/Computer%20board%20micro%20chip%20green%20by%20blickpixel%20via%20Pixabay.jpg)

The first half of October saw Rigetti Computing's (RGTI) stock nearly double on the back of $5.7 million worth of sales for its 9-qubit Novera quantum computing systems. The two systems are expected to be delivered in the first half of 2026. The stock has dropped significantly since then, though still not to the pre-announcement levels.

Last week, RGTI stock was downgraded to “Neutral” by B. Riley, with the target price raised from $35 to $42. Even though analysts continue to keep a close eye on the commercial developments, they believe it is time to step away from the stock, as a lot of the commercial success in the upcoming years is priced in. They expect the company to beat estimates at the Nov. 10 earnings, but nothing significant is expected on the guidance front, especially considering the delays in government funding.

Rigetti is also a potential candidate for a U.S. government stake. While this doesn’t necessarily make a difference on the liquidity front, as RGTI already has a decent cash position of over half a billion dollars, it does help improve investor sentiment. It would be interesting to see if the management makes any comments on this on the upcoming earnings call.

About Rigetti Computing Stock

Rigetti is a firm operating in the computer hardware industry, making both processors and quantum computers. The company’s stock offers a high-risk, high-reward proposition and often gets confused with speculative stocks despite its relatively decent fundamentals among peers. It is headquartered in Berkeley, California.

RGTI is up 134% so far in 2025, delivering 6.7x higher returns compared to the benchmark Nasdaq Composite’s ($NASX) 21.2% year-to-date (YTD) returns. This is some outperformance, which has led to the company’s market capitalization increasing to $11.4 billion. The start of the year was slightly dramatic as the stock plunged from $20 to $6 in a matter of 10 days. However, the stock price rallied ever since and exhibited a bullish spike from September onwards. It touched an all-time high of $56.34 in mid-October and is currently trading at a 39% discount to that level. Although the stock was recently downgraded by B. Riley from “Buy” to “Neutral,” the price target was raised from the previous $35 to $42.

The price surge since September does make RGTI appear overrated. At present, the stock trades at a forward price-to-sales (P/S) multiple of 1,764x, which is massively high compared to the 3.7x sector median. The forward EV/sales ratio also stands at 1,713x compared to a 3.6x median for the sector. In terms of forward price-to-book (P/B), RGTI is priced at 27.7x, which is 512% higher than the sector median. These metrics clearly reflect that the stock has run its course.

RGTI Misses Revenue and Earnings Consensus

RGTI announced its second-quarter earnings on Aug. 12, underperforming relative to market estimates for revenue and earnings. Total revenues were recorded at $1.8 million, missing the consensus by almost 4%. The company posted $19.9 million in operating losses during the quarter, with stock-based compensation being a major pain point. To make matters worse, RGTI also incurred $22.8 million of non-cash losses related to the revaluation of derivative warrants and earn-out liabilities. This led to a total net loss of under $40 million for three months, compared to $42.6 million during the first quarter.

It is pertinent to note that the first quarter profits were also driven by $62.1 million of non-cash gains from the same revaluations. For the second quarter, GAAP EPS was $0.13 compared to consensus estimates of $0.07. The strength lies in a resilient balance sheet, holding almost $572 million in cash & equivalents. This gives them a significant cushion for the ongoing operating cash burn of $19 million for every quarter.

On the earnings call, the company also emphasized its chiplet approach, which should help the company achieve scale in the future. The 100-plus qubit chiplet-based system is expected to arrive before the end of this year.

Investors will have their eyes glued to the upcoming third-quarter results announcement on Nov. 10. As per market estimates, the company will post revenues of close to $2.2 million and GAAP EPS of $0.06. Such an earnings forecast indicates significant improvement compared to the previous quarter's results.

