/Amazon%20-%20Image%20by%20bluestork%20via%20Shutterstock.jpg)

Amazon (AMZN) is once again in the focus of investors as the company's earnings announcement on Oct. 30 may indicate whether it's possible to maintain the pace of artificial intelligence (AI) growth. AMZN stock has grown by over 20% in the past six months due to increased enthusiasm surrounding the company's integration of AI.

The wider love affair with AI and cloud infrastructure helps drive megacap tech stocks, with Amazon being at the crossover point of both. As investors prepare for earnings releases, their fixation is on AWS growth, margins, and the ability of AWS chief Andy Jassy's vision for AI to deliver on promises.

About Amazon Stock

Amazon, a world leader in both online retailing and cloud infrastructure, is based in Seattle, Washington. Its current market capitalization stands above $2.35 trillion. The company functions on three main business segments—North America Retail, International Retail, and Amazon Web Services (AWS)—those include everything from online retailing and logistics to artificial intelligence infrastructure and video streaming.

AMZN stock has ranged from $161.38 to $242.52 within the last 52 weeks and has been trading around $230 recently, which is roughly 5% off its highs for the year. Amazon's stock value has increased by only 5% in the year-to-date (YTD), underperforming the S&P 500 Index's ($SPX) gain of 17%.

Valuations remain an area of interest for investors. Amazon's valuation ratios include a trailing 34.2x and 32.9x on a price-earnings multiple with a 3.75x price-sales ratio and 21.2x on the price-cash flow ratio. These ratios reflect a moderate premium to the average valuation for the consumer discretionary industry group. These ratios seem justified by Amazon's strong return on equity of 23.8%, as well as its low debt-to-equity ratio of 0.15.

Amazon Beats on Earnings

In the second quarter of 2025, Amazon delivered another round of robust results. Net sales rose 13% year-over-year (YoY) to $167.7 billion, while operating income climbed 31% to $19.2 billion. The company reported net income of $18.2 billion, or $1.68 per share, beating consensus estimates by a comfortable margin. Segment growth was broad-based:North America revenue rose 11% to $100.1 billion.

International revenue grew 16% to $36.8 billion, and AWS grew 17.5% to $30.9. The company's operating cash flow from the last twelve months increased by 12% to $121.1 billion, but free cash flow declined to $18.2 billion as it made substantial investments in infrastructure and fulfillment.

CEO Andy Jassy highlighted how Amazon’s ongoing AI transformation is beginning to compound across its ecosystem. The company has expanded Alexa+ to millions of customers, rolled out Kiro, its new agentic IDE for software developers, and launched Bedrock AgentCore, a scalable platform to run AI agents securely. These developments reinforce AWS’s evolution from cloud compute to AI-as-a-service.

Moving on to Oct. 30, when Amazon will release third-quarter earnings, Street analysts' estimates include revenue of around $170-$172 billion and earnings per share of $1.75-$1.80. The important watchpoints here include AWS profit margins and the pace of growth of advertising business and artificial intelligence monetization strategies such as Bedrock and Strands.

What Analysts Expect for AMZN Stock

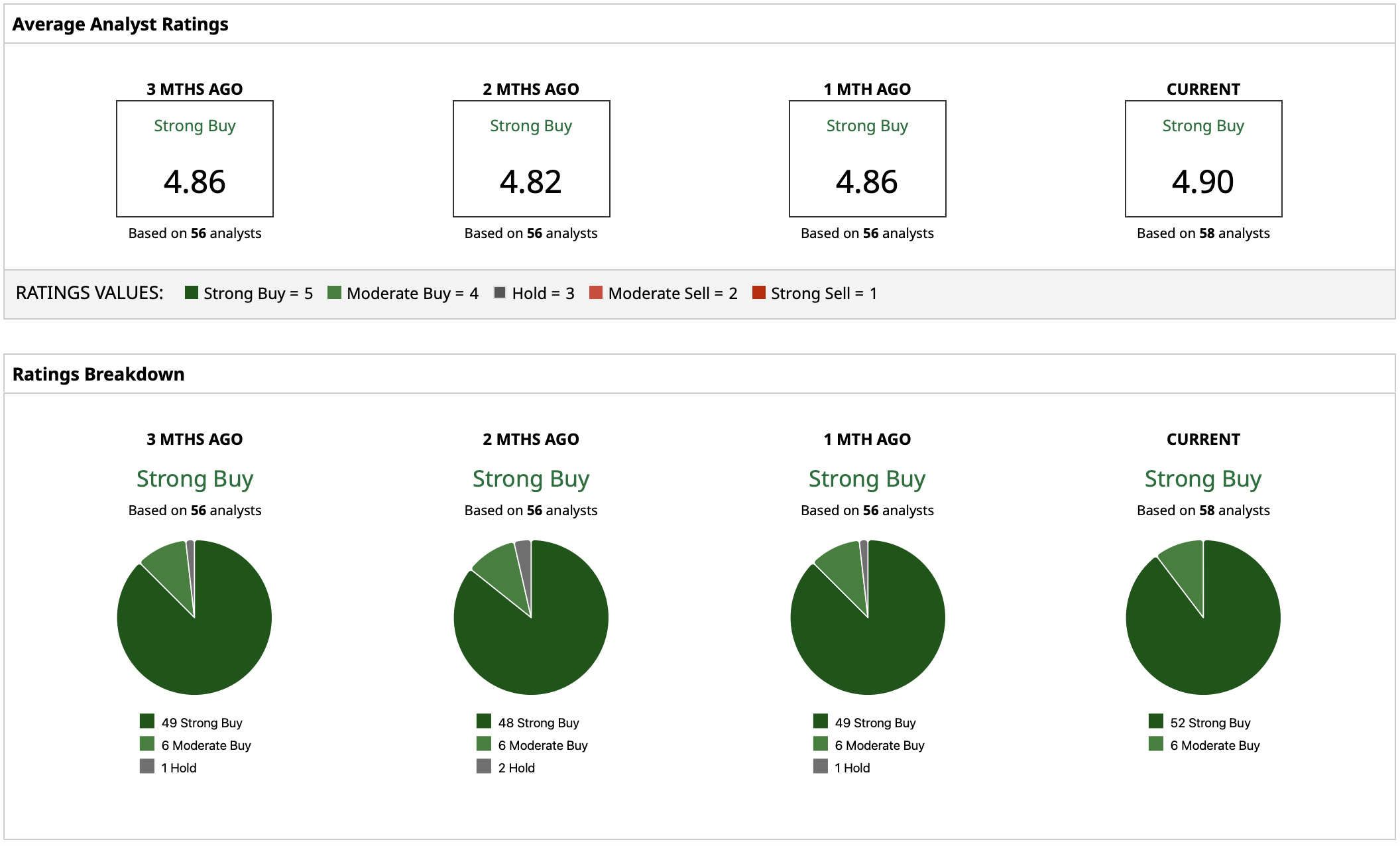

The Street is very positive on Amazon with a “Strong Buy” rating consensus. The average target of $268.69 shows upside of approximately 17% from current levels, while the high target of $305 indicates upside of 33%. The low target of $230 indicates that bearish analysts believe there may be limited downside to Amazon's diversified base of cash flows.