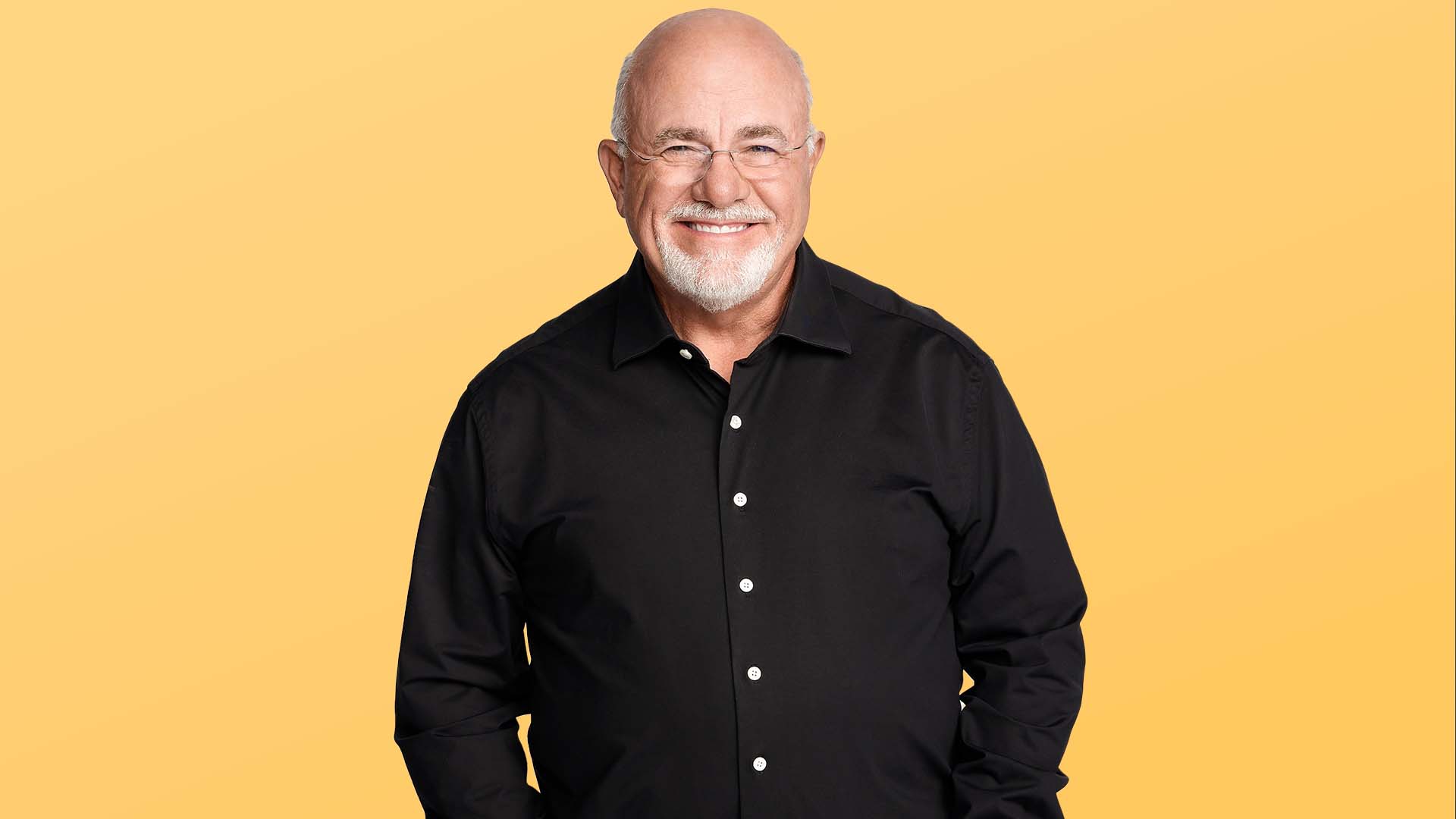

If Dave Ramsey is known for anything, it’s his strong views on how to handle — and, of course, not handle — your money. The nationally recognized money expert and radio host has built a massive platform by offering blunt, no-nonsense advice on where people go wrong with their finances and how they can fix it.

