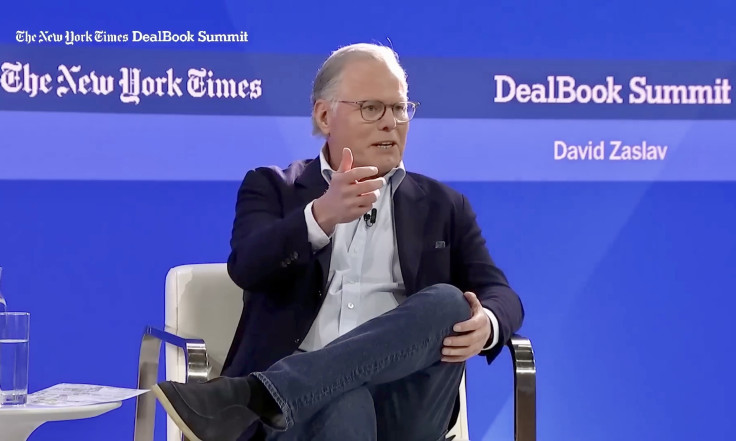

In the high-stakes theatre of Hollywood dealmaking, few negotiations have been as contentious or as costly as the current standoff between Warner Bros. Discovery and its suitors. David Zaslav has built a reputation on steely tactics, and he is currently testing the limits of the industry's wealthiest players.

While most executives would leap at an all-cash offer valuing their company at a staggering £81.3 billion ($108.4 billion), Zaslav remains unmoved, prioritising a controversial partnership with streaming giant Netflix. The tension is palpable as the entire entertainment industry waits to see if the Warner Bros. Discovery chief will capitulate to mounting pressure.

Why an £81 Billion Cash Offer Isn't Enough for Zaslav

Despite the eye-watering figures on the table, the Warner Bros. Discovery CEO has maintained a defiant posture against Paramount Skydance's increasingly lucrative advances. On 5 December 2025, Zaslav and his board announced a definitive agreement with Netflix valued at approximately £54 billion ($72 billion).

This deal, which encompasses the studio, HBO, HBO Max, and related streaming assets, is slated to close within 12 to 18 months. As part of this strategic pivot, WBD intends to spin off its cable networks into a separate entity, Discovery Global.

Critics and shareholders are scratching their heads over why the Paramount Skydance bid keeps getting rejected. It is hard to ignore the math here: Paramount isn't just putting more cash on the table; they want the whole pie, including heavyweight cable properties like CNN and TNT that the Netflix deal leaves behind. On top of that, Paramount insists their buyout would be a smoother ride with regulators, unlike a Netflix merger that mashes up the world's first- and third-biggest streamers.

Inside Paramount's War Room: Jokes, Anger, and Disbelief

Patience is wearing thin over at Paramount Skydance. By 3 January 2026, the professional courtesy had largely evaporated, replaced by genuine frustration as WBD keeps saying 'no' to what looks like a clearly better deal.

There is now a running joke among the team about what creative excuse Zaslav will invent next; one insider quipped that they expect WBD to claim they simply 'don't like the type of paper the offer is written on'. This levity masks a deep-seated anger at what is perceived as a rigged process.

David Ellison, backed by his father Larry Ellison's £180 billion ($240 billion) Oracle fortune and RedBird Capital, believes the board is unfairly favouring the Netflix deal from the start. The situation has become so contentious that litigation is being considered, with the Ellison camp viewing the bidding war as potentially manipulated against shareholder interests.

#Paramount’s first offer to buy Warner Bros. Discovery included a compensation package for #WBD’s CEO David Zaslav that was worth “several hundred million dollars."

— TheWrap (@TheWrap) December 17, 2025

Zaslav told the Ellisons "it would be inappropriate to discuss any such arrangements at that time.”

Read more:… pic.twitter.com/g8bOEG67fs

The £25.50 Per Share Number That Could Seal the Deal

The negotiations have been a rollercoaster of shifting goalposts. Initially, Zaslav demanded £22.50 ($30) per share, a figure the Ellison camp agreed to meet.

However, the terms were swiftly altered, with Zaslav demanding an all-cash deal, a personal guarantee from Larry Ellison, and coverage of a £2.1 billion ($2.8 billion) breakup fee owed to Netflix. Even after the Ellisons acquiesced to these draconian terms, the board rejected the proposal in late December.

Yet, industry insiders suggest a resolution may be on the horizon. Zaslav has been heard whispering a new magic number to media intermediaries: £25.50 ($34) per share. This figure represents a massive premium over the current Netflix valuation of roughly £20.81 ($27.75) per share.

Market analysts believe that if Paramount Skydance can stretch to this valuation, they might finally make an offer that even the stubborn Warner Bros boss cannot refuse. Such a deal would allow him to save face while securing a windfall for shareholders.

A Battle for the Soul of Hollywood's Future

This deal is going to shape how we watch movies and TV for years. It is a stark choice between a Hollywood run by Netflix, where old-school studios basically become production arms, or a future where a combined Paramount and Skydance can still stand on their own two feet.

By dragging his feet, Zaslav has actually done shareholders a favour, pushing the share price from around £14.25 ($19) up to the mid-30s. But that strategy is risky. It is testing the Ellison family's patience, and now we have banking heavyweights, tech billionaires, and media bosses all staring each other down as January 2026 kicks off.