New investors confront a lot of questions about where to begin.

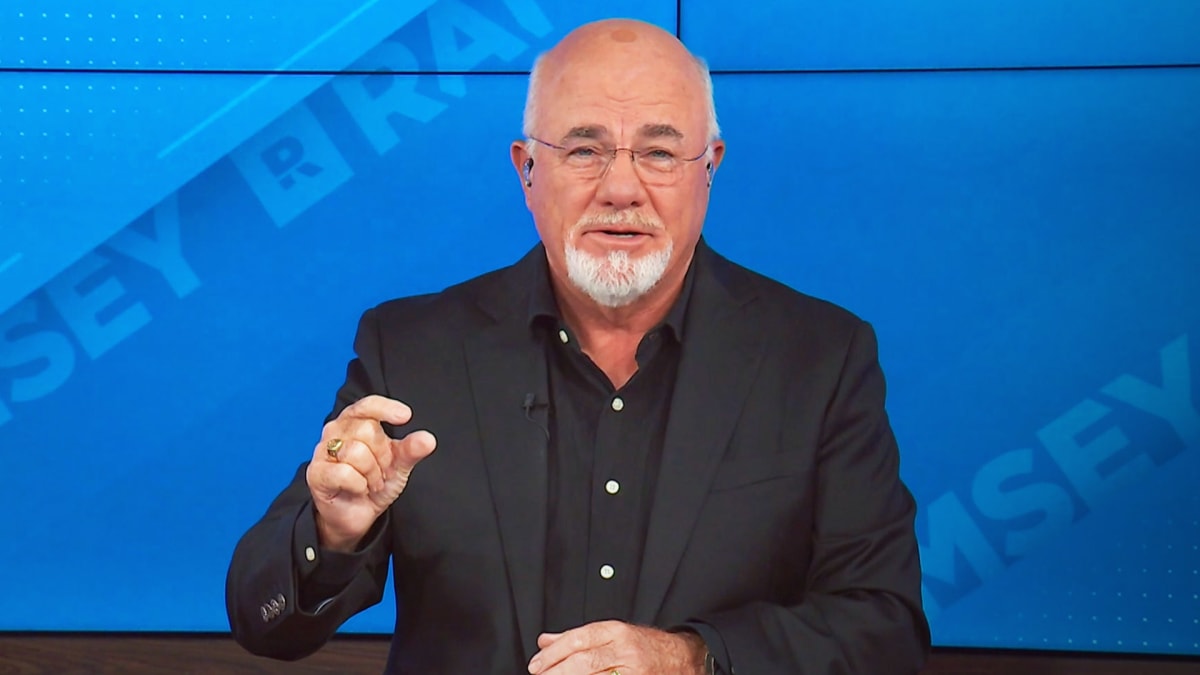

Author and radio host Dave Ramsey shared his thoughts on the subject with TheStreet Editor-in-Chief Sara Silverstein in a recent exclusive interview (video above).

DON'T MISS: Dave Ramsey Explains Why Now Is a Great Time To Buy a House

Ramsey referred to comments he had previously made about how many millionaires get started with real estate investments.

"If you're a new home buyer, listen to me carefully," he had urged. "We've studied millionaires for decades. The typical millionaire, the first $1 million to $5 million of net worth they get, is their paid-off home."

Silverstein asked Ramsey about advice he would have have for new investors.

"Well, back to those millionaires again that we were talking about," Ramsey said. "They steadily invest in things like a Roth 401(k) with a match, hopefully, and maybe a Roth IRA, if not in some good growth stock mutual funds. And that's steady investing. And you and I know from our world, they get the advantage of dollar cost averaging doing that."

The personal finance personality discussed his belief that it does not take a prohibitively large amount of money to get started.

Some of the most popular current stocks to purchase include Amazon (AMZN), Alphabet (GOOGL), Meta (META) and Nvidia (NVDA).

"But that constant steady investing, it doesn't require a lot of money to become fairly wealthy, especially if you start early," he said.

"Now, here's the trick. We teach folks to get out of debt," Ramsey continued. "Everything but your house, and build an emergency fund again before you start your 401(k)."

"Because if you don't have an emergency fund and you have an emergency, you're going to do something stupid like cash out early and end up with big penalties and taxes and all kinds of crap coming at you."

Ramsey emphasized the need to understand which steps to take and when to take them.

"So do this stuff in the right order," he said. "Get yourself free of car payments, free of student loans. Now you've got money to invest after you put that emergency fund in place."

"We recommend at what we call Baby Step four, you start putting 15% of your income into good growth stock mutual funds and some kind of retirement plan," he said. "Hopefully it's a Roth 401(k) with a match."

Dave Ramsey's Baby Steps

Ramsey frequently talks about what he calls the seven baby steps for one to take control of one's money. In step four, he calls out the percentage of household income he recommends to be put toward retirement.

Step 1: Save $1,000 for your starter emergency fund.

Step 2: Pay off all debt (except the house) using the debt snowball.

Step 3: Save 3–6 months of expenses in a fully funded emergency fund.

Step 4: Invest 15% of your household income in retirement.

Step 5: Save for your children’s college fund.

Step 6: Pay off your home early.

Step 7: Build wealth and give.

"It's not a fairy tale," Ramsey says. "It works every single time!"

Get exclusive access to portfolio managers and their proven investing strategies with Real Money Pro. Get started now.