/Salesforce%20Inc%20logo%20on%20building-by%20Sundry%20Photography%20via%20Shutterstock.jpg)

A notable avenue for large companies, especially from the technology sector, to give an idea about their plans, products, and strategies is annual events. Much less formal than the relatively bland earnings calls, annual events such as Nvidia's (NVDA) GTX Conference or Apple's (AAPL) WWDC are keenly followed by stakeholders and enthusiasts alike to get a glimpse into the direction the company is heading.

One such event is the Salesforce (CRM) Dreamforce 2025, which kicks off today, Tuesday, Oct. 14. The three-day event will include speakers like CEO Marc Benioff, Alphabet (GOOG) (GOOGL) CEO Sundar Pichai, and Starbucks CEO (SBUX) Brian Nicol, among others.

The event will also bring together Salesforce's global community of customers, partners, developers, and employees, mixing keynotes, technical sessions, hands-on training, networking, demos, entertainment, and philanthropy.

About Salesforce

Founded in 1999, Salesforce is the company most closely identified with customer relationship management, or CRM. The company pioneered the SaaS (Software as a Service) model for CRM, which involves tools that help companies manage customer data, sales, marketing, service, and support, all in the cloud. Over time, it has expanded its suite to include many cloud services beyond core CRM, such as Marketing Cloud, Service Cloud, Commerce Cloud, Data Cloud, Slack (for collaboration), generative AI features, and tools for analytics, integrations (e.g., Mulesoft), app development (AppExchange), etc.

Valued at a market cap of $230.1 billion, CRM stock is down 27% on a year-to-date (YTD) basis. Notably, the stock offers a modest dividend yield of 0.68%, which may seem low, but it is still higher than the sector median of 0.56%. Further, with a payout ratio of just 15.28%, the scope for growth remains. Yet, an increase in dividends would not be the best strategic move in the current scenario, considering the company's AI ambitions, which require heavy spending.

What to Expect From Dreamforce 2025?

Salesforce is pushing AI agents (automated workflows, decision support, and task execution) as central to its next phase. Dreamforce 2025 is likely to showcase new enhancements to Agentforce (or equivalent AI tooling) across sales, service, marketing, etc. It is also expected that the event will highlight which customers have moved from pilot phases to scale with AI, what ROI they’re seeing, and how they solved real-world problems.

The core roadmap for 2026 could also be unveiled with new features, expansions of existing clouds, increased integration between Slack and Salesforce, voice or conversational AI, and vertical/cloud extensions being the key monitorables.

Overall, Dreamforce often serves as a platform for major announcements (new product launches, acquisitions, collaborations, partnerships), so surprises or roadmap shifts may influence investor sentiment.

Speaking of investor sentiments, can the CRM stock be a good investment ahead of the annual event, or should it be given a pass? Let's find out.

Sparkling Financials

Salesforce has been a solid performer over the years, with its 5-year revenue and earnings CAGR coming in at 15.31% and 23%, respectively. Moreover, over the past two years, the company's quarterly earnings have missed Street estimates on just one occasion.

The results for the most recent quarter were not an exception as well, with both the top line and bottom line surpassing expectations.

In Q2 FY2026, Salesforce reported revenues of $10.2 billion, up 9.8% from the previous year. Subscription and support, the primary revenue segment of the company, grew by 10.6% on a year-over-year (YoY) basis to come in at $9.7 billion.

Meanwhile, the EPS of $2.91 marked an annual growth of 13.7%. Additionally, the figure comfortably outpaced the consensus estimate of an EPS of $2.78.

Notably, apart from the revenue and earnings beat, the company also guided for Q3 revenues to be in the range of $10.24-$10.29 billion. The midpoint of this range would denote an annual growth rate of 8.7%. EPS for the same period is projected to be between $1.60 and $1.62. The midpoint of this range, however, would denote a significant yearly decline of 33.2% in earnings.

Coming back to the Q2 numbers, Salesforce's current remaining performance obligations (a key indicator of demand) were at $29.4 billion, an increase of 11% from the prior year, as the company bagged more than 60 deals having a contract value of more than a million dollars in the quarter.

However, for a company of such a size, its cash from operations is relatively much smaller. In Q2 FY2026, Salesforce reported net cash from operating activities of $740 million, down from $892 million in the year-ago period. Yet, the company closed the quarter with a substantial cash balance of $10.4 billion, which is much higher than its short-term debt levels of just $580 million.

Thus, analysts remain optimistic about Salesforce's growth prospects, as its forward revenue and earnings growth rates of 8.90% and 25.74% are higher than the sector medians of 7.46% and 10.91%, respectively.

AI & Cloud: Twin Pillars for Growth

Salesforce continues to demonstrate a resolute commitment to artificial intelligence and cloud-based innovations, as reflected in the 120% YoY expansion of its product offerings during the second quarter, resulting in annual recurring revenue of roughly $1.2 billion. Central to this is Agentforce. As Salesforce's platform for AI agents (rebranded from Einstein Copilot), it delivers self-directed, anticipatory digital operatives that execute decisions and operations across key areas of enterprise activity, extending beyond simple reactive capabilities.

