/Microsoft%20Corporation%20logo%20on%20sign-by%20Jean-Luc%20Ichard%20via%20iStock.jpg)

The Q3 earnings season has begun, and several big tech companies will be reporting their results this week. Valued at a market cap of almost $4 trillion, Microsoft (MSFT) is the second-largest company in the world. It is scheduled to publish its fiscal Q1 (ended in September) results on Oct. 29.

Analysts tracking MSFT stock forecast Q1 revenue of $75.4 billion, up 15% year-over-year (YoY). Comparatively, adjusted earnings are forecast to grow by 11% YoY to $3.66 per share in Q1 of 2026. Microsoft has beaten consensus revenue and earnings estimates in each of the last five quarters.

In addition to its Q1 performance, investors will be closely watching the tech giant’s guidance for fiscal 2026. Wall Street estimates revenue to grow from $281.7 billion in fiscal 2025 to $323.3 billion in 2026. Comparatively, adjusted earnings are estimated to increase from $13.64 per share to $15.52 per share.

Microsoft Continues to Grow

Microsoft capped a record fiscal year with strong momentum across its AI and cloud portfolio. The enterprise software giant delivered results that showcase the company's leading position in the artificial intelligence revolution.

In fiscal 2025, Microsoft Cloud surpassed $168 billion in annual revenue, growing 23%, while Azure reached $75 billion, up 34%. Microsoft now operates over 400 data centers across 70 regions and has deployed more than two gigawatts of new capacity over the past year, outpacing all competitors.

The integration of GPT-5 into Microsoft 365 Copilot marks a watershed moment for the company's AI strategy. Microsoft has replaced Copilot’s backend with GPT-5’s robust orchestration capabilities.

This integration positions Copilot as the iPhone equivalent for AI applications, providing users with a unified interface to access specialized agents across financial analysis, scientific research, and business operations.

Microsoft 365 Copilot added its largest quarter of seats since launch, with major enterprises like Barclays deploying to 100,000 employees and UBS expanding to all staff after initial success.

The company's security business, already exceeding $20 billion in annual revenue, continues to accelerate with nearly 1.5 million customers. Microsoft tracks 1,500 unique threat actors—a 5x increase from the prior year—while defending against 7,000 password attacks per second. The Sentinel business generates $1 billion in revenue, and 75% of security customers now attach Purview for data governance, creating powerful synergies with AI deployments.

Azure AI Foundry processed over 500 trillion tokens this year, up sevenfold, demonstrating true platform adoption beyond a few headline applications. The service now supports 15 OpenAI models plus offerings from DeepSeek, Meta (META), and xAI, with 14,000 customers building agents.

Microsoft ended fiscal 2025 with a contracted backlog of $368 billion. Moreover, it is estimated to spend $30 billion each quarter in capital expenditures to meet surging demand. Management expects flat operating margins despite sizeable AI infrastructure investments, highlighting confidence in efficiency gains through software optimization.

The GPT-4o model family alone now delivers 90% more tokens per GPU than a year ago through pure software improvements, which showcases the compounding advantages of Microsoft's technical capabilities at scale.

