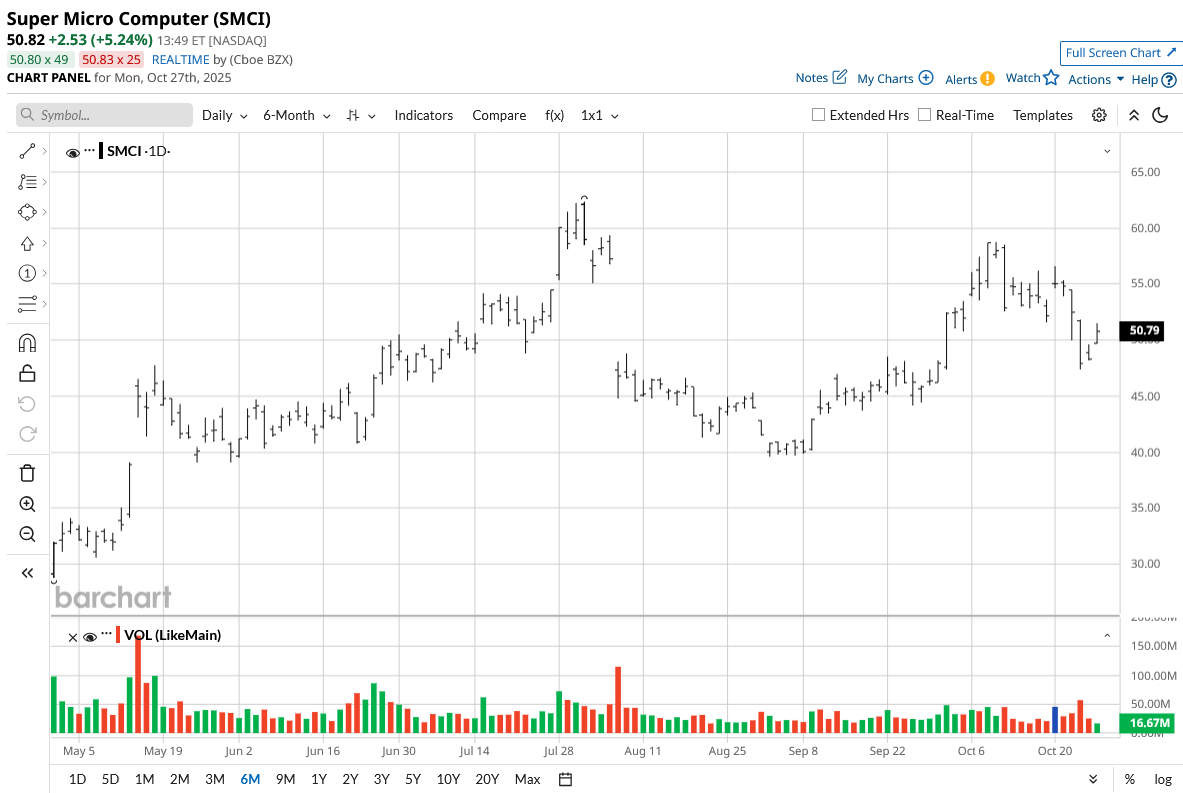

For the current year, Super Micro Computer (SMCI) stock has witnessed a healthy rally of 67%. However, from the year’s highs of $66.44, SMCI stock has corrected by 18%.

A key reason for the correction from highs is the company’s preliminary sales results for Q1 2026. The company expects Q1 revenue to miss estimates by nearly $1.5 billion. Lower revenue has been on the back of design win upgrades that have pushed some Q1 revenue to Q2 2026.

As the medium- to long-term outlook remains positive, the Q1 blip seems like a good opportunity to consider SMCI stock.

About Super Micro Computer Stock

Headquartered in San Jose, California, Super Micro Computer is a developer and seller of server and storage solutions. The company has a global presence with solutions that cater to enterprise, cloud, AI, and 5G, among others.

For financial year 2025, the company reported revenue growth of 47% on a year-on-year (YoY) basis to $22 billion. With demand from large-scale data center customers, the business outlook is positive.

SMCI stock has seen a healthy rally of 40% in the last six months, and it’s likely that the uptrend will be sustained.

Reasons to Be Positive on Super Micro Computer

For Q1 2026, Super Micro Computer had guided for revenue in the range of $6 to $7 billion. While preliminary numbers of $5 billion have caused some disappointment, the long-term outlook remains robust.

The first point to note is that the company has reaffirmed its full-year revenue guidance of $33 billion. As the company gains AI share, the coming quarters will compensate for the weakness in Q1.

It’s also worth noting that the company’s new “Datacenter Building Block Solutions” (DCBBS) is likely to be a growth driver. With DCBBS, the company expects large-scale data center customers to increase from six in FY 2025 to eight in FY 2026.

At the same time, the company is seeing “outstanding levels” of customer engagement for its newly released AI-cooled solutions. Therefore, with next-generation product launches, Super Micro Computer is well positioned to benefit.

To cater to the incremental demand, SMCI is adding a third campus in Silicon Valley for manufacturing. Further, the company plans to expand capacity in Mexico and scale up in Taiwan and the Netherlands. This will ensure that the growth momentum is sustained beyond FY 2026.

