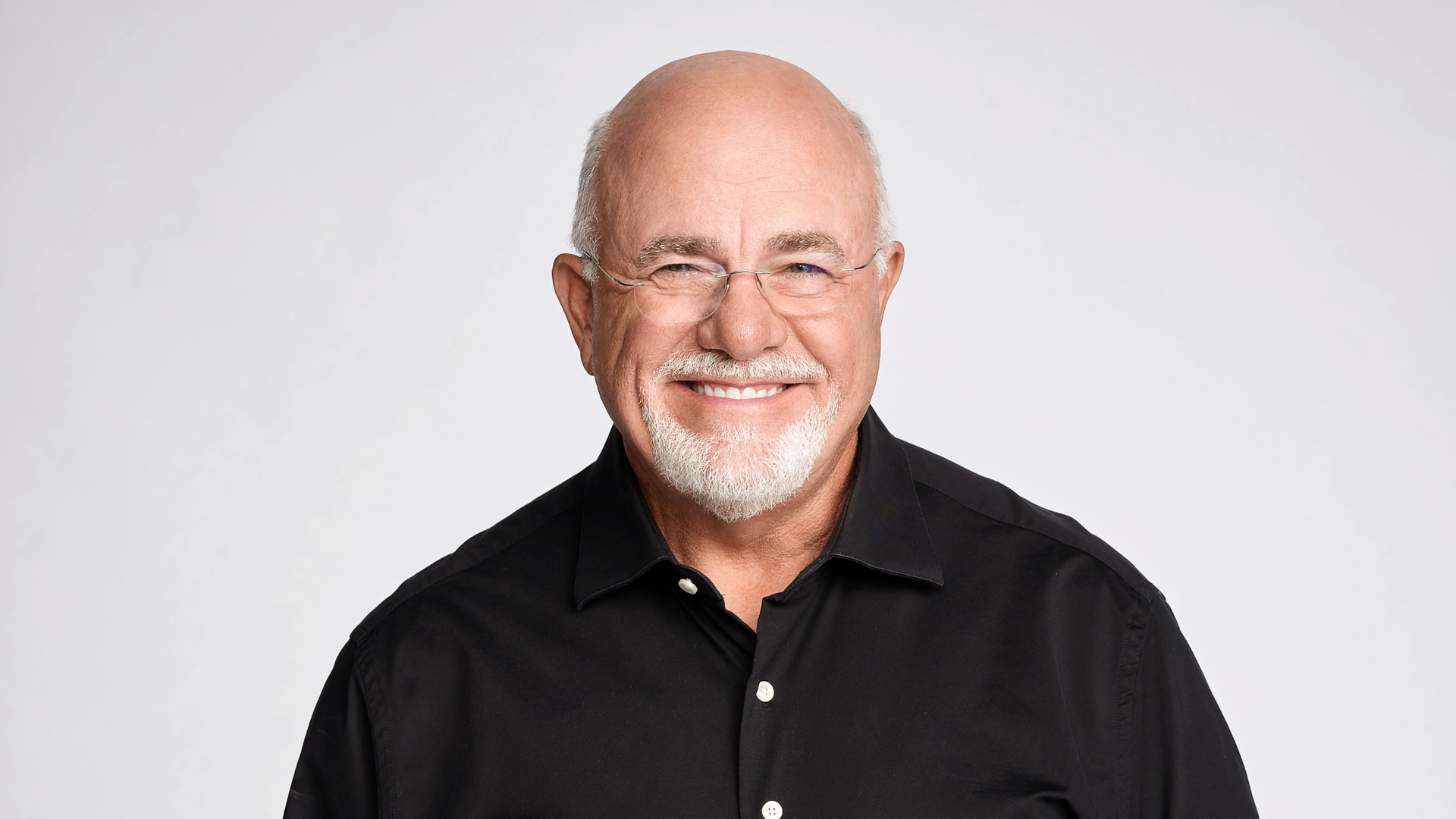

Money expert Dave Ramsey offers a wealth of personal finance advice through his highly popular radio show, “The Ramsey Show.” In one YouTube clip of the show titled, “Pet Insurance Is Not The Problem Here,” he spoke with a veterinary technician who was struggling to prioritize her expenses. More specifically, she was reluctant to cancel her $350 pet insurance bill that covered her three beloved pets.

Learn More: Dave Ramsey Says This Is the Best Way To Pay Off Debt

For You: 5 Types of Cars Retirees Should Stay Away From Buying

Ramsey explained in that call that the vet tech is focused on the wrong money problem. Including her spouse’s income, her household earned $125,000 a year — more than enough to insure her pets. The real issue was her inability to put $1,000 toward an emergency fund, which was likely due to overspending.

This isn’t a problem unique to this specific caller. It’s common for people to overlook certain money problems and focus on one particular issue or budget item. However, by zooming out and looking at the bigger picture, it can be easier to focus on the areas that need it most.

Here are some more tips on how to identify the right money problem and make financial progress.

Adjust Your Money Mindset

Rachel Cruze, a Ramsey personality and Dave Ramsey’s daughter, wrote an article called “How to Change Your Money Mindset.” In it, she explained that a money mindset is what people believe about money and their attitude towards it.

She went on to write that a big part of tackling money problems like overspending is believing you can. Cruze advised her readers to take the time to understand how their money beliefs came to be, whether it’s from childhood conversations, lessons they learned from friends at school, or something else.

When people take the time to look back and discover the root of their money beliefs, it becomes easier to identify money problems and why they have them.

Read Next: Here’s How to Fix Your Budgeting Problems, According to Kumiko Love

Look at the Bigger Picture

The woman who called into Ramsey’s show asking about pet insurance needed to look at the bigger picture. She was focusing on canceling one bill to free up money in her budget. However, by zooming out and looking at her finances overall, Ramsey could identify that she and her husband were likely spending too much.

Additionally, based on her responses, he pointed out that she and her husband needed to get on the same page in order to manage their budget more efficiently. By pivoting to focus on her overall spending, this caller can find more areas of her budget to cut. This can help her reach her financial goals much faster.

Start Small

After watching Ramsey’s video or reading Cruze’s article, people may be inspired to make meaningful progress toward their financial goals. The best way to do so is to start small. Progress can be as small as choosing to eat at home instead of going out to eat or saving the first $100 in an emergency fund.

Ultimately, being more aware of spending patterns, keeping a budget and tracking expenses can help people decide whether or not they need to pivot and focus on a different money problem.

Caitlyn Moorhead contributed to the reporting for this article.

More From GOBankingRates

- 5 Old Navy Items Retirees Need To Buy Ahead of Fall

- I Paid Off $40,000 in 7 Months Doing These 5 Things

- Mark Cuban Tells Americans To Stock Up on Consumables as Trump's Tariffs Hit -- Here's What To Buy

- 10 Used Cars That Will Last Longer Than the Average New Vehicle

This article originally appeared on GOBankingRates.com: Dave Ramsey: How To Stop Focusing on the Wrong Money Problems

.jpg?w=600)