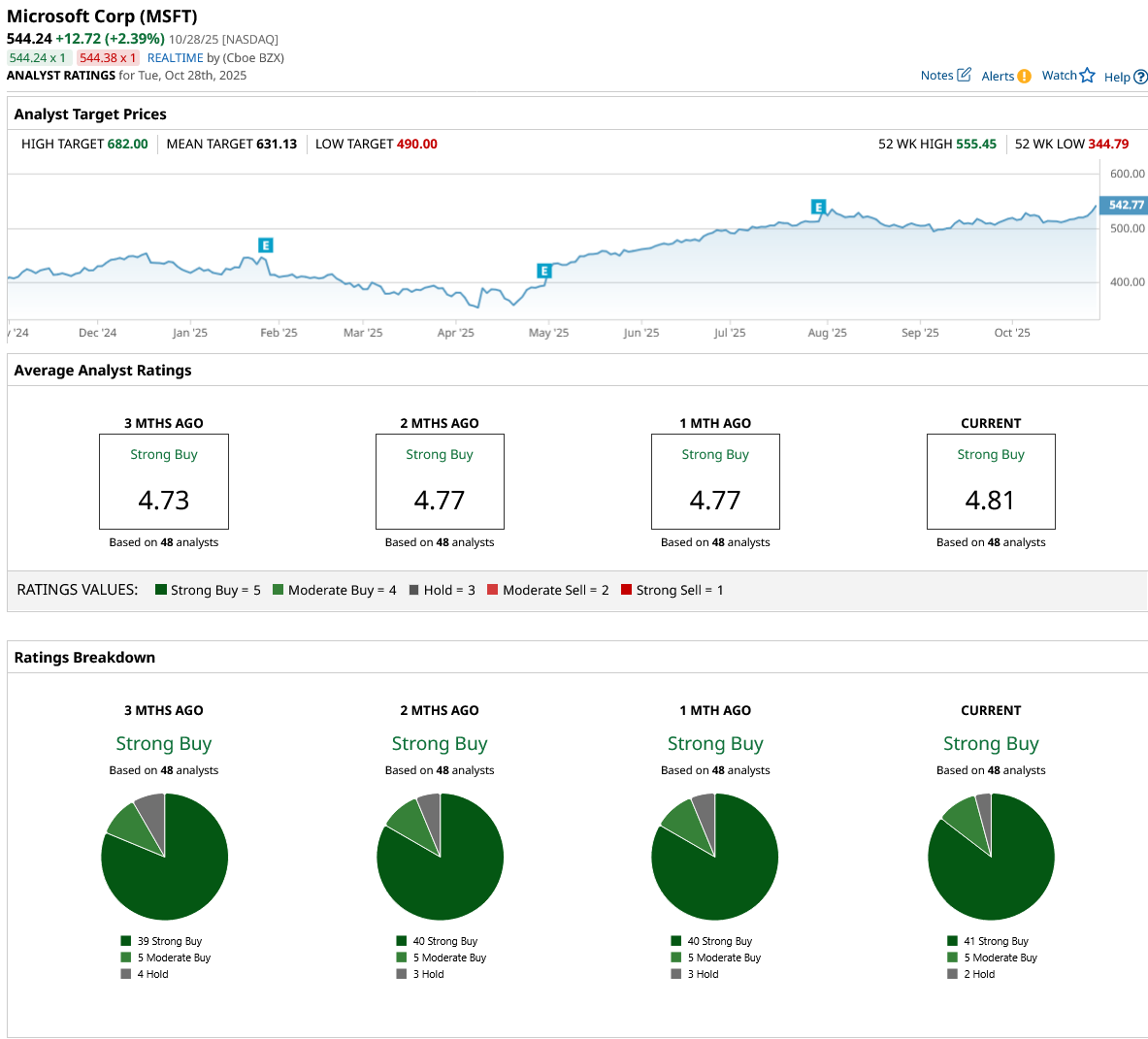

What Is the MSFT Stock Price Target?

Analysts tracking MSFT stock forecast revenue to increase from $282 billion in fiscal 2025 to $507 billion in fiscal 2030. In this period, adjusted earnings are forecast to expand from $13.64 per share to $27.2 per share.