Notably, adoption among the company's clientele has accelerated markedly for Agentforce, with users extending applications and ramping up deployment of the same at a brisk pace. This is underscored by the booking of 6,000 revenue-generating arrangements in only three quarters since its rollout, as enterprises remain steadfast in advancing agentic AI capabilities. Blue-chip names, including Dell Technologies (DELL) and FedEx (FDX), have signed on as participants in its Agentic Enterprise program. Across the board, Salesforce has finalized 12,500 transactions following Agentforce's introduction, while the system has fielded over 1.4 million queries via the support site help.salesforce.com.

Also, growing evidence points to the profound embedding of Service Cloud, Sales Cloud, and the encompassing Salesforce Platform within customers' core processes, a dynamic that erects formidable barriers to defection, thereby shielding the business's most profitable revenue streams, i.e., their cloud business. The tight interconnections binding these cloud modules further elevate their utility as an integrated package, rendering them more compelling to buyers and propelling incremental bookings. Such stickiness has fueled a progressive uptick in retention metrics over Salesforce's tenure, now holding firm at 92%.

In a bid to broaden its AI-focused arsenal, Salesforce is leaning into targeted buyouts, exemplified by Regrello, an outfit specializing in AI-centric automation for multifaceted operational workflows.

Analyst Opinion

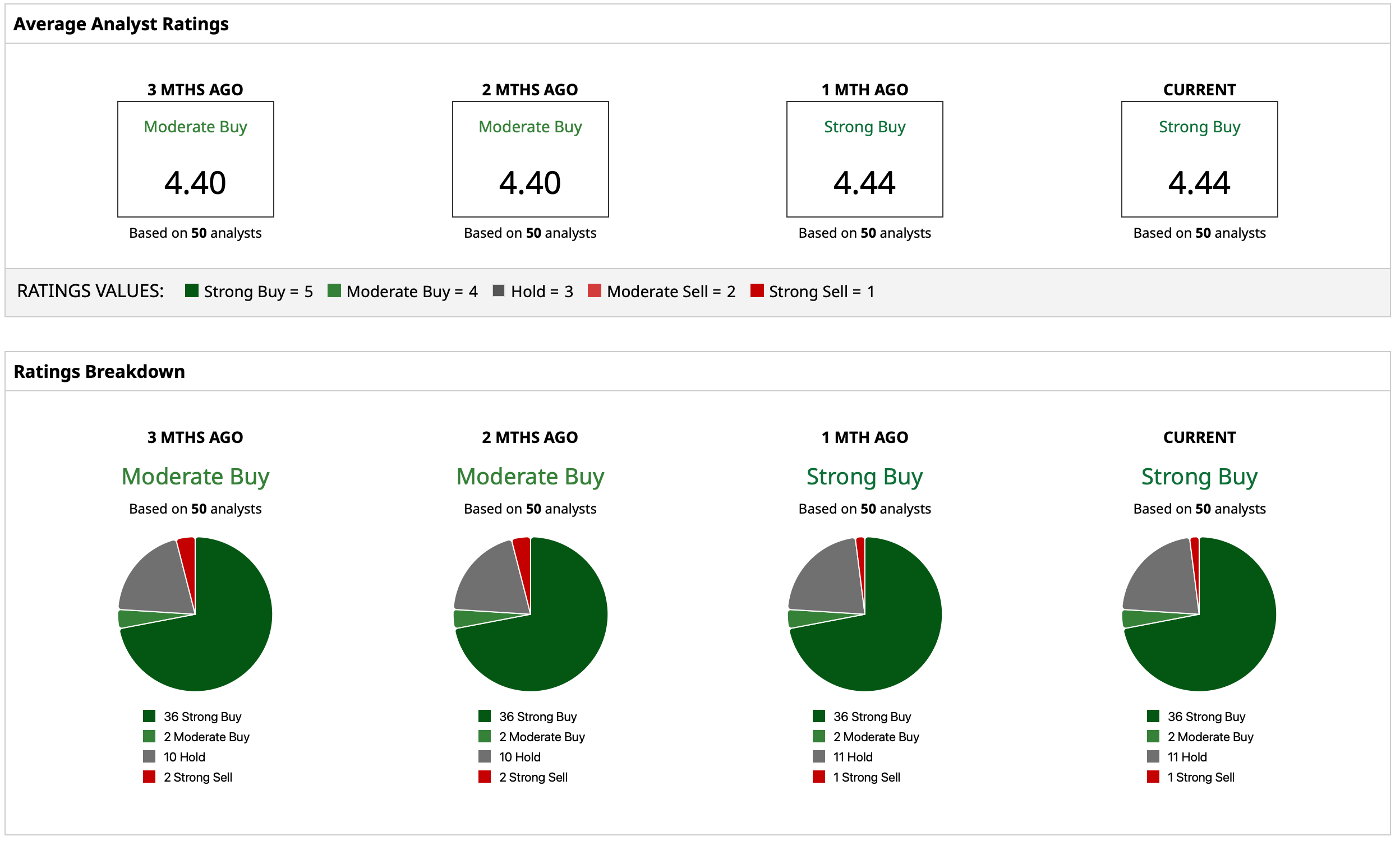

Thus, analysts have attributed a rating of “Strong Buy” for the stock, with a mean target price of $333.50. This indicates an upside potential of about 36% from current levels. Out of 50 analysts covering the stock, 36 have a “Strong Buy” rating, two have a “Moderate Buy” rating, 11 have a “Hold” rating, and one has a “Strong Sell” rating.