/Meta%20Platforms%20by%20Primakov%20via%20Shutterstock.jpg)

Tech behemoth Meta Platforms (META) is gearing up for its Meta Connect 2025 event, which is expected to reveal some innovations. There could be significant launches at the event, such as the much-awaited Meta Hypernova smart glasses or an upgraded version of the Ray-Ban Meta smart glasses. All in all, the super event on Sept. 17 is expected to feature interesting announcements that may impact META stock.

About Meta Platforms Stock

Based in Menlo Park, California, Meta Platforms is a major player in the global tech industry, widely recognized for operating social media giants like Facebook, Instagram, and WhatsApp. Initially launched as Facebook, the company underwent a rebrand in 2021 to its new name, marking a significant shift in its long-term objectives.

While it still holds a dominant position in digital advertising through its core apps, Meta is now channeling significant efforts into developing the metaverse. This virtual space enables people to connect, work, and engage through AR and VR technologies. This vision is primarily driven by its Reality Labs division, which produces devices like the Meta Quest headsets. The company has a market capitalization of $1.9 trillion.

Based on the company’s aggressive spending spree on artificial intelligence (AI), combined with its solid market position, META stock has been surging on Wall Street. Over the past 52 weeks, the stock has gained nearly 50%, while it is up by 29% year-to-date (YTD). META stock reached a 52-week high of $796.25 in August, but it is now down 5.5% from this high.

Currently, Meta Platforms' stock is trading at a premium valuation. Its price sits at 26.7 times forward earnings, which is higher compared to the industry average.

Meta Platforms Surpassed Q2 Earnings Expectations

On July 30, Meta reported solid growth in its second-quarter results for fiscal 2025. The tech company’s revenue increased by 22% year-over-year (YOY) to $47.52 billion, higher than the $44.81 billion Wall Street analysts were expecting for the period.

This growth was primarily led by Meta’s popular Family of Apps, as revenue from this segment climbed by 21.8% YOY to $47.15 billion. Its Family of Apps’ daily active people (DAP) increased 6% YOY to 3.48 billion on average for June 2025, while its ad impressions also increased 11% annually.

Meta’s Reality Labs segment, which deals with the “metaverse” view, reported 4.8% YOY growth in its topline to reach $370 million. However, this segment remains unprofitable, reporting a loss from operations of $4.53 billion for the quarter. On the other hand, Meta’s Family of Apps segment reported $24.97 billion in income from operations.

Meta’s overall income from operations increased by 38% YOY to $20.44 billion. EPS for the quarter was $7.14, which was 38% higher YOY and also surpassed the $5.88 EPS that Wall Street analysts were expecting.

Meta Platforms expects Q3 revenue to be in the range of $47.5 billion to $50.5 billion. Moreover, the company has ambitious plans for expanding its AI capabilities. At a gathering of tech CEOs, in front of President Donald Trump, Meta CEO Mark Zuckerberg revealed that the company plans to invest “something like at least $600 billion” through 2028 on data centers and other U.S. infrastructure.

Wall Street analysts are optimistic about Meta’s future earnings. They expect the company’s EPS to climb by 11.8% YOY to $6.74 for the third quarter. For the current fiscal year, EPS is projected to surge 17.9% annually to $28.13, then grow 5% to $29.54 in the next fiscal year.

What Do Analysts Think About Meta Platforms Stock?

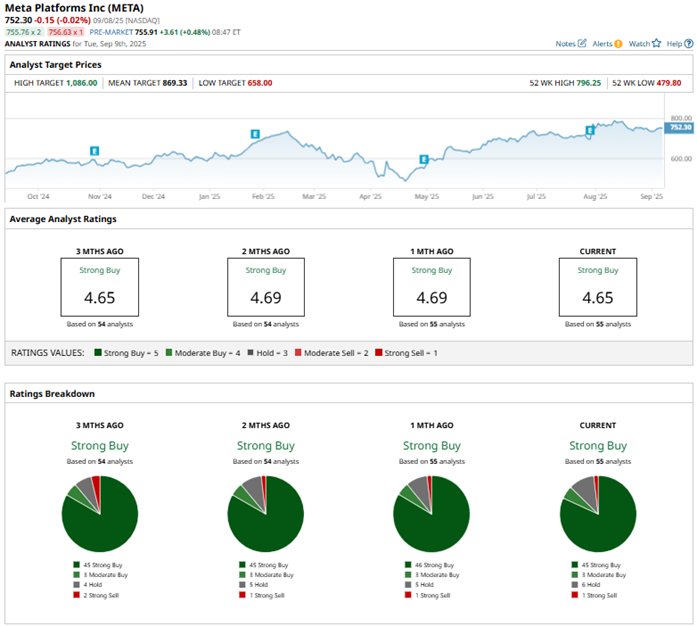

Analysts are exceptionally bullish on META stock now, particularly as it advances toward its “superintelligence” ambitions. Recently, analysts at Cantor Fitzgerald reiterated their “Overweight” rating and $920 price target on the stock. Cantor Fitzgerald believes that, despite ongoing pressures from a lawsuit, Meta's financial health remains solid.

Loop Capital analysts cited the company’s “meaningful revenue growth acceleration and strong outlook” while raising the price target on the stock from $888 to $980 and maintaining a “Buy” rating. Barclays analyst Ross Sandler also maintained an “Overweight” rating, while raising the price target from $640 to $810.

Meta has been in the spotlight on Wall Street for some time now, with analysts awarding it a consensus “Strong Buy” rating overall. Of the 55 analysts rating the stock, a majority of 45 analysts rate it a “Strong Buy,” three analysts suggest a “Moderate Buy,” six analysts play it safe with a “Hold” rating, and only one analyst gives a “Strong Sell” rating. The consensus price target of $869.33 represents 16% potential upside from current levels. However, the Street-high price target of $1,086 indicates 45% potential upside from here.