Disney (DIS) stock investors should mark Oct. 21 on their calendars, as the entertainment giant plans to raise prices across its streaming services on that date, marking another attempt to boost profitability in its direct-to-consumer business.

The price increases are substantial, given that the ad-supported Disney+ plan will jump $2 to reach $11.99 monthly, while the premium no-ads version will rise $3 to $18.99 per month. Annual subscribers will see a $30 increase to $189.99.

Bundle packages that combine Disney+, Hulu, and ESPN will also increase by $3 monthly. This marks the second consecutive October that Disney has raised streaming prices, though last year's hikes were smaller at $1 to $2 per plan. Disney telegraphed these increases during its third-quarter earnings call and expects modest subscriber growth in the fourth fiscal quarter despite the higher prices.

Research from Deloitte shows households now pay an average of $69 per month for streaming services, up 13% from last year. While 60% of consumers say they would cancel their favorite service after a $5 price increase, many still view streaming as essential. The industry has shifted focus from adding new subscribers to retaining existing ones through bundling and exclusive content.

For Disney shareholders, the price hikes indicate management's continued push toward streaming profitability. Whether subscribers will accept another round of increases or join the growing ranks of serial churners who cancel and resubscribe based on content availability remains the key question facing the stock.

Disney Adapting to a New Media Environment

Disney is making bold moves to consolidate its position in a rapidly changing media landscape. The biggest news centers on ESPN's transformation into a comprehensive digital sports platform.

The direct-to-consumer ESPN service launched on Aug. 21 at $29.99 monthly, offering all 12 ESPN networks with over 47,000 live events. But Disney isn't abandoning traditional cable and is running what CEO Bob Iger calls a hybrid approach, serving sports fans wherever they choose to watch.

The ESPN strategy got a significant boost through an expanded partnership with the NFL. Disney will acquire NFL Network and RedZone in exchange for giving the league a 10% stake in ESPN. The deal adds more NFL games to ESPN's lineup, bringing the total to 28 game windows compared to 22 previously.

Management expects the transaction to be accretive in its first year after closing, which is targeted for late 2026. The deal also includes WWE Premium Live Events, further strengthening ESPN's sports portfolio.

On the streaming front, Disney announced plans to fully integrate Hulu into Disney+ next year. This creates a unified app combining Disney's premium franchises with general entertainment content. The move should reduce churn through better engagement while delivering operational efficiencies by operating on a single tech stack. The combined offering positions Disney+ as a more complete entertainment destination that can compete effectively with rivals.

Older Segments Still Going Strong

The company's Experiences division continues to perform well. Domestic per capita spending jumped 8% in the third quarter, the strongest growth in over two years. Walt Disney World posted record third-quarter revenue, and the cruise line business looks promising with ships operating at high occupancies and strong forward bookings.

Two new ships will launch later this year, including the Disney Adventure sailing from Singapore. This massive vessel will accommodate 7,000 passengers and serve as a floating ambassador for Disney's brand throughout Southeast Asia.

Management raised full-year guidance while maintaining discipline around content spending and capital allocation. The strategy prioritizes quality over quantity, as evidenced by the theatrical momentum of hits like Lilo & Stitch, which has crossed the billion-dollar mark globally.

Is DIS Stock Undervalued?

Analysts tracking DIS stock forecast revenue to increase from $91.36 billion in fiscal 2024 (ended in September) to $109 billion in fiscal 2028. In this period, adjusted earnings are forecast to expand from $4.97 per share to $7.82 per share.

Today, the stock trades at 17.9x forward earnings, which is below its 10-year historical average of 20.4x. If Disney is priced at 18x earnings, it could gain 29% over the next two years.

