AMC Entertainment (AMC) has had a rough ride in recent years, with its stock struggling to regain ground. The pandemic dealt a heavy blow to the world’s largest movie theater chain, forcing the shutdown of thousands of theaters and costing the company billions. While AMC briefly captured the attention of retail investors as a meme stock in 2021, its recovery was hampered again in 2023 when prolonged Hollywood strikes led to a halt in film production.

On top of that, the company continues to wrestle with a hefty debt load. But now, some much-needed good news may finally be on the way. Recently, AMC has joined forces with Taylor Swift to release her surprise film, “The Life of a Showgirl,” exclusively in theaters starting Oct. 3. Announcing the project on Instagram, Swift described it as a “dazzling soirée” and revealed that fans will only have a limited chance, from Oct. 3 to Oct. 5, to catch it on the big screen.

To make it even more special, audiences will also get the world premiere of her new music video, “The Fate of Ophelia,” along with behind-the-scenes footage and her personal reflections on the upcoming album. So, with Oct. 3 fast approaching, this high-profile collaboration could be just the kind of spotlight AMC needs to win back investors’ confidence.

About AMC Entertainment Stock

Kansas-based AMC is the largest movie theater chain in the U.S., Europe, and worldwide, operating roughly 900 theaters and 10,000 screens globally. The company has introduced several changes in the exhibition industry, including power-recliner seating, expanded food and beverage options, and loyalty and subscription programs. AMC also offers premium large-format screenings and a mix of content, from major Hollywood releases to independent films, while keeping audiences connected through its website and mobile apps.

Currently valued at around $1.5 billion by market capitalization, AMC is trading nearly 47% below its December 2024 peak of $5.56, reflecting the challenges the company has faced in recent years. Over the past 52 weeks, the stock has dropped 35%, a steep decline compared with the S&P 500 Index’s ($SPX) gain of 16.2% over the same period, highlighting how AMC has significantly lagged the broader market.

In 2025, AMC shares are down 26.2%, while the broader market has risen approximately 13.3%, underscoring the continuing pressure on the company’s stock amid lingering operational headwinds.

AMC's Financial Overview

On Aug. 11, AMC Entertainment surprised Wall Street with a better-than-expected second-quarter report for fiscal 2025, sending its shares up about 3.4% in a single day. The movie theater giant posted total revenue of $1.40 billion, up a notable 35.6% from the same quarter last year and above analysts’ forecast of $1.36 billion. The company also reported a net loss of just $4.7 million, or $0.01 per share, a huge improvement from the $32.8 million loss, or $0.10 per share, a year earlier.

On an adjusted basis, AMC broke even, beating Wall Street’s expectation of a $0.08 loss per share. Strong revenue growth helped drive djusted EBITDA up a staggering 391.4% to $189.2 million, highlighting the chain’s operational rebound. Attendance at AMC theaters rose 26% compared with last year, signaling renewed audience interest after years of pandemic-related disruptions and Hollywood strikes.

For the first time, consolidated admissions revenue per patron exceeded $12, hitting $12.14, another milestone in the chain’s recovery. CEO Adam Aron noted that these results reflect a “recovering industry-wide box office” and growing momentum heading into the second half of the year. Beyond operational improvements, management highlighted that AMC has been actively strengthening its balance sheet.

In July, the company completed a major refinancing designed to strengthen its balance sheet and position itself to benefit from a recovering box office. Key highlights include $244 million in new financing, primarily used to pay off debt maturing in 2026, and the conversion of at least $143 million of existing debt into equity, with the potential to equitize up to $337 million. As of June 30, 2025, AMC had $423.7 million in cash, not including $51.4 million in restricted cash.

Taylor Swift Takes Over AMC Theatres for a Weekend-Only Album Event

AMC announced on Sept. 19 that it will host a special cinematic event for Taylor Swift’s 12th studio album, “The Life of a Showgirl,” debuting on Oct. 3. The 89-minute showcase, “The Official Release Party of a Showgirl,” will play at all 540 AMC locations in the U.S. from Oct. 3 to 5, giving fans a rare, one-weekend-only chance to experience the album on the big screen.

