Popular neobank Dave Inc.’s (NASDAQ:DAVE) CEO, Jason Wilk, acknowledges his company’s growing need to communicate better with a new breed of shareholders, that is, its retail investor base that predominantly hangs out on platforms such as Reddit, X and now Substack.

DAVE is trading at elevated levels. See the full story here.

We Probably ‘Haven’t Done Enough’ To Engage Retail Shareholders

In a recent interview for Marketopolis by Benzinga, Wilk said, “We probably haven't done enough” to reach out to this new class of retail investors.

The neobank, which went public via a SPAC during the fintech boom, now finds itself navigating a new era of shareholder engagement, one that is being increasingly shaped by social media and digitally-native investors.

See Also: Stocks Shrug Off Bank Fears, AMEX Jumps: What’s Moving Markets Friday?

“Some of these retail investors are writing these Substacks,” he said, adding that “there’s some really intelligent stuff out there,” which he finds insightful, while acknowledging independent voices across Reddit, X, and similar platforms that are starting to influence how companies are perceived.

The company, however, does not underrate traditional Wall Street coverage, with Wilk saying, “We’ll certainly read all the analyst coverage of the 10 banks that currently cover us,” adding that it’s “Super helpful to see where they’re at, where their models are.”

One Of The Few Winners Of ‘The Fintech Winter’

Wilk also reflected on how the company and the broader fintech sector have evolved since the downturn that followed the pandemic-era boom.

“The unique part about the sort of FinTech winter that happened in 2022, 23 is [that] it just really cut out a lot of the venture capital dollars going into the ecosystem,” which he said has led to Dave emerging as “one of very few winners in the neobank space.”

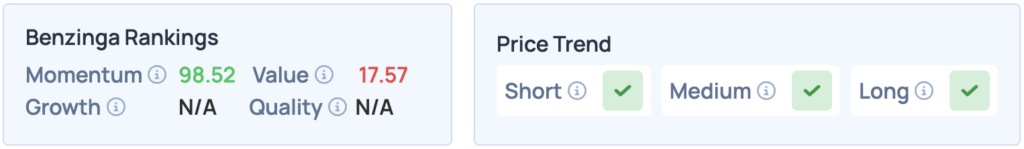

Shares of Dave were up 5.05% on Tuesday, closing at $226.40, and are down 0.18% premarket. The stock scores high on Momentum in Benzinga’s Edge Stock Rankings, with a favorable price trend in the short, medium and long terms. Click here for deeper insights into the stock, its peers and competitors.

Read More:

Photo courtesy: T. Schneider / Shutterstock.com