/DaVita%20Inc%20logo%20on%20building-by%20JHVEPhoto%20via%20iStock.jpg)

With a market cap of $10.8 billion, DaVita Inc. (DVA) is a leading U.S.-based provider of kidney dialysis services, operating over 3,000 outpatient centers domestically and internationally. The Denver, Colorado-based company is expected to release its Q2 2025 earnings on Tuesday, Aug. 5.

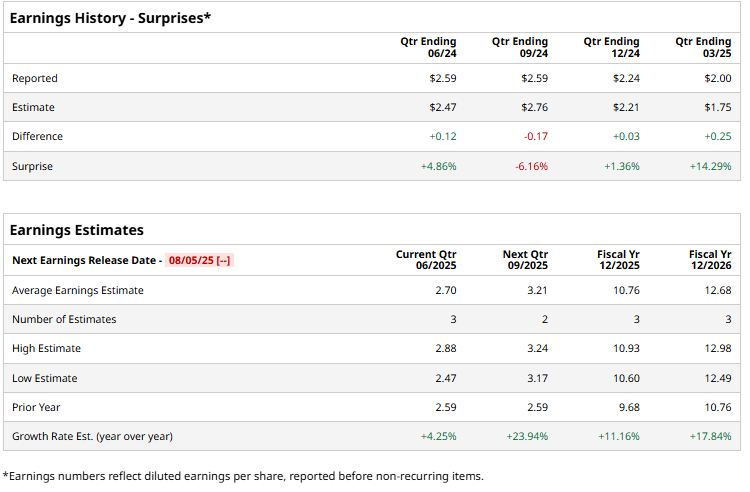

Ahead of this event, analysts expect DaVita to post adjusted earnings of $2.70 per share, up 4.3% from $2.59 per share reported in the same quarter last year. While the company has surpassed Wall Street's bottom-line estimates in three of the past four quarters, it has missed the projections on one other occasion.

Analysts forecast DVA to report an adjusted EPS of $10.76 this year, marking an increase of 11.2% from $9.68 reported in fiscal 2024. Moreover, in fiscal 2026, its adjusted earnings are expected to further grow 17.8% year-over-year to $12.68 per share.

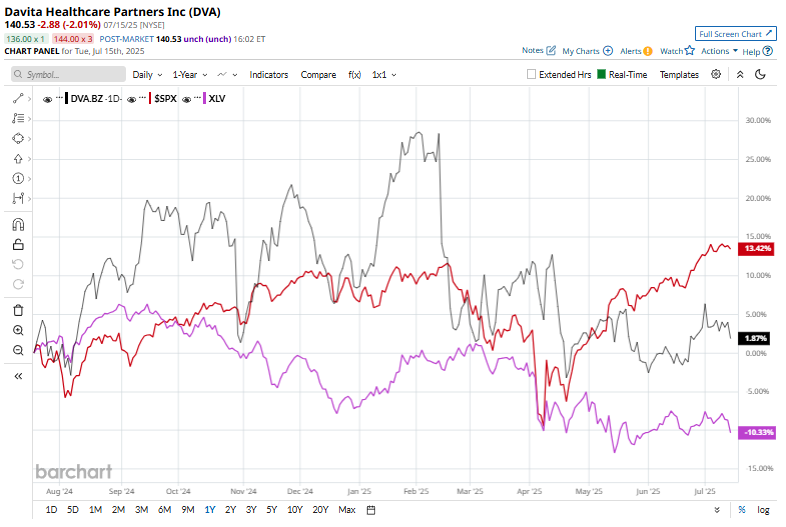

Shares of DVA have soared 3.4% over the past 52 weeks, lagging behind the S&P 500 Index's ($SPX) 10.9% gain but surpassing the Health Care Select Sector SPDR Fund’s (XLV) 10.3% decline during the same time frame.

On May 12, DVA shares rose marginally after reporting its Q1 results. Its revenue climbed 5% year-over-year to $3.2 billion, supported by growth in treatment volumes and a more favorable commercial mix. However, adjusted EPS fell 11.5% to $2, as rising operating expenses pressured profitability

Furthermore, analysts' consensus view on DVA is cautious, with a "Hold" rating overall. Among eight analysts covering the stock, one suggests a "Strong Buy," six recommend a "Hold,” and one gives a “Moderate Sell” rating. Its mean price target of $162.28 represents a 15.5% premium to current price levels.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.