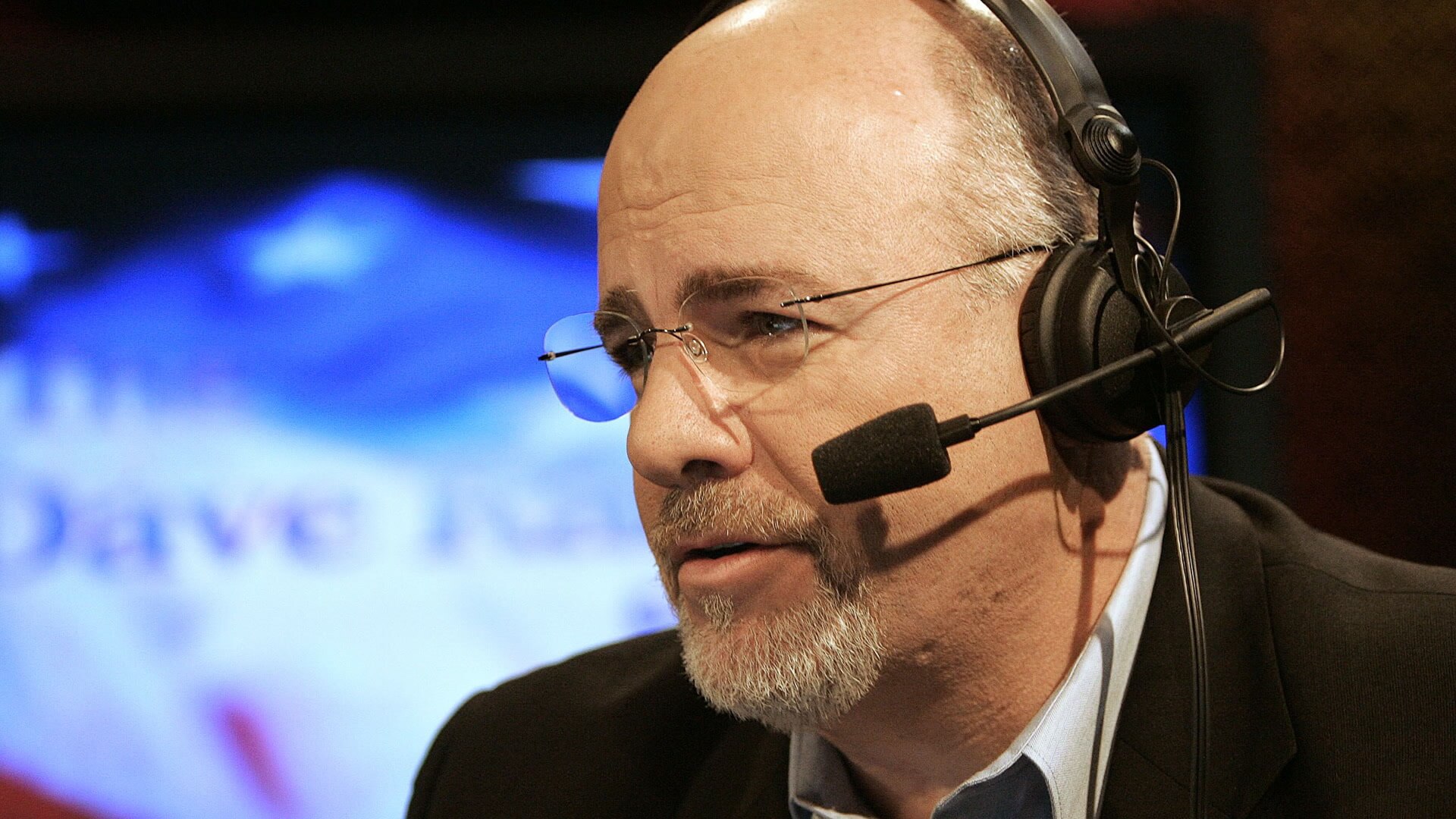

When interviewed by Rebecca Mezistrano, producer of TheStreet, personal finance expert Dave Ramsey weighed in on the biggest 401(k) plan mistake Americans make that could be costing them millions.

His answer? Jumping in and out of the market.

“They freak out when the market goes down,” stated Ramsey. “They stop, they start, they try to time the market.”

Ramsey then noted that people trained to time the market can’t even do it well — so the lay person shouldn’t try.

Learn More: Dave Ramsey Says This Is the Best Way To Pay Off Debt

Consider This: 4 Housing Markets That Have Plummeted in Value Over the Past 5 Years

Ramsey stated that those with money invested in the market do best when they ignore their emotions (be it panic or excitement), avoid reacting to short-term fluctuations and simply allow their 401(k) plans to grow untouched.

He goes on to say that individuals trying to time the market never keep up with steady investor. The steady investor wins every time, but do other financial professionals agree?

Do Other Financial Professionals Agree or Disagree with Ramsey’s Take?

“I often disagree with Dave Ramsey, but on this point he is 100% spot on,” stated Robert Johnson, chairman and CEO at Economic Index Associates, who claimed attempting to time the market is “fool’s gold.”

Johnson cited the J.P. Morgan Asset Management’s 2025 Retirement Guide to demonstrate that over a 20-year period from Jan. 3, 2005, to Dec. 31, 2024, “if you missed the top 10 days in the stock market, your overall return was cut by over 40%,” and, “[seven] of the best 10 days occurred within two weeks of the worst ten days.”

Translation? The biggest market gains happen too infrequently, too unpredictably and too densely to risk pulling your money out of the market and missing them.

Find Out: Here’s Why You Might Want To Invest Your Retirement Savings in a Roth 401(k)

Lisa A. Cummings, Esq., attorney at Cummings & Cummings Law, also agreed with Ramsey, adding that timing the market results in counterproductively buying expensive securities during market highs and selling low amid fear — “which results in the opposite long-term goal to preserve your contributions and grow your earnings over a longer time horizon.”

Listen to Ramsey on this one: Set it and forget it.

More From GOBankingRates

- Here's What It Costs To Charge a Tesla Monthly vs. Using Gas for a Nissan Altima

- Why You Should Start Investing Now (Even If You Only Have $10)

- 7 Ways To Tell If You're Rich or Middle Class -- It's More Than Your Paycheck

- Mark Cuban Tells Americans To Stock Up on Consumables as Trump's Tariffs Hit -- Here's What To Buy

This article originally appeared on GOBankingRates.com: Dave Ramsey: The Biggest 401(k) Mistake People Make