Taking care of one's parents is a financial responsibility that eventually falls on many.

For better or worse, there are many options available and many ways to do it. Since each situation is different, it's important to make appropriate decisions based on circumstances.

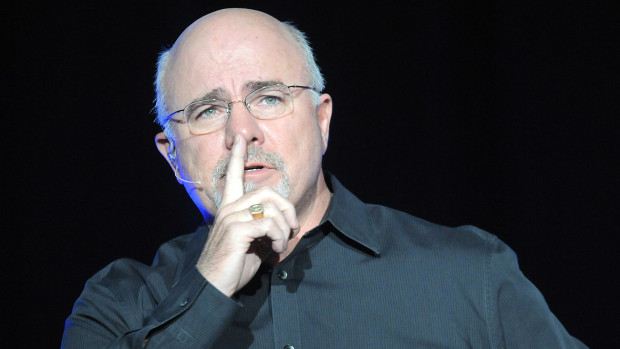

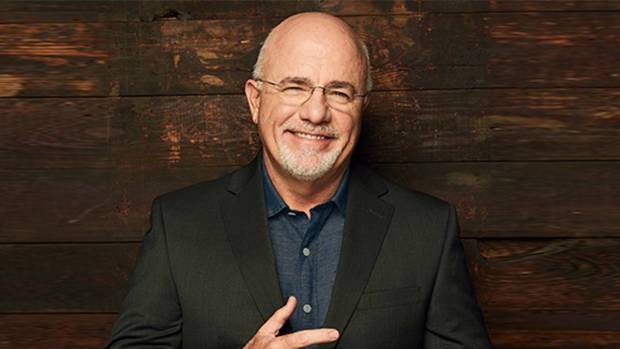

Related: Dave Ramsey admits to the financial mistake that once left him broke

Author and radio host Dave Ramsey always seems eager to embrace these vital discussions.

An advice seeker identifying himself as Ed recently explained his mother-in-law's situation and wondered what Ramsey might say about it, according to KTAR News in Phoenix.

"Dear Dave," he wrote. "My mother-in-law is 85, and she’s had some health setbacks recently. The family got together with her, and as a group, we decided it was time to sell her property and move her into an apartment at a nice senior living facility."

Ed explained a bit about her finances.

"She should see a little over $300,000 from the sale of her house. Aside from that, she has about $10,000 in a savings account," he wrote.

"The problem is, she'll only receive $2,100 a month in Social Security, and rent at the facility is $2,600 per month," he continued. "Plus she loves making donations to charities. With interest rates where they are, is a CD ladder a good place to put the money to help her cash flow expenses in the future?"

The personal finance personality answered with some real-world financial considerations.

"If this were my mother-in-law, I’d want her to do better than a CD (certificate of deposit) ladder," Ramsey wrote. "Even with the deficit between her Social Security income and the cost of rent, she'll only need to see $6,000 a year from the investment to make up the difference."

"And plus, she's 85. Even if she's got nothing in terms of interest, the chances of her burning all the way through her nest egg before she dies are almost zero," he continued. "I know the thought of her passing away isn't pleasant, but it's something you have to take into consideration."

RamseySolutions.com

How to view the situation and what not to do

Ramsey got a little philosophical as the conversation moved along.

"As far as the charities go? Right now, she's the charity. Maybe not in the traditional sense of the word, but it's time for Mom to come first," Ramsey wrote. "Only the strong can help the weak. I didn't let my toddlers carry our newborn."

"And when it comes to money, you’ve got to have the financial strength — the free and clear assets — to carry others," he added. "Take care of your own household first. That’s her responsibility at this point."

Ramsey addressed some other saving and investing options, but implored Ed not to do anything risky.

"You're not going to mess this up unless you put the money in crypto, or something stupid like that," he wrote. "If you want to do some high-yield savings as a part of it, that’s fine. If it were me, I’d probably end up investing some of it too."

Ramsey then offered up some math for Ed to think about.

"Here’s the thing: Overall, if you could make 8% on it, that's $2,000 a month, and it lasts indefinitely," he wrote. "That's not even touching the principal. But like I said before, even if you make nothing on it, just divide $6,000 into $300,000. See what I mean? It's probably going to last as long as she does."

Ramsey also suggested thinking about quality of life in addition to meeting financial obligations.

"Of course, there may be some other medical bills, and you'd probably want her to have a life other than just paying bills," he wrote. "That's why I’d like to see that extra $2,000 a month happening. It would provide a little cushion. And there may be a few other little things from time to time the family would have to pick up, but that's not unusual in a situation like this."

"You all can make this work for her. Don't be super aggressive, but don't be super conservative either."

Get exclusive access to portfolio managers and their proven investing strategies with Real Money Pro. Get started now.