/Dayforce%20Inc%20app-by%20Premio%20Studio%20via%20Shutterstock.jpg)

With a market cap of $8.4 billion, Dayforce Inc (DAY) is a leading human capital management (HCM) software company. The company provides its flagship cloud platform, Dayforce, along with payroll, workforce management, and HR solutions to clients across the U.S., Canada, Australia, and internationally.

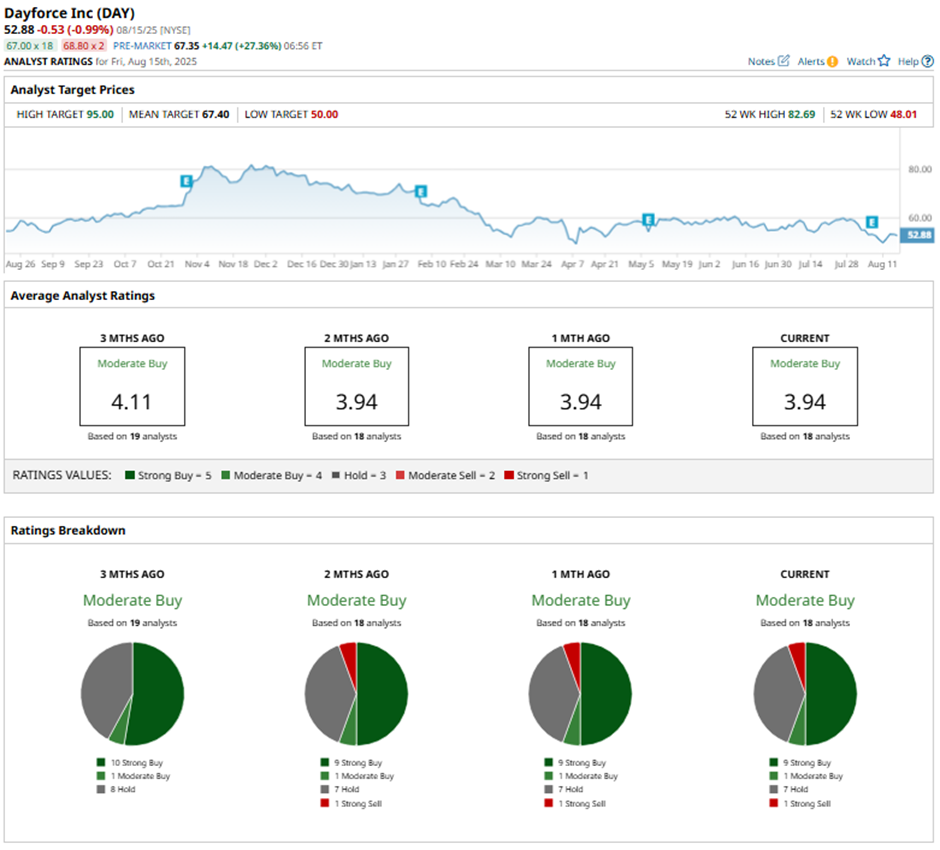

Shares of the Minneapolis, Minnesota-based company have underperformed the broader market over the past 52 weeks. DAY stock has declined 4.7% over this time frame, while the broader S&P 500 Index ($SPX) has rallied 16.4%. Moreover, shares of Dayforce are down 27.2% on a YTD basis, compared to SPX’s 9.7% gain.

Focusing more closely, the human resources software provider stock has lagged behind the Industrial Select Sector SPDR Fund’s (XLI) 18.3% return over the past 52 weeks and a 14.2% YTD gain.

Shares of Dayforce recovered marginally on Aug. 6 after the company reported Q2 2025 adjusted EPS of $0.61 and revenue of $464.7 million, surpassing forecasts. Investors were encouraged by management’s decision to raise its annual revenue forecast to $1.94 billion - $1.96 billion, reflecting confidence in sustained demand for its cloud-based HCM platform.

For the fiscal year, ending in December 2025, analysts expect DAY’s EPS to grow 52.5% year-over-year to $1.51. The company's earnings surprise history is mixed. It topped the consensus estimates in one of the last four quarters while missing on three other occasions.

Among the 18 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on nine “Strong Buy” ratings, one “Moderate Buy,” seven “Holds,” and one “Strong Sell.”

This configuration is slightly less bullish than three months ago, with 10 “Strong Buy” ratings on the stock.

On Aug. 7, Barclays analyst Raimo Lenschow raised Dayforce’s price target to $61 while maintaining an “Equal Weight” rating.

As of writing, the stock is trading below the mean price target of $67.40. The Street-high price target of $95 implies a potential upside of 79.7% from the current price levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.