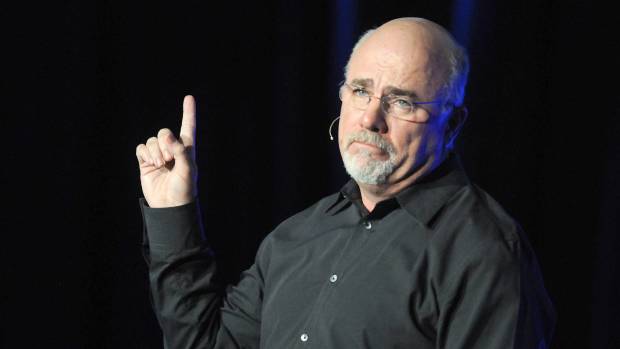

While Dave Ramsey may seem like the paragon of financial smarts to many of his fans, the financial pundit admits that his success is partly due to making a terrible mistake in his earlier years.

The radio personality disclosed that mistake to a caller named Joe on The Dave Ramsey Show. The guest wanted to discuss his goal of becoming a millionaire.

Don't Miss: Kevin O'Leary warns about a fatal mistake small-business owners often make

The caller explained that he and his wife are 23 years old, that he owns his company, and that "this is just the beginning levels -- we're going to make a whole lot more."

Joe and his wife are using debt to invest in rental properties with the goal of becoming millionaires, and he called in to The Ramsey Show for advice. pic.twitter.com/b8wlVF31v0

— Dave Ramsey (@DaveRamsey) August 16, 2023

"You are doing very well," Ramsey replied in a patient voice. "There's so much energy and so many positive, um, adjectives in your description of your situation, that it makes me a little bit fearful that you're going to try to move too fast."

Ramsey went on to relate his own experience, saying that when he was the caller's age he started to buy and sell real estate, borrowing money from the bank to do his first "flip."

"But what happened to me was that I got rich quick," Ransey said. "By the time I was 26 I had $1 million net worth, I owned $4 million worth of real estate. But I had borrowed up to my eyeballs. I had $3 million worth of debt.

"The bank got sold to another bank, they called our notes, we spent the next 2 1/2 years of our life losing everything we owned. With a brand-new baby and a toddler, we got to start over when I was 28. I don't want that for you."

More Dave Ramsey:

- Dave Ramsey has a blunt warning on a key homeowner mistake

- Dave Ramsey has outspoken view on the ‘lie’ about college

- This couple’s million-dollar confession actually floored Dave Ramsey

Ramsey's story sounded dire but he then circled back, giving the caller some hopeful words.

"You're going to be a multimillionaire, Joe," he said. "When you're 40, your net worth is going to be well over $5 million. I can promise you that. But I can promise you it won't be if you keep borrowing money and buying real estate. You're gonna get yourself in trouble. Slow down a notch."

Ramsey advised Joe to pay off his house and his rental first and set a new goal: paying cash for his next investment property.

Get exclusive access to portfolio managers and their proven investing strategies with Real Money Pro. Get started now.