Valued at a market cap of $8.69 billion, QuantumScape (QS) is focused on the development and commercialization of solid-state lithium-metal batteries for electric vehicles (EVs) and other applications in the United States.

A pre-revenue company, QuantumScape, is scheduled to report its Q3 earnings on Oct. 22. Analysts tracking the tech stock forecast adjusted losses per share to narrow to $0.20 per share from $0.23 per share in the year-ago period.

The company’s losses per share for 2025 are forecast to narrow to $0.78 per share, compared to $0.89 per share in 2026. While the upcoming earnings will impact QS stock in the near term, let’s see if the company is a good investment for the upcoming decade.

Is QS Stock a Good Buy Today?

QuantumScape is accelerating the commercialization of its solid-state battery technology through two significant partnerships. It joined forces with Corning (GLW) to develop ceramic separator manufacturing capabilities, integrating QuantumScape's battery innovation with Corning's expertise in ceramics production. This collaboration aims to establish the manufacturing infrastructure needed for high-volume production of the ceramic separators that are critical to QuantumScape's batteries.

Notably, QuantumScape and PowerCo demonstrated the world's first electric vehicle powered by solid-state lithium-metal batteries at IAA Mobility in Munich. A modified Ducati motorcycle rode across the stage using QuantumScape's QSE-5 battery cells, showing what the technology can actually do in real-world conditions. The cells delivered 844 Wh/L energy density, charged from 10% to 80% in just over 12 minutes, and handled continuous 10C discharge rates.

PowerCo sweetened its existing deal by committing up to $131 million in milestone payments over two years. The expanded agreement gives PowerCo the right to produce an additional five gigawatt-hours of cells annually, including for customers outside Volkswagen Group. QuantumScape expects payments to start flowing in 2025 as milestones get hit.

QuantumScape is moving from the lab to the real world with its solid-state battery technology, and the company's partnerships are starting to generate actual cash. The company's business model has two revenue streams. First, customers pay for development work where QuantumScape customizes its technology to their specific needs. Second, once production ramps up, royalty payments kick in based on manufacturing volume.

QuantumScape isn't putting all its eggs in one basket. The company signed a joint development agreement with another major global automaker, upgrading their relationship from a basic sampling deal.

Management says they're being selective about customers because the licensing model is high-touch, requiring close collaboration to transfer the technology properly. A joint QuantumScape-PowerCo team is already working together in San Jose to industrialize the production process.

The company's breakthrough Cobra ceramic separator process is now the baseline, offering 25 times better productivity than the previous Raptor process. QuantumScape is installing higher-volume cell production equipment to keep pace with this improved separator output.

What Is the QuantumScape Stock Price Target?

QuantumScape expects its cash runway to stretch into 2029, a six-month improvement from previous guidance. Management emphasized it is focused on customer revenue rather than tapping capital markets. With $797.5 million in liquidity and payments starting to flow from partners, QuantumScape is transitioning from pure R&D to commercialization.

Analysts tracking QS stock forecast revenue to rise from $5.10 million in 2026 to $1.14 billion in 2029. It is forecast to end 2029 with a free cash flow of $190 million, compared to an outflow of $337 million in 2024.

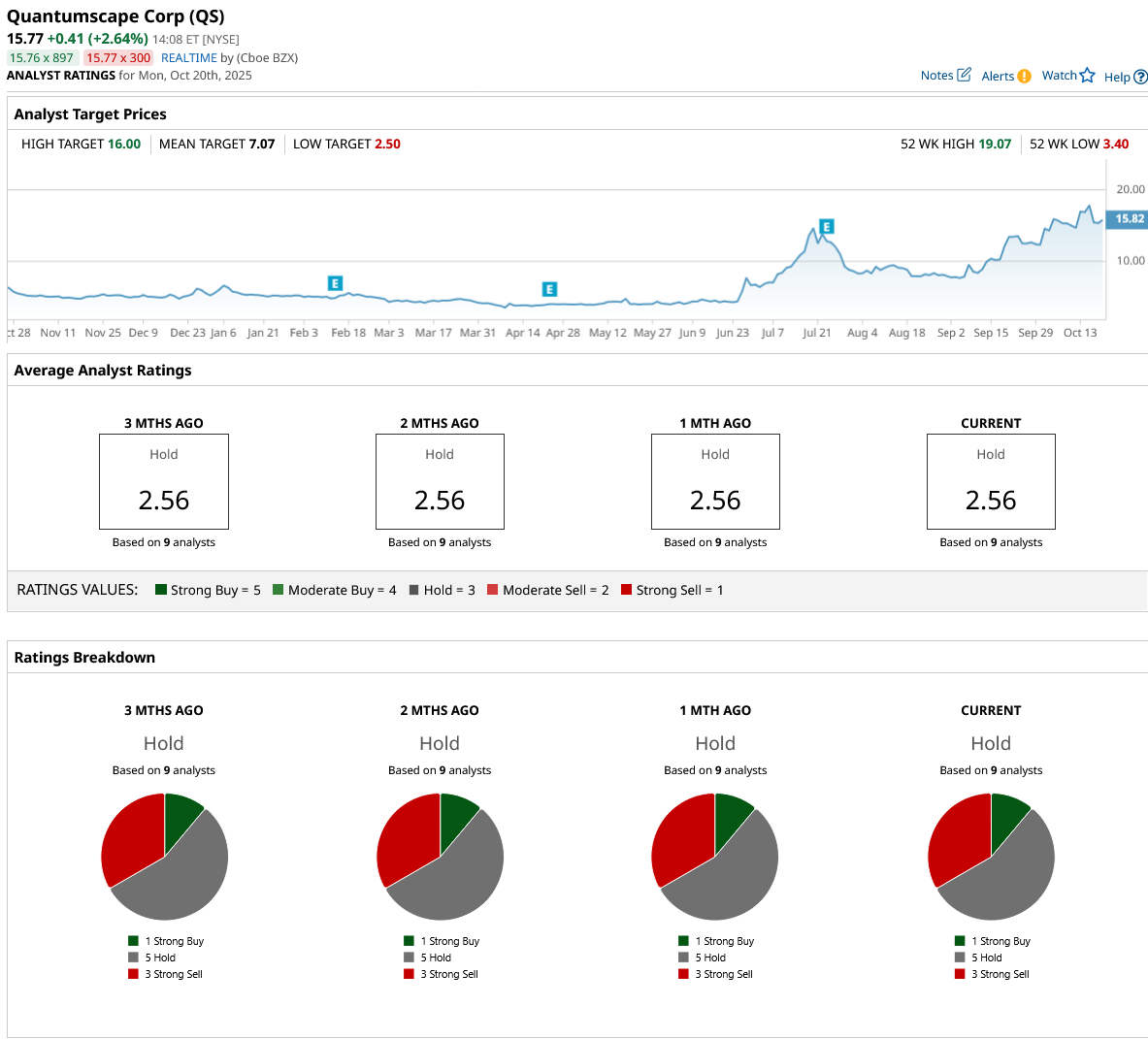

Out of nine analysts covering QS stock, one recommends “Strong Buy,” five recommend “Hold,” and three recommend “Strong Sell.” The average QS stock price target is $7.07, which is below the current price of $15.77.