An important point to note is that SMCI ended FY 2025 with a cash buffer of $5.2 billion. The company’s financial flexibility is therefore robust for capital investments and innovation. Further, for the last FY, the company reported operating cash flow of $1.7 billion. As cash flows swell on healthy growth, the company’s credit health is likely to remain robust.

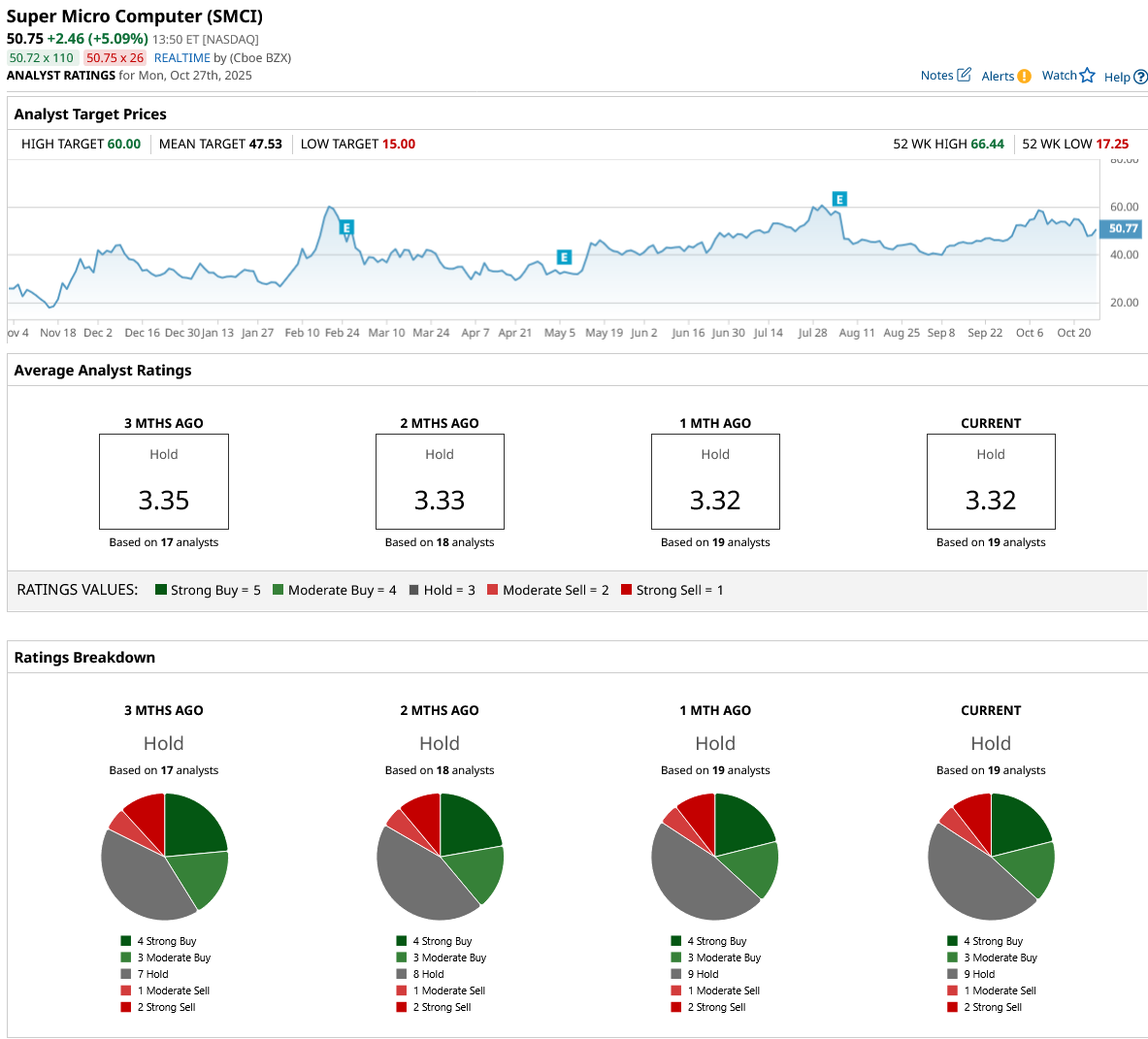

What Analysts Say About SMCI Stock

Analyst opinion seems mixed when it comes to SMCI stock. Currently, four analysts believe that the stock is a “Strong Buy,” and two analysts opine that SMCI stock is a “Strong Sell.” However, nine analysts recommend a “Hold,” with another three suggesting that the stock is a “Moderate Buy” and one a “Moderate Sell.”

Further, a mean price target of $47.53 is largely in line with the current stock price of $50.75. With Super Micro Computer having already reported preliminary sales results, the weakness in Q1 seems to be discounted in SMCI stock.

From a valuation perspective, SMCI stock trades at a forward P/E and price-earnings-to-growth ratio of 22.8 and 1.2, respectively. Valuations seem attractive considering the fact that the S&P 500 Index ($SPX) trades at a P/E of 31.5.

The view on valuation is further underscored by the point that analysts expect the company’s earnings growth for FY 2026 and FY 2027 at 22.7% and 42.2%, respectively. With potential growth acceleration, the weakness on the back of weak Q1 results seems like an accumulation opportunity.