Read More: Most Experts Say Buy Index Funds. Charles Payne Says Do This Instead

Learn About: 3 Advanced Investing Moves Experts Use to Minimize Taxes and Help Boost Returns

In his decades on the air, he’s heard countless mistakes from the people who call in to his show. While some callers have tales of woe that feel like gawking at a smoking wreck of debt, making you grateful that you’ll never blow that much money in one go, Ramsey is also privy to some of the most common mistakes that people make when trying to build wealth. Despite your best intentions, there’s a good chance you’ve made one too.

The good news is that it’s not too late to fix those mistakes. But knowing what they are is the first step.

Not Having a Written Budget, Even With a High Income

To hear Ramsey tell it, nothing instills accountability like sitting down every month and writing out your budget. Sure, you can try to remember it, but given that your budget is just one among other spinning plates in your mind, along with your grocery list and your kid’s ballet schedule, the odds aren’t exactly high that you will.

The problem, according to Ramsey, is that without a clearly defined budget you can turn to every month, you run the risk of simply not knowing where your money is going. While you might think that careful budgeting is only for people who are struggling to make ends meet, Ramsey has some stern words for you — or, rather, he did for a letter writer whose parents insisted that as high earners, they didn’t need to worry about budgeting.

“If you think doing a budget is only for people who have trouble making ends meet, think again. My wife and I have lived by a written, monthly budget every single month for about 30 years,” Ramsey wrote. “It doesn’t matter whether you’re a multimillionaire, or if you have just $100 to your name. Knowing exactly how much money you have — and where it’s going — is an essential part of managing your finances accurately and successfully.”

For You: 5 Ways ‘Loud Budgeting’ Can Make You Richer, According to Vivian Tu

Allowing Yourself To Remain in Debt

If there’s one thing Ramsey hates, it’s debt. Credit card debt. Car loans. Student loans. Personal loans. He hates all of it. If Ramsey were in the Dune universe, instead of “fear is the mind-killer,” Paul Atreides might be saying, “debt is the wealth-killer.”

To Ramsey, borrowing any money, even at lower interest rates, snares you in the cycle of payments and keeps you from your biggest, most powerful wealth-building resource — your income. He’s famous for saying, “You can’t win with debt. It doesn’t work.”

How do you win, then? Ramsey has popularized the debt snowball method as a way of continually motivating yourself to pay down debt. Using the debt snowball method, you tackle your debt from the smallest to largest balance regardless of the interest rate. While you make minimum payments on your other debts, you throw everything you can at that smallest debt. Once you’ve paid it off, you take everything you’d have applied to that debt and “snowball” it up to the next smallest and repeat the process until you’re debt-free.

Comparing Yourself to Others and Overspending Because of It

Once you’ve started earning a little money (or a substantial amount), it’s easy to give in to the temptation to show it off to others. You finance a car that will bite you with its monthly payments. You go on a shopping spree for fancy new clothes. Oh, and why not add that gorgeous lawn sculpture to your front yard? After all, haven’t you worked hard? Don’t you deserve to show that you too can keep up with the Joneses — even if your credit card statement feels like a brick lobbed into your inbox every month?

Unfortunately, you’ve fallen into a common trap. Ramsey says that the pressure to compete with other people, whether they’re in your Instagram feed or down the street, can lead to financial ruin.

As the Ramsey Solutions site puts it, “Remember — the grass isn’t always greener on the other side. Sure, it may look greener, but are you willing to go into thousands of dollars of debt each year for the nicest lawn in the neighborhood?”

When advising a young caller who was concerned that her peers seemed to be living the lavish lifestyle of vacations galore, Ramsey reminded her that being debt-free was better than living large — and that “on social media, you’re only seeing the highlight reel [of someone’s life]. We can all fall prey to this because we’re not seeing reality.”

Bottom Line

Dave Ramsey has seen a lot of people make a lot of mistakes when trying to build wealth, but some of his top callouts are not writing down a budget, staying in debt, and overspending to impress others. Avoiding these pitfalls won’t make you wealthy overnight, but Ramsey believes they can help lay the groundwork to build — and keep — long-term wealth.

More From GoBankingRates

- Here's How Much You Need To Retire With a $100K Lifestyle

- Dave Ramsey Warns: This Common Habit Can Ruin Your Retirement

- I'm a Retired Boomer: 6 Bills I Canceled This Year That Were a Waste of Money

- 25 Places To Buy a Home If You Want It To Gain Value

This article originally appeared on GOBankingRates.com: Dave Ramsey: The 3 Worst Mistakes People Make When Trying To Build Wealth