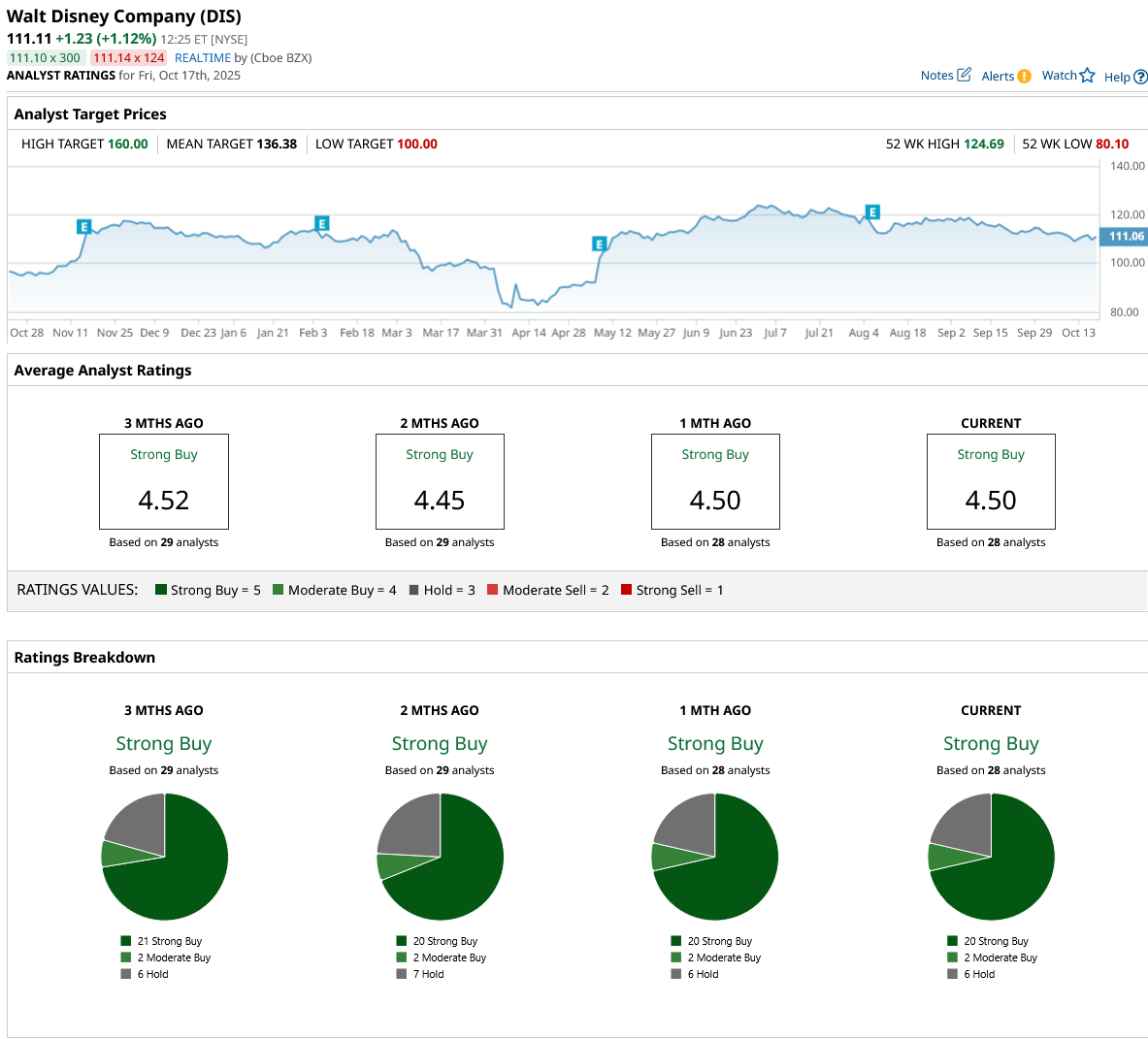

Out of 28 analysts covering DIS stock, 20 recommend “Strong Buy,” two recommend “Moderate Buy,” and six recommend “Hold.” The average DIS stock price target is $136.38, above the current price of $111.11.