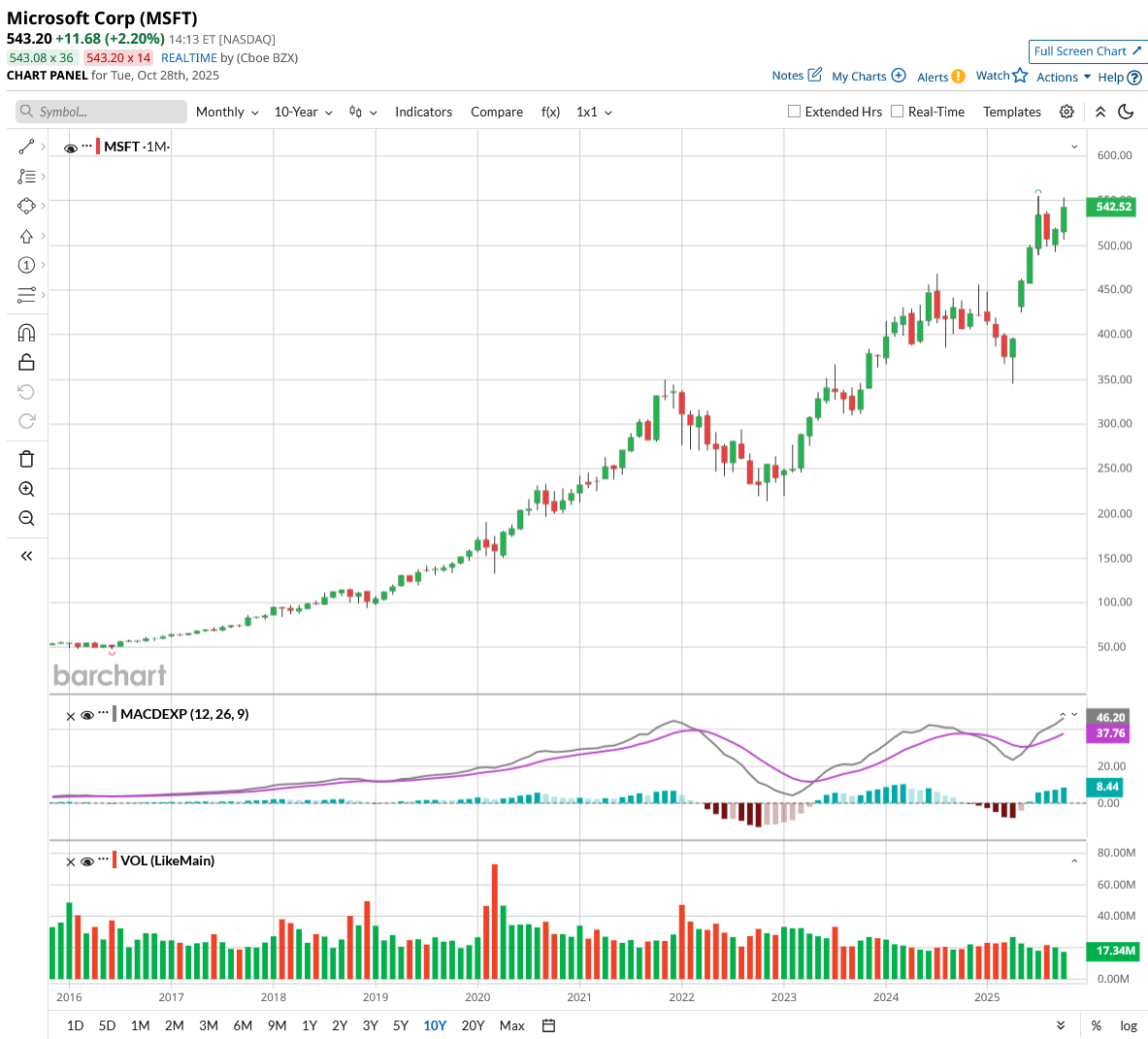

Today, MSFT stock trades at a forward price-to-earnings (P/E) multiple of 34x, which is above its 10-year average of 28x. If the tech stock reverts to its 10-year average, it could gain more than 50% over the next four years.

Out of the 48 analysts tracking MSFT stock, 41 recommend “Strong Buy,” five recommend “Moderate Buy,” and two recommend “Hold.” The average MSFT stock price target is $631, above the current price of $544.