What Analysts Are Saying About RGTI Stock

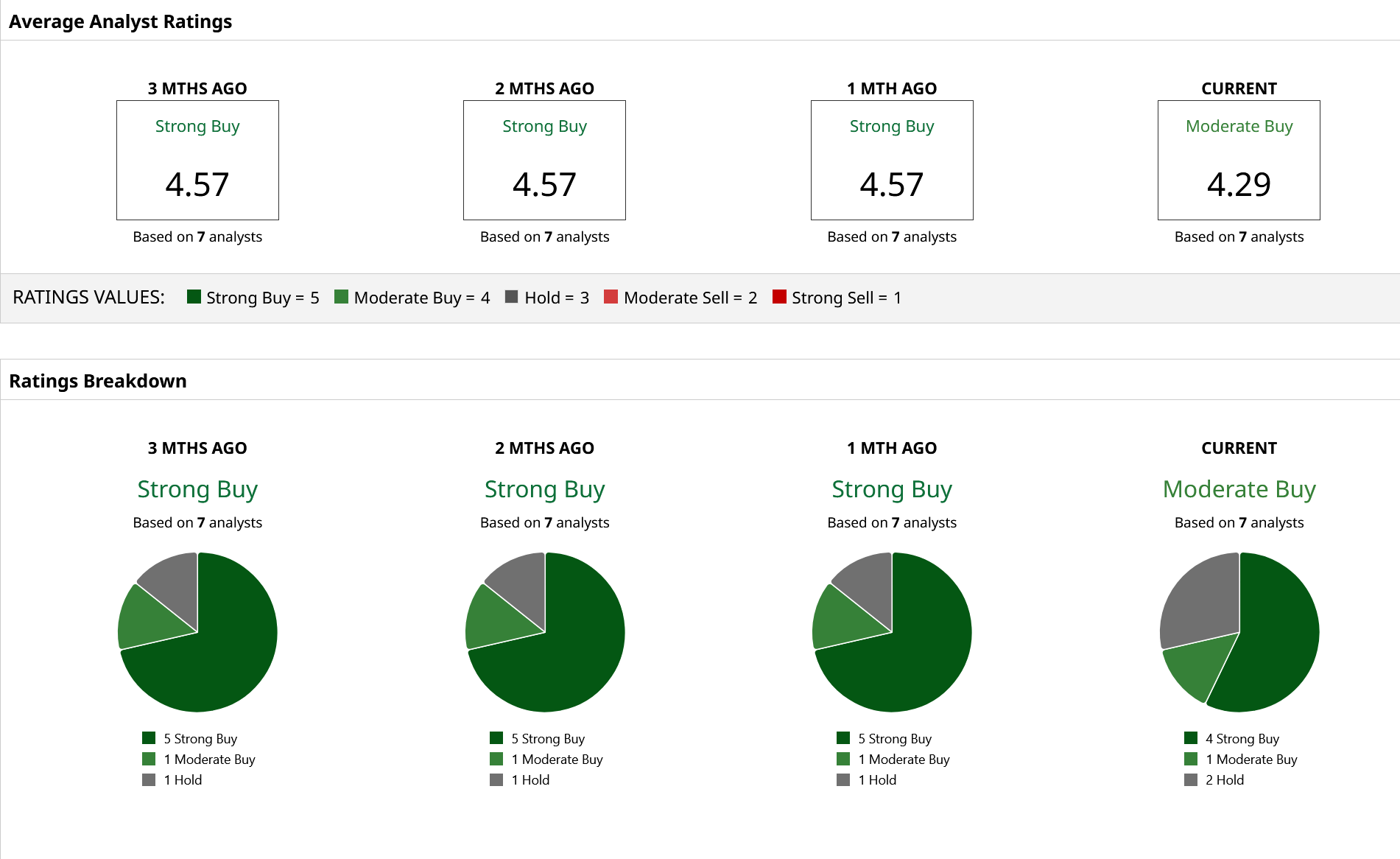

Analysts’ sentiment has remained quite stable in the last three months, with a recent downgrade from one of the seven analysts who cover the stock. RGTI has a total of four “Strong Buy,” one “Moderate Buy,” and two “Hold” ratings. The stock’s mean target price of $27.67 is 30% below the current price, while the highest target price of $50 offers 31.5% upside.