The event will also feature the world premiere of Swift’s new music video, “The Fate of Ophelia,” exclusive behind-the-scenes footage, brand-new lyric videos, and personal reflections from Taylor herself. Screenings will start promptly at showtime with no previews or pre-show ads. Tickets are $12, with premium large-format options available at select theaters for their usual upcharges.

AMC is also taking the event global, with screenings planned for up to 100 additional countries, including Canada, Mexico, the U.K., Ireland, and key European markets. Tickets for the first 18 international countries went on sale Sept. 23. This marks Swift’s second collaboration with AMC, following the record-breaking “The Eras Tour” concert film in 2023.

While AMC shares have struggled for some time, this partnership with Taylor Swift presents a massive opportunity for AMC to leverage special event programming to attract audiences and enhance investor confidence. By aligning with Swift's massive global appeal, AMC appears well-positioned to revitalize its brand and capitalize on the anticipated success of the “The Life of a Showgirl” event.

What Do Analysts Think About AMC Stock?

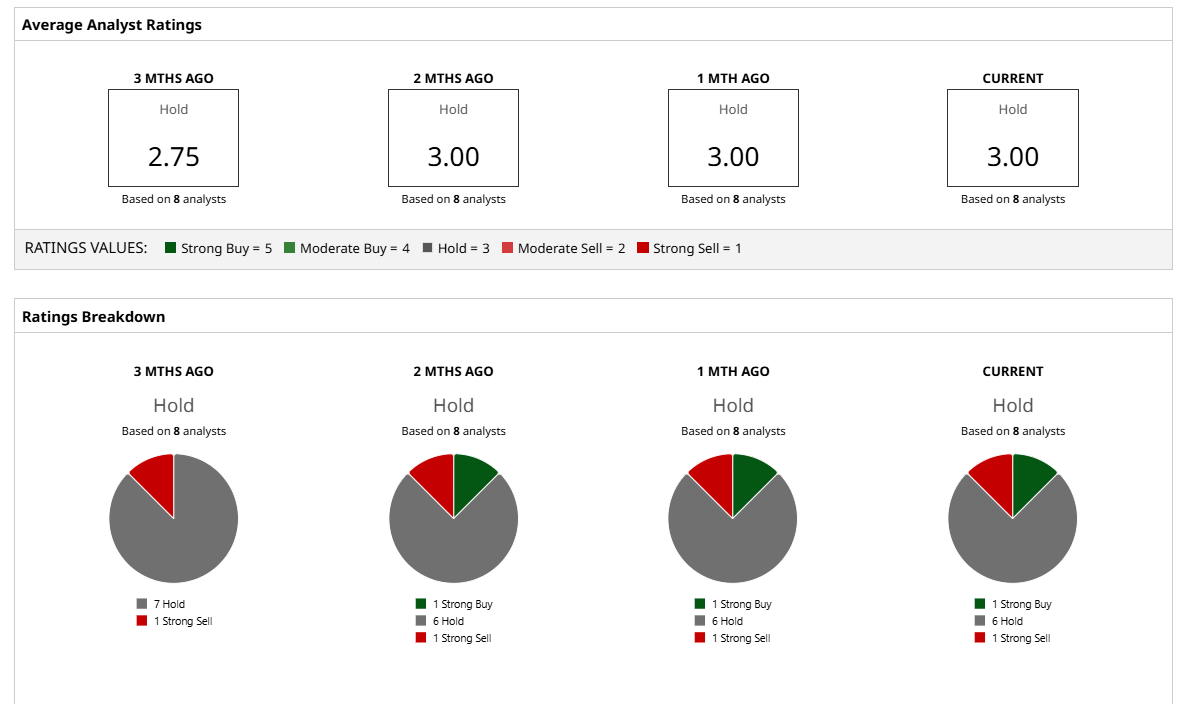

Wall Street has largely taken a cautious, wait-and-see approach to AMC, assigning the stock a consensus “Hold” rating overall. Among the eight analysts currently covering the stock, one calls it a “Strong Buy,” six recommend a “Hold,” and one suggests a “Strong Sell.”

The average price target of $3.34 implies a potential upside of roughly 12.8% from current levels, while the most optimistic projection on the Street, $4.50, suggests AMC could surge as much as 52% if it hits that mark.