Chipotle Mexican Grill (CMG) stock has been depressed with a correction of 30% year-to-date (YTD). With the company’s third-quarter results round the corner, it’s time to assess if valuations are attractive considering the business outlook.

Recently, UBS issued a warning that the company’s third-quarter earnings could fall short of consensus estimates and the full-year guidance is likely to be lowered. However, UBS analysts indicated that the pressure on sales and earnings is on the back of broader industry and macroeconomic challenges.

While disappointing results can impact near-term stock sentiment, it’s likely to be a good opportunity for long-term investors to consider exposure at oversold levels.

About Chipotle Stock

Chipotle is the owner and operator of a line of fast-casual Mexican restaurants serving food without artificial colors, flavors, and preservatives. As of June 2025, Chipotle has 3,800 restaurants in the United States, Europe, and the Middle East. It’s worth noting that the company owns and operates all restaurants in North America and Europe.

For Q2 2025, Chipotle reported muted revenue growth of 3% on a year-on-year (YoY) basis to $3.1 billion. For the same period, the company’s restaurant-level operating margin and operating margin were 27.4% and 18.2%, respectively.

With the factors of macroeconomic headwinds and margin compression, CMG stock has remained subdued, but there appears to be some consolidation in the last six months.

Positives Beyond the Current Challenges

Besides muted revenue growth, Chipotle reported a 4% decline in comparable store sales for Q2 2025. Additionally, margin compression was a concern.

Having said that, there are multiple positives beyond the current headwinds. First, Chipotle opened 61 company-owned restaurants during Q2 2025. The company has also guided for 315 to 345 new restaurant openings for 2025. New company-owned restaurants will have a positive impact on growth in the next few years.

Another important point to note is that for FY 2024, Chipotle reported operating cash flow of $2.1 billion. Further, for the first half of 2025, OCF was $1.1 billion. Even with sluggish growth and margin compression, cash flows have been robust. This provides ample flexibility for Chipotle to continue expanding its owned restaurants in the U.S. and Europe.

At the same time, Chipotle depends on new menu innovation to drive comparable restaurant sales growth. It’s worth adding here that besides the U.S. and Europe, Chipotle has opened restaurants in Kuwait and the UAE. In September 2025, the company announced a joint venture with SPC Group for entry into South Korea and Singapore in 2026. Entry into new markets is another catalyst for value creation. Therefore, with flexibility for investment in innovation and global expansion, it’s likely that growth will accelerate once industry headwinds wane.

What Analysts Say About CMG Stock

On Oct. 20, UBS issued a warning on potentially weak Q3 earnings and a downward revision of earnings guidance for the full year. With this bearish outlook, UBS has cut its price target for CMG stock from $65 to $56. Even with the downward revision, the price target still implies an upside potential of 33%.

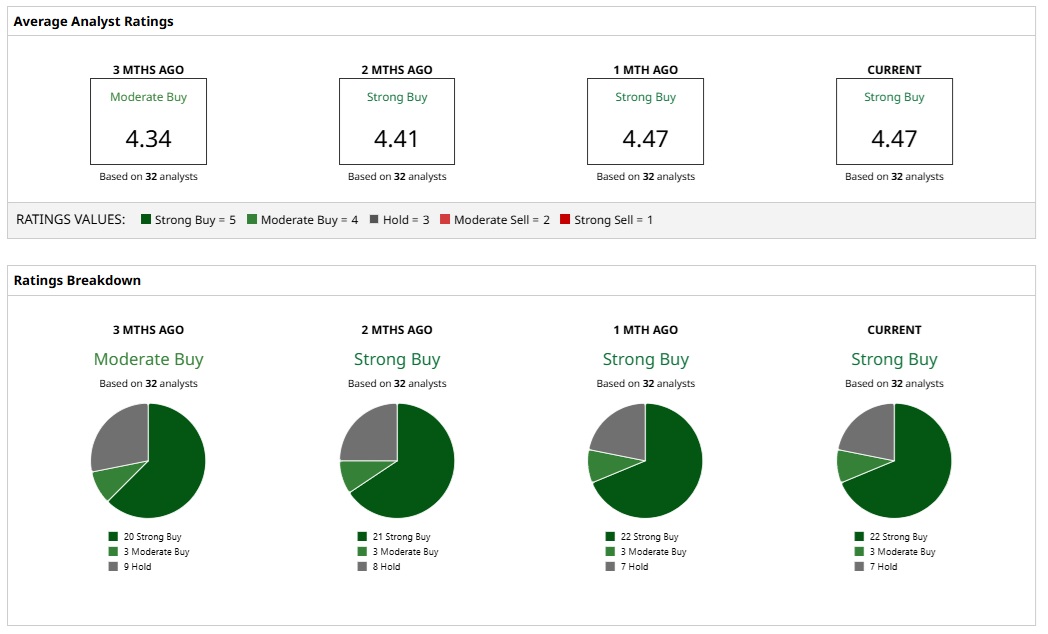

On looking at a broader analyst estimate, CMG stock commands a “Strong Buy” rating. Currently, 22 analysts have a “Strong Buy” view on the stock, with three analysts recommending a “Moderate Buy.” Further, seven analysts believe that CMG stock is a “Hold” at current levels. If we consider the mean analyst price target of $54.97, it would imply an upside potential of 30%.

It's also worth noting that for FY 2025, analysts expect earnings growth of just 6.25% on a YoY basis. However, for FY 2026, it’s expected that earnings growth will accelerate to 15.97%. Therefore, as macroeconomic headwinds wane on the back of expansionary monetary policies, Chipotle will be positioned to deliver better results.